Produced by Omdia, the Identity in Digital Banking survey by FICO found that the complexity and cost of validating the identity of digital banking customers are the top pain points for banks in the Philippines.

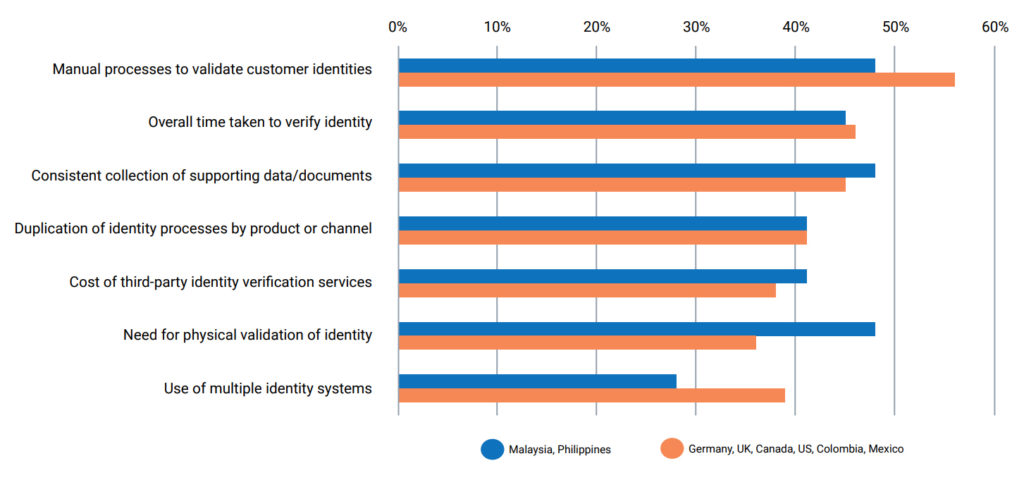

Almost 50% of respondents nominated the ‘high level of manual processes to validate customer identities’ as their top challenge along with ‘consistent collection of supporting data/documents’ and the ‘need for physical validation of identity’.

The ‘time taken to verify identity’ and the ‘cost of third-party verification services’ were nominated by more than 40% of respondents.

Subhashish Bose, FICO’s lead for fraud, security and compliance in Asia-Pacific, said identity challenges are intensifying with digital banking. “You can see from the survey that many Philippine banks still have issues with manual processing that slows down the process, introducing friction into digital applications,” said Bose.

Onboarding trends

He added that a third of banks still force customers to go to a branch to open a personal bank account. However, lenders will need to shift toward identity verification that is seamlessly integrated into the digital application process and can be rapidly confirmed or risk losing business.

FICO’s previous consumer study found that up to 67% of Filipinos said they should be able to complete all aspects of account opening online or on their phone.

Only 41% of Filipino consumers said they would carry out the necessary offline actions as soon as possible if all actions required to complete an account opening could not be accomplished in-session.

A further 13% said they would try a competitor while 5 percent said they would give up completely.

Bose commented that Filipinos are comparing their banking experience not just to other lenders but to other digital businesses.

“The notion that banks can afford to ignore delivering the kind of instant gratification delivered by companies like Uber, Netflix, and Amazon just because they are selling financial products will disappear this decade,” he added.

Authenticating customers

Technology challenges are also impacting the ability of Philippine banks to authenticate customers. The survey revealed that banks feel the time taken for systems change is a problem (45%), as well as inflexibility around identity approaches (45%).

This may be due to rapid innovations in authentication and the number of technologies deployed (biometric authentication, for example, is deployed in 93% of respondents).

“Philippine banks are often torn between the deployment of multiple point solutions that require integration and broader platforms that span authentication but don’t play well with third-party systems,” said Bose. “New-breed platforms that allow innovation with AI and integrate more widely are now seen as the next step. A strategic consolidation is needed, and banks will have to determine which technologies are proving effective both internally and with customers to gain an edge over their competition.”

Concerns about authentication

Authentication strategies at Philippine banks are driven more by security than by regulation; concern over the sophistication (50%) or volume (29%) of attempts to breach access controls is much higher than in the other seven countries surveyed, where, on average, concern levels for sophistication are 43%, and volume 30%.

This can partly be explained by fewer and less onerous guidelines or legislation around authentication. However, if criminals are successful it will be only a short time before Filipino regulators impose more rules around authentication.

Lito Villanueva, executive vice president and chief innovation & inclusion officer, Rizal Commercial Banking Corporation (RCBC) acknowledged that challenges in any innovation or technology updates exist, but these should not hinder banks from moving forward.

“We take all the precautions and conduct due diligence in ensuring we get the best possible solutions for eKYC or account verification. This is an investment on our part to ensure that the integrity and security around customer authentication is not compromised. We also ensure that there is a fine balance between the robustness of the authentication procedure and the accessibility to our customers,” he added.

The goal is to get as many unbanked customers into the formal finance system as possible. “This will be hard to achieve if authentication will be too complicated for the common Filipino to go through," explained Villanueva.

Mixing fraud with authentication

“Another issue here is that many banks in the Philippines are not making separate fraud and authentication decisions,” said Bose. “They are less concerned with user experience and therefore will ask a customer to authenticate again for a particular action which they consider high risk, even if they have already been identified in the same session.”

The survey showed that adoption of this strategic approach is already underway. While only 7% of banks say they currently have a common identity management platform or orchestration layer, 78% of banks say that they have ambitions to make the move within the next three years.

Villanueva said RCBC is part of the 7%. “We have put in place ways to improve fraud detection. For one, we have implemented and upgraded our biometric solutions as part of our Authentication and Fraud Detection. These biometrics security solutions are in place in our mobile apps. Technology is moving at lightspeed, the banking industry is also levelling up in this area especially given this pandemic,” he continued.