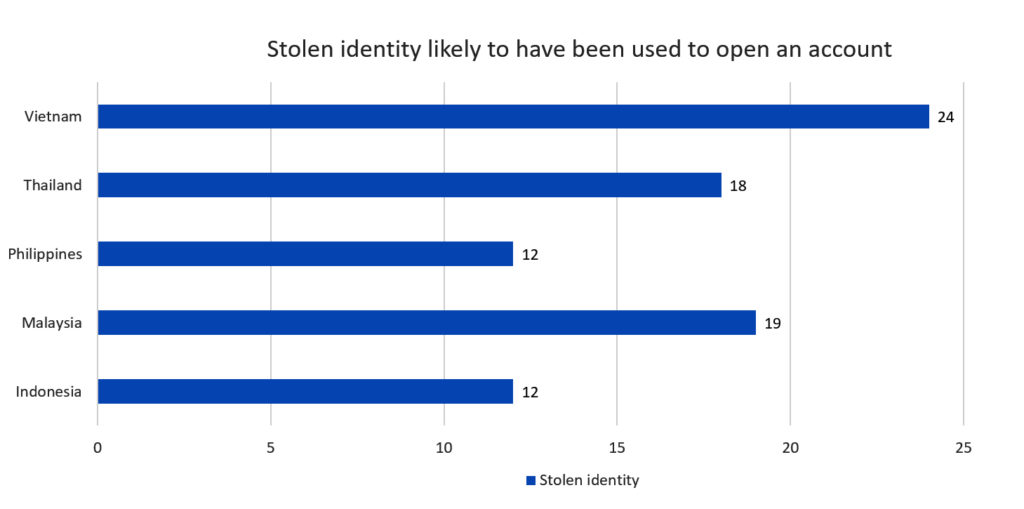

FICO's identity proofing and digital banking survey shows identity theft is a tangible threat for people across several ASEAN markets. Asked whether they think their identity has been used by someone else to open an account without their knowledge and consent, 24% of respondents in Vietnam believed this to be true. In Indonesia, 3% said they know their identity has been stolen and used by a fraudster to open an account, while a further 9% believe it is likely to have happened.

Consumers across all five markets display varying degrees of acceptance of the necessity for financial institutions to check their identity: Indonesia (71%), Malaysia and the Philippines (3/4), Thailand (1/3) and Vietnam (72%).

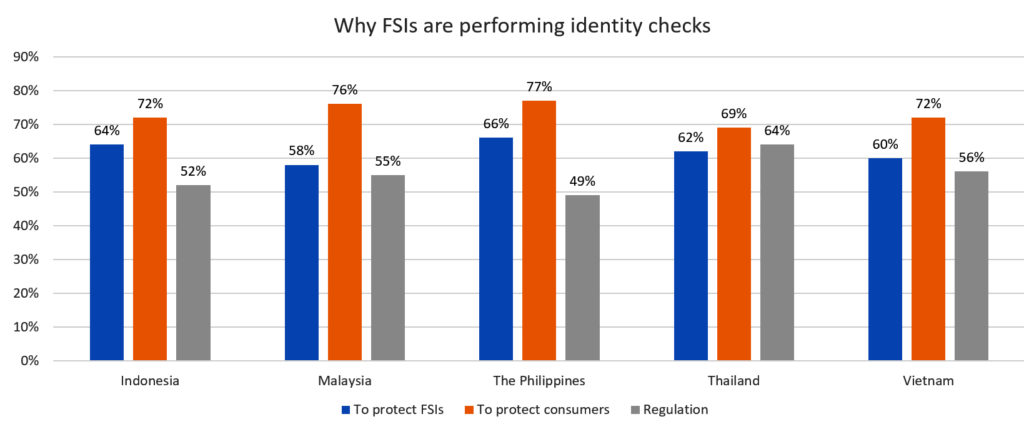

A majority (64%) of Indonesian respondents did see identity proofing as a way for banks to protect themselves, while 41% regard it as a tool to prevent money laundering.

These data points are not far off from their counterparts in other ASEAN markets:

Opening digital accounts

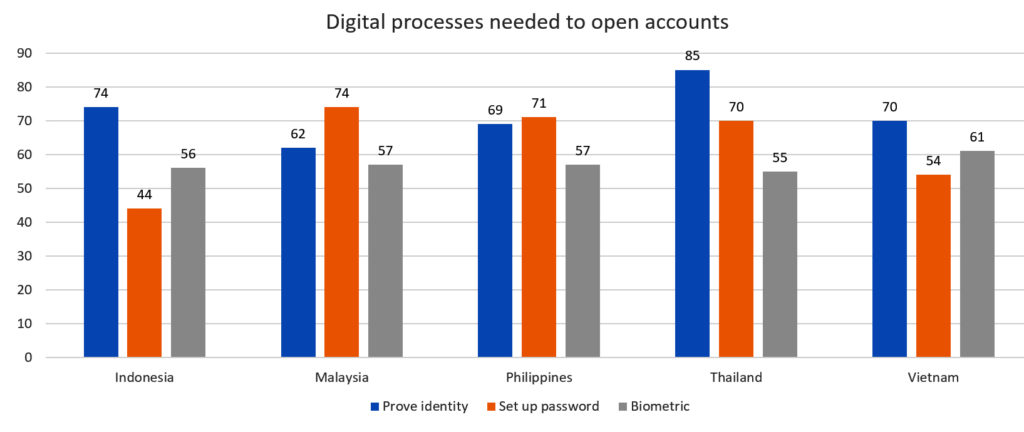

Most respondents to the FICO survey accept the necessity to prove their identity when opening an account, more so with digital. While setting up user ID and password is still a prefer, FutureCIO editors believe other factors may influence user preference, including but not limited to the prevalence of eCommerce, the use of mobile payments and e-wallets, and the extent to which financial institutions themselves have introduced digital authentication technologies in the provision of their services – online and offline.

One technology that is gaining traction is biometrics.

Gartner says biometric authentication methods use unique personal traits, such as facial and fingerprint, to corroborate a person’s claim to an identity to enable access to a digital asset. Its uses can potentially improve user experience and provide higher trust than other credential-based methods. Still, Gartner warns that no biometric authentication solution can provide 100% success rate as there will always be trade-offs between security and user experience.

Among respondents that participated in the FICO survey, there is varying degree of acceptance for using biometric identities such as a facial scan, fingerprint, or voiceprint to secure their accounts.

FICO’s lead for fraud, security and compliance in Asia Pacific, Subhashish Bose says in a lot of Asian countries, fingerprinting, identity cards and authentication apps have been commonplace for some time.

"There is less concern around privacy and the survey shows there is broad acceptance of the benefits that biometrics deliver when it comes to securing bank accounts and stopping money laundering," he added.

The fate of branches

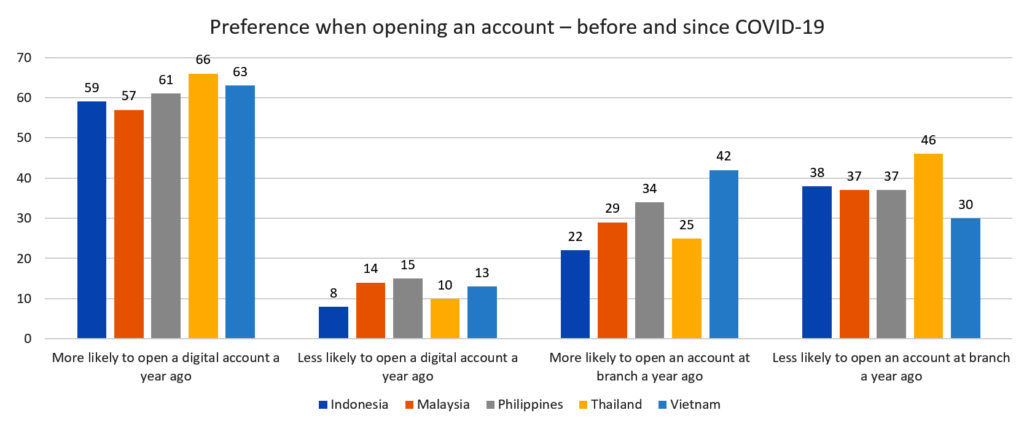

COVID-19 and the restrictions it has imposed on consumers has had an impact in the preference of consumers to open accounts digitally. As shown in the FICO survey, more than half of consumers in the surveyed countries are willing to open, if not already have opened, a digital account.

"While digital banking is growing, an inconsistent experience across digital channels, a lack of financial literacy and an ongoing use of cash has seen consumers continue to open accounts at branches," said Bose. "A strong belief that accessing a branch offers a more informed and secure account opening process explains why many Indonesians prefer to turn up in person."

As the landscape and preferences evolve, this presents an opportunity for banks who adopt multichannel strategies that can adapt to a growing shift online.