A Bain & Company survey of 55 banks and financial services institutions, representing more than $40 trillion in assets,

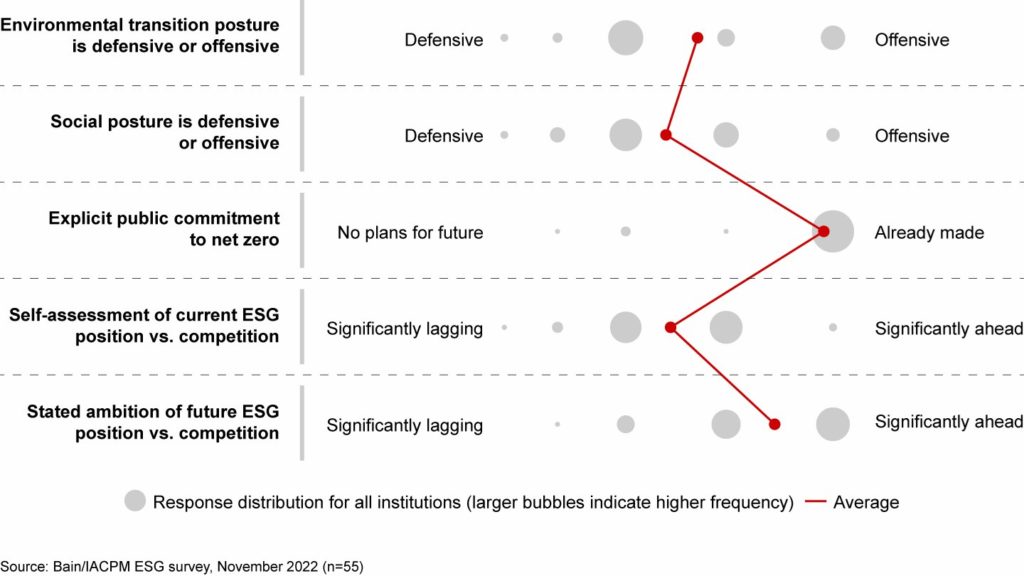

Banks remain divided in their responses to ESG pressures from regulators, shareholders, and customers.

The global survey of International Association of Credit Portfolio Managers (IACPM) members shows them split nearly down the middle on whether ESG pillars primarily represent downside risks to be managed or upside opportunities to be captured, with European respondents most bullish on opportunities.

Jointly executed with Bain the study noted that while institutions are making progress, they are hampered by unclear decision rights and different regulatory priorities across regions. The survey found 65% of banks and financial institutions have yet to define who has primary accountability for identifying and addressing climate risks within their operations.

Figure 1: Respondents are roughly split on defensive vs. offensive postures toward ESG issues

Similarly, 55% of respondents say there are still unclear roles and responsibilities for managing climate risk between their companies’ business and corporate functions. And 40% report that they do not embed accountability within their business line, which is considered best practice, instead coordinating ESG initiatives through centralised teams.

“Incorporating ESG strategies into banking operations requires a delicate balance of managing risk and seizing opportunities,” said Michael Kochan, a partner in Bain & Company’s Financial Services practice.

“The gap between ESG aspirations and results has widened for many financial services institutions, despite increased pressure from stakeholders. Winners will focus on strategy to create tangible value from climate-related products, services, and consulting.”

Michael Kochan

Regional differences and lessons from Europe

Globally, external pressures for more ESG activities will only increase, with 83% of respondents expecting more influence from regulators, compared to 67% from customers and 53% from shareholders.

European and Asian respondents feel more influence from regulators than their counterparts in the Americas, and shareholders have greater sway in the Americas. While regulatory expectations differ markedly between Europe and the Americas, Europe can serve as a robust source of insights in supporting the transition to managing climate risks.

How banks are responding

Banks are expecting to broaden their green product portfolios over the next three years, launching clean-energy project financing in commercial markets and expecting to expand the consumer portfolio to car loans, mortgages, and deposits.

Recognising that climate-related perils may contribute to credit risk across their portfolios in ways that aren’t yet fully understood, they are also starting to incorporate climate risk factors into strategic planning, credit origination, and insurance underwriting.

European banks have made the most progress on incorporating climate metrics into credit underwriting, with other regions expected to follow. Overall, 64% of respondents have yet to incorporate climate data and metrics into credit underwriting, with most banks from the Americas planning to do so in the next three years. However, 46% of respondents expect to limit credit underwriting to low-carbon, ESG-aligned customers by 2050.

Four areas that merit attention and resources

There are four critical areas for all banks and financial institutions to consider within their ESG strategies:

- Manage stakeholders to align their views in support of decarbonisation, coordinating expectations for value creation closely.

- Sharpen decision-making power for transition finance priorities, working together with boards to inform strategic priorities and provide risk oversight.

- Define strategies to address customer demand, considering both commercial opportunities and investor requirements.

- Augment climate-risk data analytics capabilities to integrate these risk factors into core banking processes, leading to sustainable long-term value creation.