The projected total cost of financial crime compliance across all financial institutions will reach $213.9 billion in 2021, according to LexisNexis.

In the report, True Cost of Financial Crime Compliance Study, participants to the survey estimate an increase of US$33 billion year-over-year.

Key findings

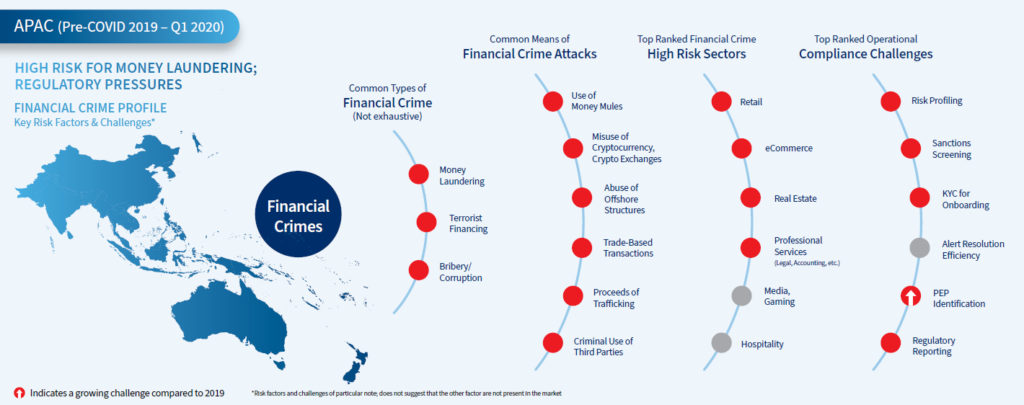

Less consensus on operational challenges – In previous years there has been consensus on the top two or three ranked compliance challenges within financial institutions. There is less uniformity in this year’s survey.

Customer risk profiling, sanctions screening, regulatory reporting, identifying politically exposed persons (PEPs), KYC for account onboarding and efficient alerts resolution are all similarly ranked as key challenges.

Pandemic impact – The ongoing pandemic has left a significant imprint on compliance departments, which exacerbated existing issues and led to an increase in the time and spending needed for due diligence.

Key operational challenges became heightened in these markets since the start of the pandemic, including increased alert volumes and suspicious transactions, inefficiencies with alert resolution and due diligence, more manual work and limitations with proper risk profiling/sanctions screening/PEP identification.

Technology investment leads to better outcomes – Financial institutions implementing technology solutions to support financial crime compliance efforts have been more prepared and less impacted overall by increasing regulatory pressures and COVID-19.

Compared to firms that distributed more of their annual compliance costs to labour, those that allocated costs more toward technology are seeing smaller year-on-year financial crime compliance operations cost increases, lower costs per full-time employee and fewer pandemic-related challenges.

APAC perspective

“Financial institutions across APAC that allocate more financial crime compliance expenditure to technology realize smaller increases in cost compared to those with lower technology spend,” said Douglas Wolfson, director, financial crime compliance for LexisNexis Risk Solutions.

He noted that firms with above average compliance spend on technology solutions are less challenged during the customer acquisition process.

“A large majority of APAC financial institutions surveyed expect the COVID-19 pandemic to further increase compliance costs over the next 12 to 24 months. The use of more comprehensive risk-management technology platforms will help ensure compliance and lessen financial crime compliance expenditure,” Wolfson concluded.