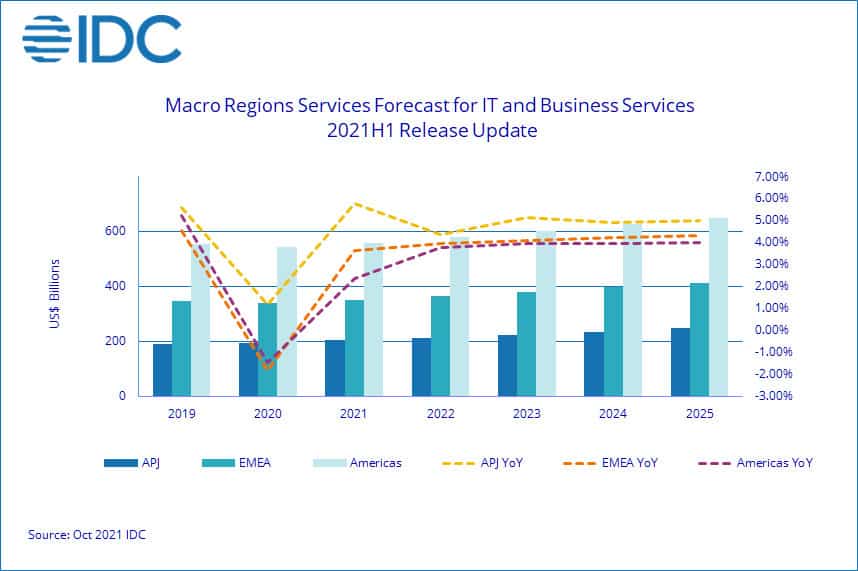

IDC is forecasting the worldwide IT and business services revenue to grow by 3.4% (in constant currency) in 2021. In nominal dollar-denominated revenue based on today's exchange rate, the market will grow by 6% year over year, due to foreign exchange fluctuation.

The services market is forecast to top $1.1 trillion in 2021. This year's recovery is in line with IDC's forecast from April. This has been consistent with what major vendors have been reporting in the first and second quarters of this year.

IDC believes that the market will continue to expand through 2023 and 2024 with growth between 3.8% to 4.0% annually. The mid-term and long-term market growth has also increased slightly by 20—50 basis points each year, pushing the market's long-term growth rate to 4.3%, up from the previous forecast of 4.1%.

A better economic outlook has contributed to the improved optimism, but the main driver was the stronger demand for IT and business services.

Growth drivers at the country level

Asia/Pacific's growth outlook did not change significantly. Mature markets continue to recover steadily: the growth outlook for the larger economies, such as Japan, South Korea, and Australia, remains in the 2—3% range while the smaller economies are clocking faster growth, particularly in this cycle.

IDC has lifted the near-term and long-term growth for New Zealand and Singapore by 15—20 and more than 30 basis points, respectively.

Additionally, because certain markets are recovering slightly faster, IDC has shifted more mid-term growth rates to the near term to reflect this. For example, China's projected market size for the year has been adjusted upward to almost 11% (across most foundation markets) as buyers are more "squeezed" on the supply side.

However, as this is driven partially by one-time "pent-up" demand from 2020, and thus not sustainable, 2022's growth rate will fall to just 4%, before eventually tracking back to its normal growth path.

As for the other emerging markets in the region, IDC's outlook remains largely unchanged: they still enjoy a better growth outlook than most other regions/countries, but short-term growth is more susceptible to extraneous factors.

"The need for digital transformation and the demographic squeeze on (the right) talent pool, expedited by the pandemic, global supply chain disruptions, and loose monetary policies, have created the perfect push and pull for enterprise buyers; therefore, our long-term growth outlook for the IT and business services market remains sanguine," said Xiao-Fei Zhang, research director, IDC Global Services Markets and Trends.

He added that large services providers are also making big bets, both organic and inorganically, on the operations and product side, which enjoys more than twice the market growth of the existing IT/business services market, based on IDC’s Digital Engineering & Operational Technology Tracker.