A BNP Paribas Securities Services global survey revealed that chief operating officers (COOs) are more focused than ever on growth and transformation, reflecting financial institutions’ drive to adapt to change.

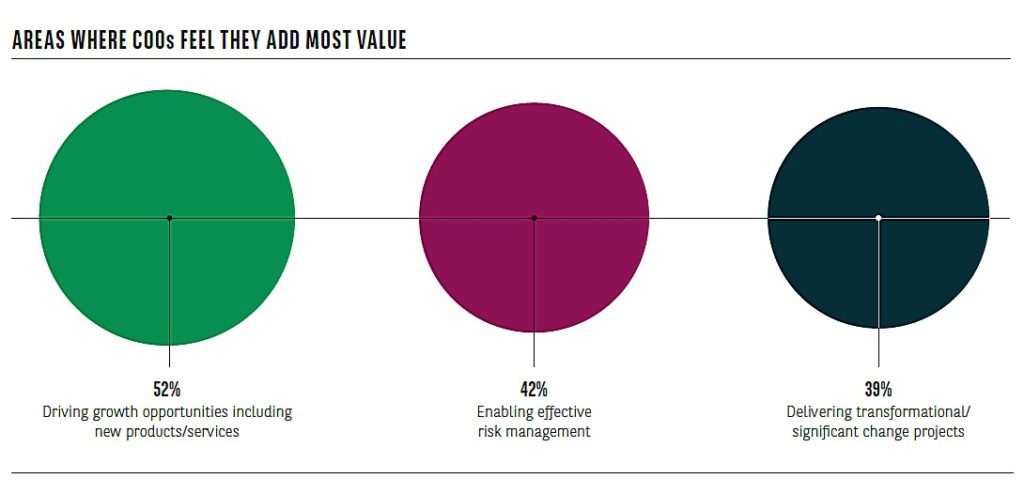

While risk management remains a key part of the role (cited by 42% of respondents), COOs said that driving growth opportunities, including new products and services (52%), and delivering transformational and significant change projects (39%), have become essential.

This trend is particularly marked in APAC where 56% of COOs ranked transformation as their top priority (vs. 26% in North America).

COOs also recognise the role IT in driving transformation. Sixty-eight per cent of COOs say they collaborate closely or very closely with IT while 38% say they want greater collaboration with technology and IT departments.

But technology will not be enough. Asked what could help drive transformation projects and business growth, 67% of COOs said upskilling the workforce while 60% said spending time with clients.

APAC COO data points:

- Over two-thirds (68%) of APAC COOs want a different title – with “Chief Change Officer” the preferred alternative.

- 52% of APAC respondents said they wanted closer collaboration with technology and IT departments.

- 37% of APAC COOs have technology or IT teams reporting to them, compared with 24% of COOs globally.

- 62% of APAC COOs think change projects will become one of the areas they spend most of their time.

Diana Senanayake, chief executive officer for Singapore and South East Asia at BNP Paribas Securities Services, said: “Given the fast rate of growth in Asia, COOs need to be able to implement new strategies rapidly and new technologies will be a strong enabler and drive this transformation. This is why we are constantly developing new technology partnerships and initiatives that enable COOs to explore new operating models bringing greater efficiencies.”