The most recent Quarterly InsurTech Briefing from Willis Towers Watson revealed that total new worldwide funding commitments to the InsurTech sector in 2019 were US$6.37 billion, 33.9% of the historical total, following a record-breaking $1.99 billion of investment in 75 projects during Q4 2019.

I am not writing this to gush over the euphoric attention InsurTechs, and other startups, have been receiving since post 2008. Indeed, the challenge for many entrepreneurs has been funding. Well and good that funding is finally available to those with the right stories/goals to tell.

But now that funding is less an issue, it is time to ask: what is the problem you are solving? For investors, you should be scrutinising the business value that the startup is flaunting.

The sad reality is that some don’t have one, i.e., business value or problem being solved. Dr Andrew Johnston, global head of InsurTech at Willis Re, estimate that no less than 184 funded InsurTechs have closed permanently over a three-year period.

The numbers could be bigger.

In CB Insight’s list of 189 Of The Biggest, Costliest Startup Failures Of All Times, financial fraud, lawsuits and a most-wanted founder were top of the list for many of the failed ventures.

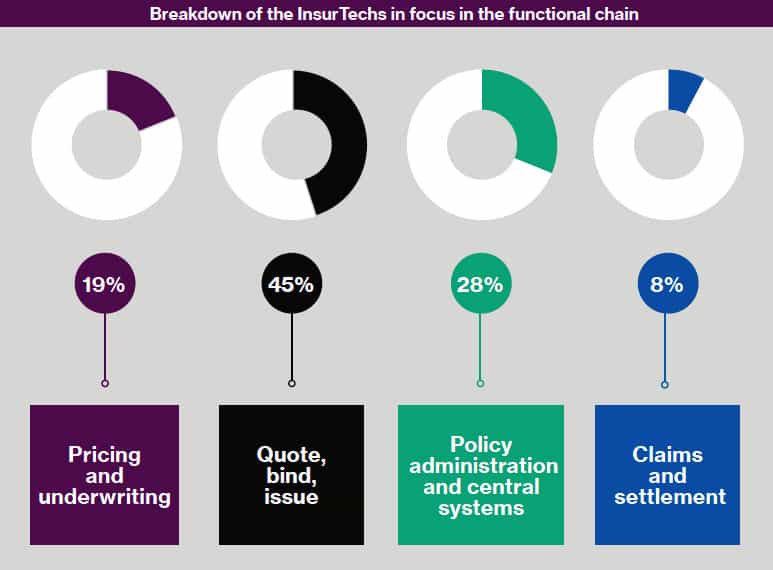

Going back to the Willis Towers Watson quarterly report, it concludes with a look at claims and settlement (an area with the least focus among InsurTech startups (I wonder why).

Source: Q4 2019 Quarterly InsurTech Briefing, Willis Towers Watson

Tom Helm, head of Claims Consulting at Willis Towers Watson’s Insurance Consulting and Technology business, acknowledges that some of the simplest common claims, such as automobile windscreen, may already be handled entirely by automated systems at some insurers.

He goes on to argue that end-to-end automation can never work in all scenarios, even in consumer lines.

“Some aspects of the claims process require complex human judgement or investigation, and other cases, such as the need to empathise with a customer who needs support, demand the human touch. This means that claims handlers will remain in the driving seat. It is essential that automated mechanisms are able to identify when a situation needs human intervention, making effective management of the interaction between handler and machine a critical consideration,” he concluded.