PT Bank INA Perdana will use Mambu’s cloud-native banking platform as the technology foundation for its new digital banking services.

Mambu claims its cloud-native platform enables banks and financial institutions to scale rapidly and launch new digital banking services within weeks. Mambu’s composable approach allows banks to launch innovative banking services that meet the specific wants and needs of their customers.

Daniel Budirahayu, president director at Bank INA, said, “As we transition into a digital bank, we have been very focused on ensuring we have the right systems and infrastructure in place to guarantee optimal experience and security for our customers.”

Around August 2021, Indonesia’s Financial Services Authority or Otoritas Jasa Keuangan (OJK) introduced new banking rules opening the country’s banking to near-full foreign ownership of local lenders to spur growth in the local emerging digital banking industry.

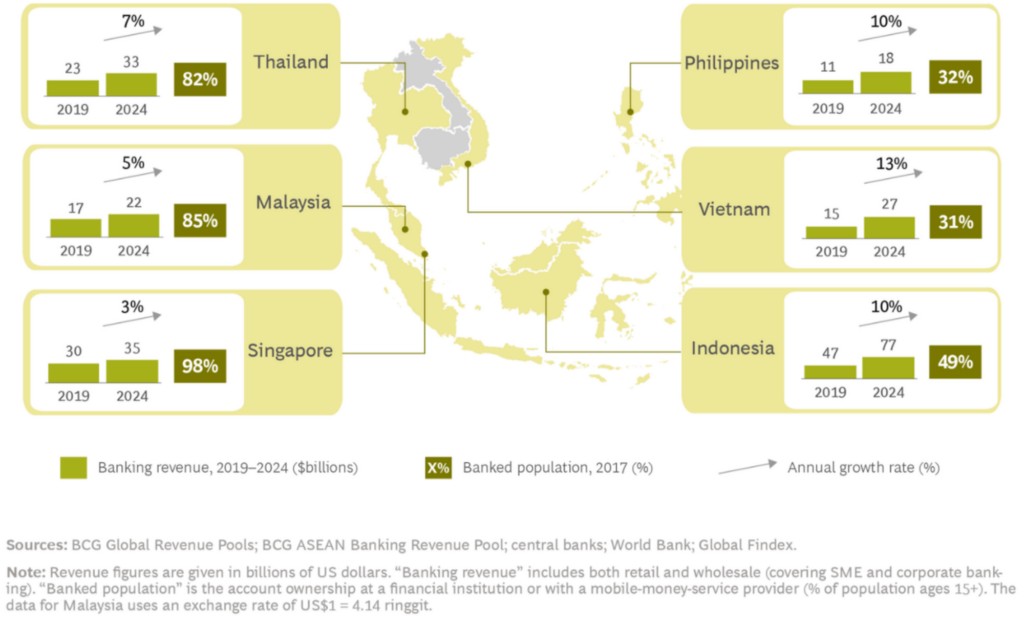

The Boston Consulting Group has high growth expectations for Southeast Asia’s banking sector. These countries have large underbanked populations and are ripe for disruption by successful digital banks.

Husni Fuad, general manager Indonesia at Mambu, added, “The pandemic has accelerated the adoption of digital banking technology right around the world, and Indonesia is no exception. Bank INA will soon be able to offer digital services to both retail consumers and MSMEs, offering greater convenience and speed, and improving access to financial services for many consumers who are currently unbanked or underserved.”