While numerous existing real time location systems (RTLS) technologies, including Bluetooth, Wi-Fi, and UWB have been available for a few years now, they have failed to capture the market potential so far.

An ABI Research survey noted that 87% of enterprises said they have not yet deployed RTLS technology within their business, primarily because of the significant barriers to adoption facing existing RTLS solutions.

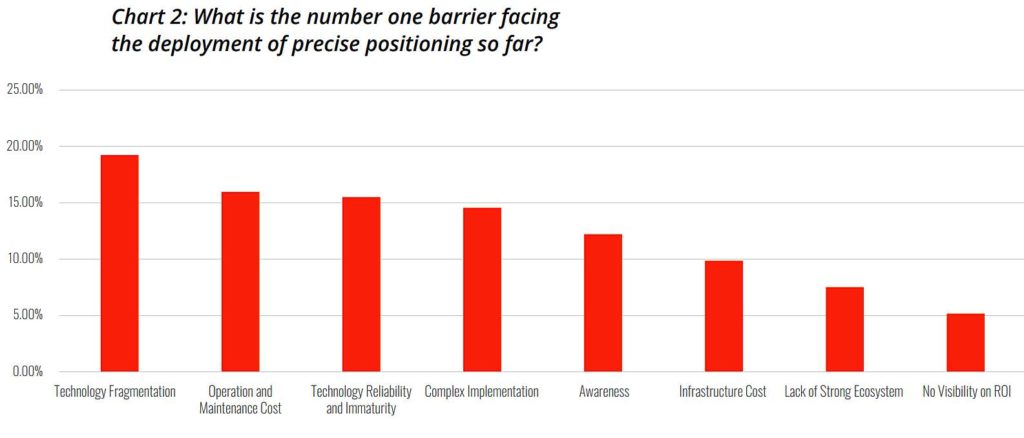

Most of the barriers to the deployment of RTLS mentioned in ABI Research’s survey point to the fragmentation of existing solutions. This impacts the total cost of ownership, the complexity to implement, how to operate and maintain them, and the uncertainties around their reliability and their maturity level.

“All the barriers identified by the survey are currently constraining the RTLS ecosystem from developing and flourishing. Current solutions addressing this market today are struggling to generate scale as they are not ticking all the commercial and technology requirement boxes of end-users,” explained Malik Saadi, vice president of strategic technologies at ABI Research.

According to the ABI Research survey results, which polled decision-makers from more than 210 medium to large enterprises across key industry verticals, 56% of respondents selected 5G positioning, among several alternative technologies, as the preferred RTLS solution they are willing to adopt despite the fact the technology will not fully mature before 2025, at the earliest.

“5G positioning will mature incrementally through the commercial introduction of 3GPP Release 16, Release 17, and Release 18 between 2022 and 2025,” said Andrew Zignani, research director at ABI Research.

He opined that there are still many limitations that need to be addressed before we see the technology widely deployed.

“The 5G supply chain must come together to deliver improvements on accuracy, reliability, scalability, terminal power consumption and cost, and many other key metrics demanded by the varied RTLS use cases,” he continued.

Ultimately, 5G positioning is unlikely to replace alternative RTLS technologies anytime soon, however, for many industry verticals, the unique combination of communications and positioning, as well as seamless indoor and outdoor coverage, backed by the 5G ecosystem, will prove a strong value proposition.

“5G positioning can achieve its full market potential only if the entire supply chain, including operators, infrastructure suppliers, device vendors, and chipset suppliers can work together on end-to-end solutions. Otherwise, they could face the very same issue of fragmentation that has prevented alternative RTLS technologies from taking off,” concluded Saadi.