As we prepare our next buying study to go to the field, we are looking back at some earlier results to decide how to tune the survey to get useful information.

In our earlier study (from 2019) that focused on the biggest purchase a respondent was involved in, we worked to uncover the frequency of occurrence of what we call high quality, low regret deals.

If you follow this blog, you know that the percentage of these deals was quite low–only 27% out of 1464 purchases studied met the criteria.

With that in hand, we worked to understand why. What we discovered were issues on both sides of the tables. Many buyers are not confident in their own decision processes and vendors are not doing enough to help them. Add to that some inherent scepticism and it creates a challenging environment.

But there are other issues, as tech buying gets more and more distributed across the organization, I expect the challenges to increase. On the surface, the idea of putting decision making close to the groups that will be getting the most value seems like a good idea but it also means that you will have a lot of people involved in big buying decisions that they don’t make on a regular basis.

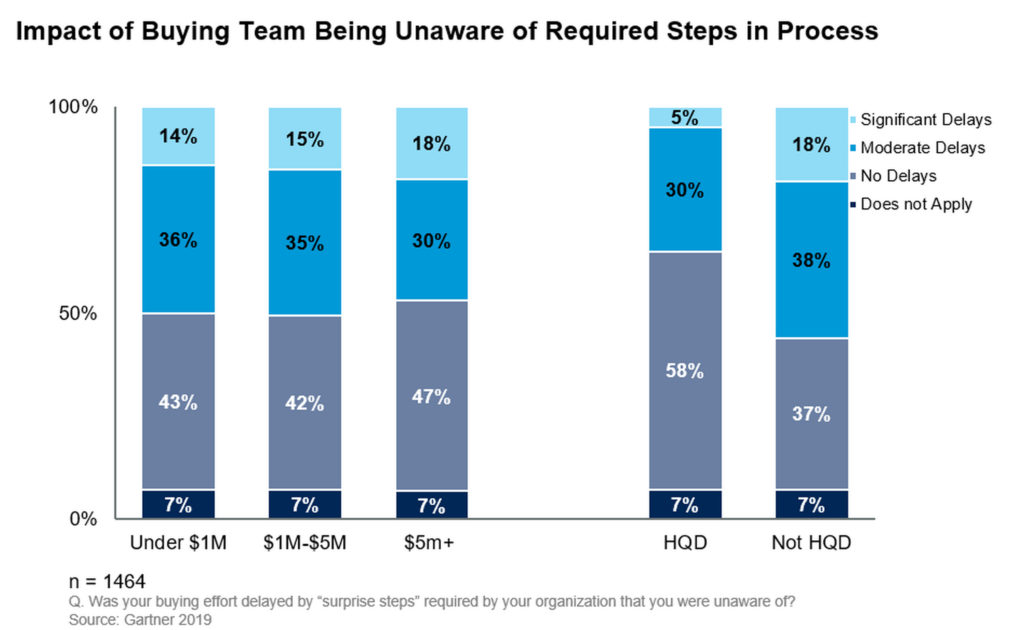

We already saw some evidence of this. One of the things we asked in 2019, was whether the buying effort was delayed by “surprise steps” that the buying team was unaware of.

Remember, this was the biggest purchase that the respondent was involved in. Also, these were buying teams with 10+ people actively or occasionally participating. You would think that awareness of the steps required to buy would be very high.

Unfortunately, it was not.

Basically, when looking at things based on deal size, 50% of our respondents said their buying efforts were delayed by these surprise steps for purchases under $5M. That number went down slightly (48%) for deals over $5M, but those also had a higher percentage of significant delays.

When looking at this by high-quality deals, the numbers are due to shift. For high-quality deals, only 35% experienced delays due to surprise steps (still a big number!), whereas 56% experienced delays for deals that did not meet our criteria.

Does this surprise you? It really shouldn’t, but often we go into situations assuming our customers know what they want to do and know how to do it. That is often not the case.

To accelerate good business, vendors need to help their customers buy (see all of our work on buyer enablement and sensemaking). They need to help customers build confidence–not just in the vendor, but in themselves.

They need to guide the customer through common efforts that other successful customers follow–reducing surprises and delays.

The old question used to be, “How much time should we spend educating our prospects?”

The new question should be, “Can we afford not to educate and guide our prospects on how to buy effectively?”

Those that commit to this area will reduce the frustrations that could come as decision making continues to be distributed across the organization.

Originally published on Gartner Blog Network