The International Compliance Association says there are two types of activities that are deemed as leading to or resulting in a financial crime. One is an activity that dishonestly generates wealth for those engaged in the conduct in question. The other is protecting a benefit that has already been obtained or to facilitate the taking of such benefit.

Dev Dhiman, managing director of Asia Pacific at GBG, cautioned that financial crime has become very complex. He pointed to fraud attacks and techniques as having escalated in sophistication, enabled by digitalization, hyper-connectivity and data deluge.

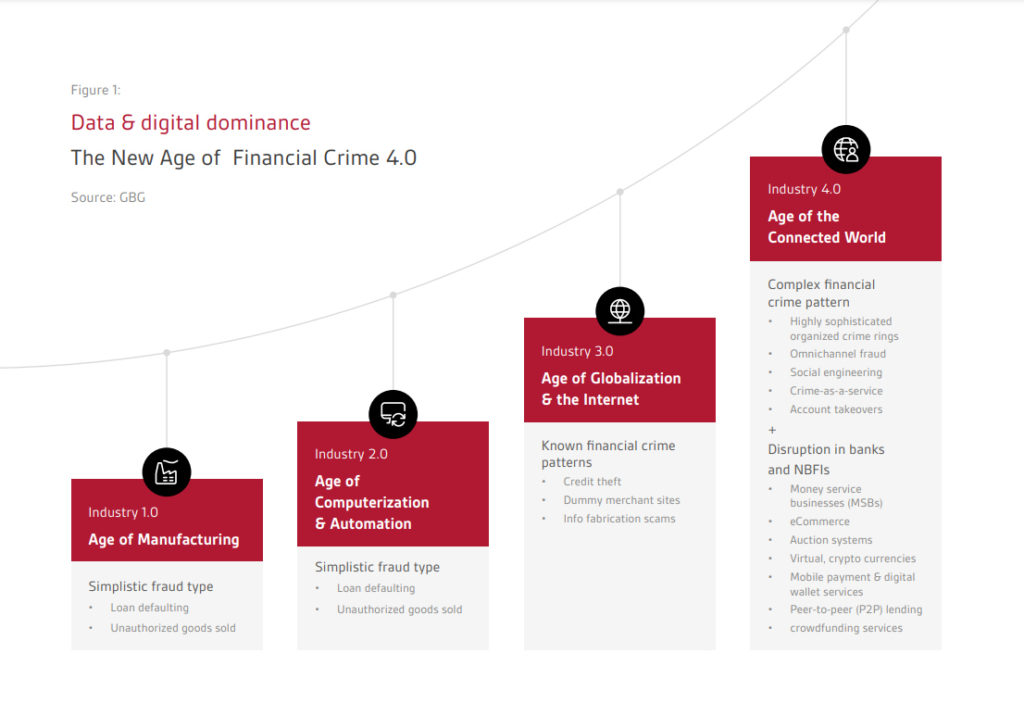

According to Dhiman GBG coined the term “Financial Crime 4.0” to encapsulate the evolution of fraud. “It is a mega risk trend covering the heightened complexity and growing volume of an emerging financial crime arising from the state of hyperconnectivity and data deluge in today's Industry 4.0. This includes the boom in digitally connected devices, internet of things (IOT), and online social sharing, where these rapid changes have opened new access points and vulnerabilities that are being harnessed by sophisticated, malicious actors with speed and scale,” he explained.

And what does a CIO have to do with financial crime? These days hardly any business can operate without information technology and data.

Dhiman says the CIO is there to protect the interests of the company and its shareholders, including against the risks of a financial crime. However, Dhiman believes that the financial crime is not limited to the defrauding of money but more important, the loss of a customer’s trust.

Dhiman added that IT has evolved in focus from the technology to the data. “Data drives decision-making. It needs to be consumed in a way that enriches decision-making and drive the business agenda forward,” he elaborated.

In the fight against financial crime, he sees IT as making sure that the data is accurate and protected.

Given the evolving nature of financial crime, Dhiman see greater risk of “fraud coming through the system which is really unfortunate because this is the time when as a society, we should be collaborating and showing solidarity.

“We've seen also that, as a result of the pandemic, more and more organizations, I think around 70% of the people we speak to say that COVID has really driven an acceleration in their digital transformations. But along with digital transformations, again comes at a rising risk of financial crime.

“So as more of these processes that were traditionally manual move online, it opens a little chink in the armour for potential fraudsters to take advantage of,” he warned.

Click on the PodChat player to listen to the full details of Dhiman’s responses to the questions posed to him during the dialogue, including:

- Let’s start off with the obvious. In 30 seconds, what is GBG?

- What is Financial Crimes 4.0? What makes it stand out from FC 3.0, 2.0 and 1.0?

- Why should a CIO care about financial crime other than it involves money?

- How does financial crime impact how the CIO and IT team functions?

- In the case of GBG, how do you integrate with an organisation’s IT and financial crime systems and controls? Does integration introduce significant latency?

- What have we learned from 2020 as regards to financial crime mitigation and what should organisations do in 2021?

- What is your advice to CIOs to better strengthen the company’s systems and processes against financial crime in 2021 and beyond?