The Juniper Research study, Conversational Commerce: Market Outlook, Emerging Opportunities & Forecasts 2021-2025, highlighted that the ability to offer conversational commerce as a component of an omnichannel retail strategy will increase confidence in the channels amongst retailers.

This enables these retailers to expand their reach, whilst allowing a fallback on more established commerce channels. Conversational commerce leverages AI to automate retail transactions and payments through channels including chatbots, messaging and digital voice assistants.

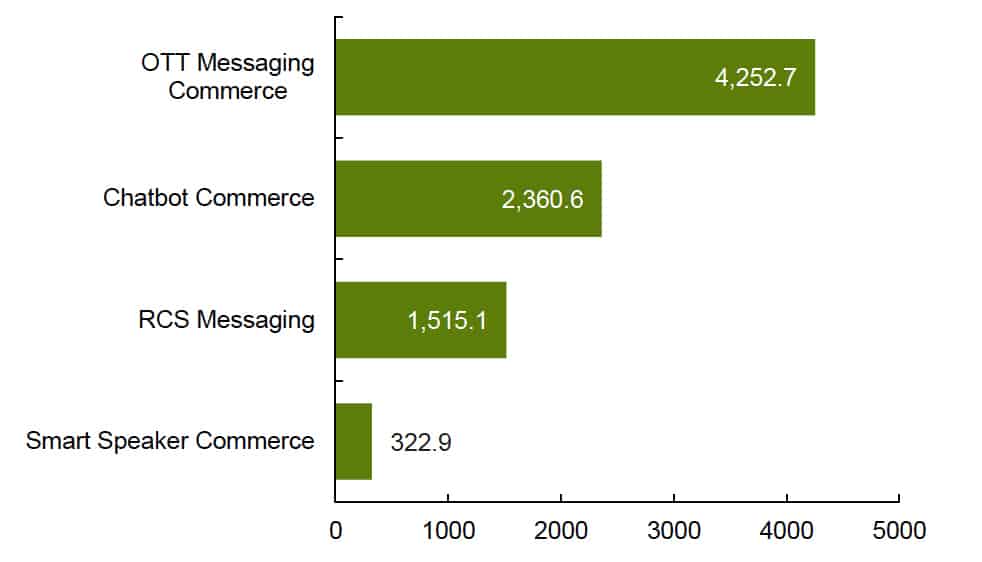

Figure 1: Addressable User Base of Conversational Commerce in 2021 (m), Split by 4 Key Services

Juniper Research forecasts the total spend over conversational commerce channels will reach $290 billion by 2025; rising from $41 billion in 2021. This represents a rise of 590% over the next four years. It also predicts that communications platforms that provide the connection between brands and end-users will be crucial in increasing the adoption of conversational commerce channels.

The research predicts that China, Japan and South Korea would account for over 90% of chatbot spend by 2025. Messaging apps popular in these countries, such as WeChat, LINE and Kakao Talk, have all established chatbot ecosystems in which retailers play a significant role in the development of chatbot and conversational commerce functionality.

The report urges emerging conversational commerce channels to emulate the chatbots ecosystems in these countries. To maximise the potential of other conversational commerce channels, such as voice commerce and RCS messaging, it recommends that retailers and communications platforms explore the possibility of a revenue-sharing model, in which a small proportion of the transaction value is paid to the conversational commerce service provider.

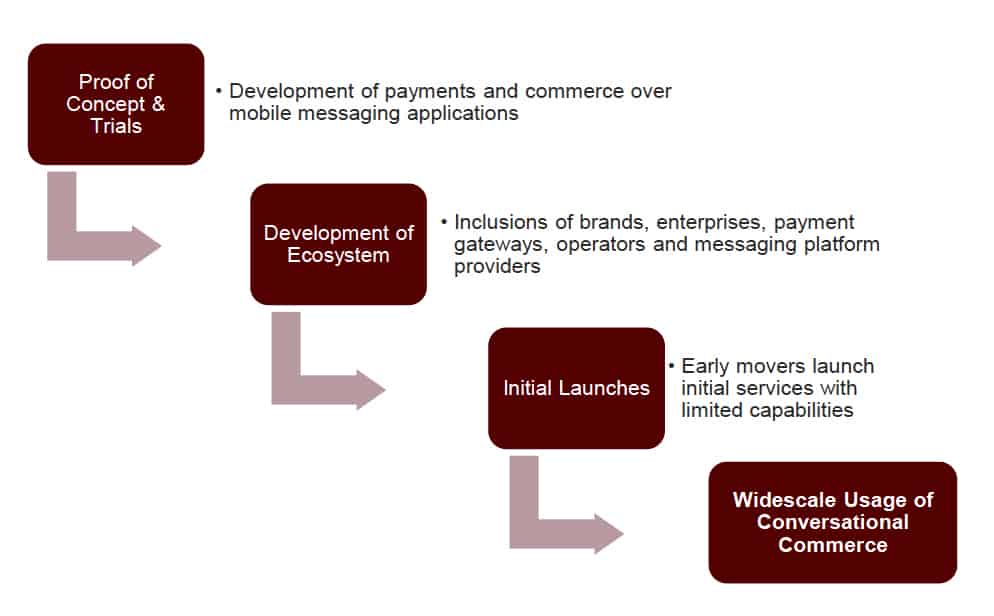

Figure 2: Future of RCS-based conversational commerce

Research author Sam Barker remarked that revenue-sharing models will enable conversational commerce channels to monetise their services by levying costs on brands and enterprises, rather than the end-users themselves.

“This revenue can be used to improve commerce channels to generate further investment from brands and enterprises,” he concluded.