According to the 11th EY and Institute of International Finance (IIF) bank risk management survey, Resilient banking: Capturing opportunities and managing risks over the long term, climate change now tops the list of risks for Asia-Pacific (APAC) banks.

What keeps APAC CROs awake at night

Ninety per cent of APAC bank CROs surveyed view climate change as a top long-term emerging risk over the next five years – up from 59% in 2019.

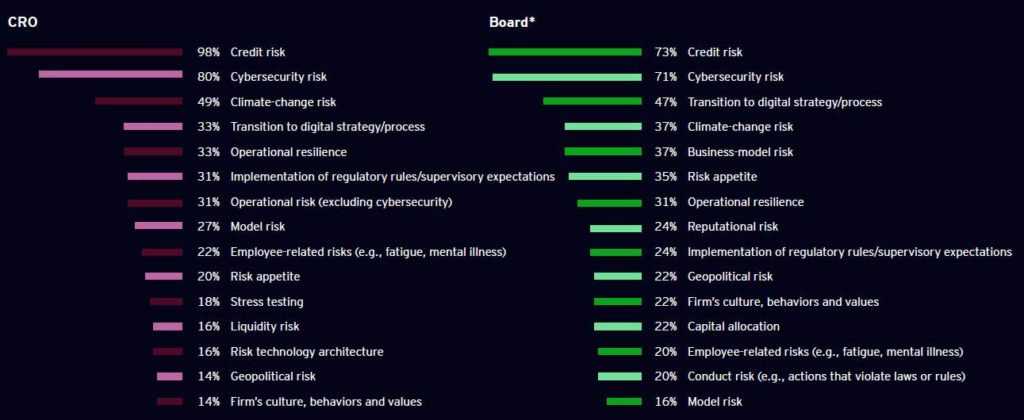

APAC bank CROs are more focused on climate change in the near term with 100% viewing it as a top risk, requiring their urgent attention over the next 12 months. This compares to just 49% of CROs globally who view it as a top short-term priority.

The survey of 88 financial institutions across 33 countries, including banks headquartered in Asia-Pacific, provides a window into the changes in risk management seen globally and regionally during the past decade and examines the major risks anticipated over the next 10 years.

David Scott, EY Asia-Pacific financial services risk management leader says: “The greater immediacy that Asia-Pacific banks’ CROs are placing on climate change risk over the next year, compared to the global average, reflects the urgency that regulators across the Asia-Pacific region have placed on climate risk management capabilities, as well as a heightened focus by investors and shareholders on disclosures.”

The survey finds that Asia-Pacific banks in practice are still maturing in their ability to assess physical and transitional risk exposures and that sourcing and managing climate risk-related data remains a challenge.

While 80% of surveyed Asia-Pacific banks’ CROs report having a preliminary understanding of their climate change risk exposure, just 20% say they have a somewhat complete understanding.

Aside from climate change in the top position, not surprisingly resilience factors that have been amplified by the COVID-19 pandemic are leading the risk agenda for Asia-Pacific banks’ CROs. Cybersecurity is perceived as the second most urgent risk by CROs in the region over the next 12 months (89%), followed by credit risk linked to economic uncertainty (67%) at number three. This near-term regional priority order also differs from the global results.

The pandemic factor

The COVID-19 crisis also proved to be an unprecedented and unexpected test of banks’ risk management. Greater technological resilience also came about as a result of banks accelerating their digital transformation in light of the pandemic.

“The COVID-19 pandemic has shown just how quickly things can change, but it’s also shown us the agility of the banking sector in times of crisis,” says EY Asia-Pacific banking and capital markets consulting leader, Douglas Nixon.

He opines those banks, both regionally and globally, may have to contend with persistent and dynamic disruption currently as well as into the future.

“It’s vital they remain resilient to all forms of risk – existing, new and emerging. Over the next decade, the crossover between talent, data and technology may be at the front of Asia-Pacific banks’ ability to survive new challenges and continue to thrive,” he continues.

Other findings

- The majority of Asia-Pacific banks still see control costs increasing – primarily due to embedding greater resilience and addressing digital transformation agendas – 10% now believe they can manage down costs of controls over the next three years by using data and technology to improve risk management.

- Half of the top 10 emerging risks according to Asia-Pacific banks’ CROs relate to technology and data, including industry disruption due to new technologies (70%), the pace and breadth of change from digitization (60%), and model risk related to machine learning / AI (50%).

- Based on lessons learned from the COVID-19 pandemic, 80% of Asia-Pacific banks’ CROs expect to see the introduction of new or additional regulatory requirements on operational resilience, and 70% of CROs expect the same on financial resilience.

- Asia-Pacific banks’ CROs expect their banks to further accelerate their digital transformation, including automating processes (78%), modernizing core technology platforms (56%) and delivering enhanced insights to customers (56%).