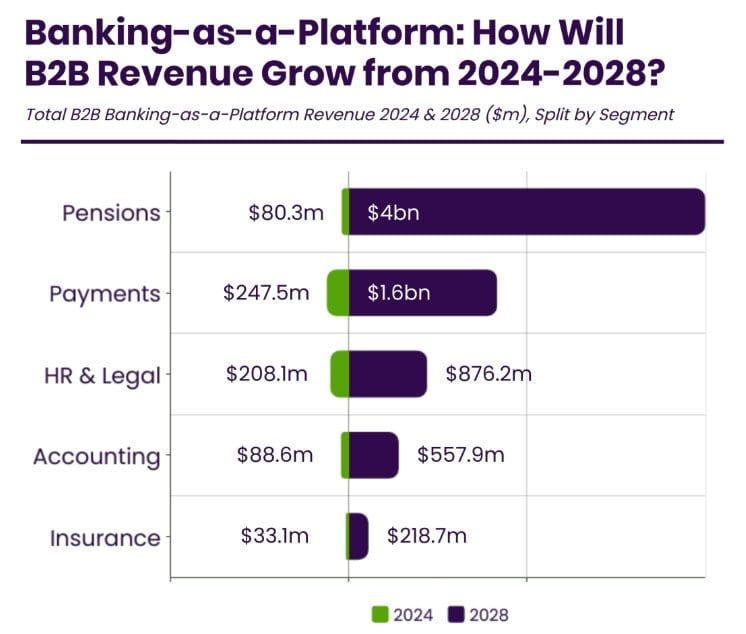

Juniper Research forecasts that global revenue from BaaP (Banking-as-a-Platform) services will increase to $49 billion globally in 2028, from $4 billion in 2023.

The study argued that BaaP can help traditional banks regain their competitive edge against neobanks. Through collaboration with innovative vendors, banks can offer new services from partners, including embedded insurance, lifestyle offers with leading brands or access to HR services for small businesses.

What is banking-as-a-platform?

Juniper Research defines Banking-as-a-Platform as: “A business model that enables third-party partners to build products and services for bank customers, most commonly a technology company that can provide APIs while the bank manages data exchange, oversees authentication and ensures compliance.”

The study argues that banks can utilise partnerships with industry leaders to build upon their core banking model; helping them compete with fintechs by offering more user-friendly services.

Compared with traditional acquisitions, BaaP partnerships are highly flexible and can be easier to integrate, as banks transition to API-focused models.

By offering a wide range of services via BaaP, banks can gain a competitive edge without having to stray from their core business.

Finastra's head and chief product officer for embedded finance/BaaS, Radha Suvarna concurs adding that Banking as a Platform can be a crucial component of banks’ and FIs’ value creation strategies, as partnering with speciality fintechs helps them keep pace with increasing competition and evolving customer demands in a way that would be difficult otherwise.

He opines that as part of this ongoing evolution, banks and FIs need to find new ways of defending and deepening their customer relationships, which is where new value creation through embedded finance has really become a key narrative.

"Embedding financial services at customers’ point of need, and on the other hand leveraging bank/ FI channels to offer value-added services creates entirely new revenue streams and cost efficiencies for banks/ FIs."

Radha Suvarna

Digital banks must capitalise on BaaP marketplaces

The report commented that banking marketplaces are the most effective way for banks to adapt to the digital age; helping them create financial services ecosystems that offer personalised customer experiences, without developing services themselves.

For example, Revolut has extensively expanded its lifestyle offerings in-app; creating its own ecosystem of services, without taking on the costs traditional banks have faced in expanding services. In turn, customers benefit from innovative solutions that are tailored to their needs; increasing satisfaction and improving the stickiness of their banking relationships.

Suvarna suggests that identifying specific client needs, technology, and partnerships are vital to seize these opportunities. Another suggestion is to identify specific use cases with opportunities to enhance client value or address a set of pain points should be the first step. This will be followed by the right technology and partnerships that can provide access to specific solutions or distribution.

"Software solutions with decomposable components, particularly those built on the cloud – will make it much easier to embed their services into channels such as B2B Payment products, business software, and e-commerce platforms, etc.," suggested Suvarna.

Juniper Research recommends that banks evaluate which services are core, and which services can be replaced by working with innovative third parties; enabling banks to improve services being offered, while reducing costs in a difficult economic climate.