Depending on whom you talk to, banking has changed even before the arrival of COVID-19. The changes continue to happen particularly in places where lockdowns are most severe. What is also certain, the transformation we are experiencing is in part due to changes in consumer behaviour, maturing digital technologies and evolving regulation.

FutureCIO spoke to Ganesh Vasudevan, research director, IDC Financial Insights to talk about changes in retail banking in Asia.

Has COVID-19 diminished the value of bank branches in favour of online and mobile?

Ganesh Vasudevan: Digital initiatives like online, mobile, and contactless technologies had already shaken up transactional banking through branches for some time and Covid-19 has accelerated this decline.

Beyond transactional banking, Covid 19 fast-tracked migration of higher value banking services like remote loan origination, account opening, collection, and investment advisory services to digital channels. With significant branch banking services migrating to alternate channels along with plummeting cash usage, the relevance of branch banking further diminished.

In the East Asia Pacific region, the bank branches per 100K adults reduced from over 11 branches in 2011 to around 10 branches in 2019. Add to it the top 4 global markets for real-time payments in 2020 by volume are in Asia – India, China, South Korea, and Thailand.

While convenience has been one of the biggest drivers of this shift before 2020, now combined with the safety of managing affairs from home amid infection risks is driving changes in the conventional branch banking business model.

Do you know of any bank in Asia that has successfully innovated the branch while transforming its banking business?

Ganesh Vasudevan: Even before the advent of Covid 19 various banks in the region were revisiting their branch strategy.

In 2017 Union Bank of the Philippines launched its first fully digital branch, called The Ark, making the customer experience entirely digital, including internet-connected self-service kiosks and virtual reality boxes.

This initiative along with a broader digital focus resulted in retail banking profits doubling in 2019, and net income increasing by 104% year on year. UnionBank has since added nine new locations for The ARK, bringing the total number of said branches to 50 since the introduction of the first ARK.

In late 2020 DBS Bank Singapore launched a branch transformation initiative to boost convenience and accessibility for the customer to complement their digital banking services and provide a ‘phygital’ banking experience by retaining ‘human touch’ in the form of face-to-face assistance and consultations.

The transformation which began with one branch is expected to be rolled out across at least one-third of the bank’s branch network over the next 12 to 18 months. DBS is rolling out more self-service banking machines, such as Video Teller Machines (VTMs) or Branch Teller Machines (BTMs), enabling customers to complete more complex transactions safely and securely.

Similarly, in early 2021, Shinhan Bank South Korea unveiled a new brick-and-mortar branch concept, dubbed Digilog, to prove that there is still a place for offline banks in an increasingly digital industry. Digilog branches are a mix of digital and analogue, which is expected to allow a fun and innovative financial experience for the customers.

What applications (use cases) in the bank branch do you see being transformed (not necessarily going away)?

Ganesh Vasudevan: In the Asia Pacific region IDC predicts that by 2024, 50% of in-branch transactions will be initiated as pre-staged transactions or appointments for specialists that start on digital platforms and are fulfilled on bank-owned technology and locations.

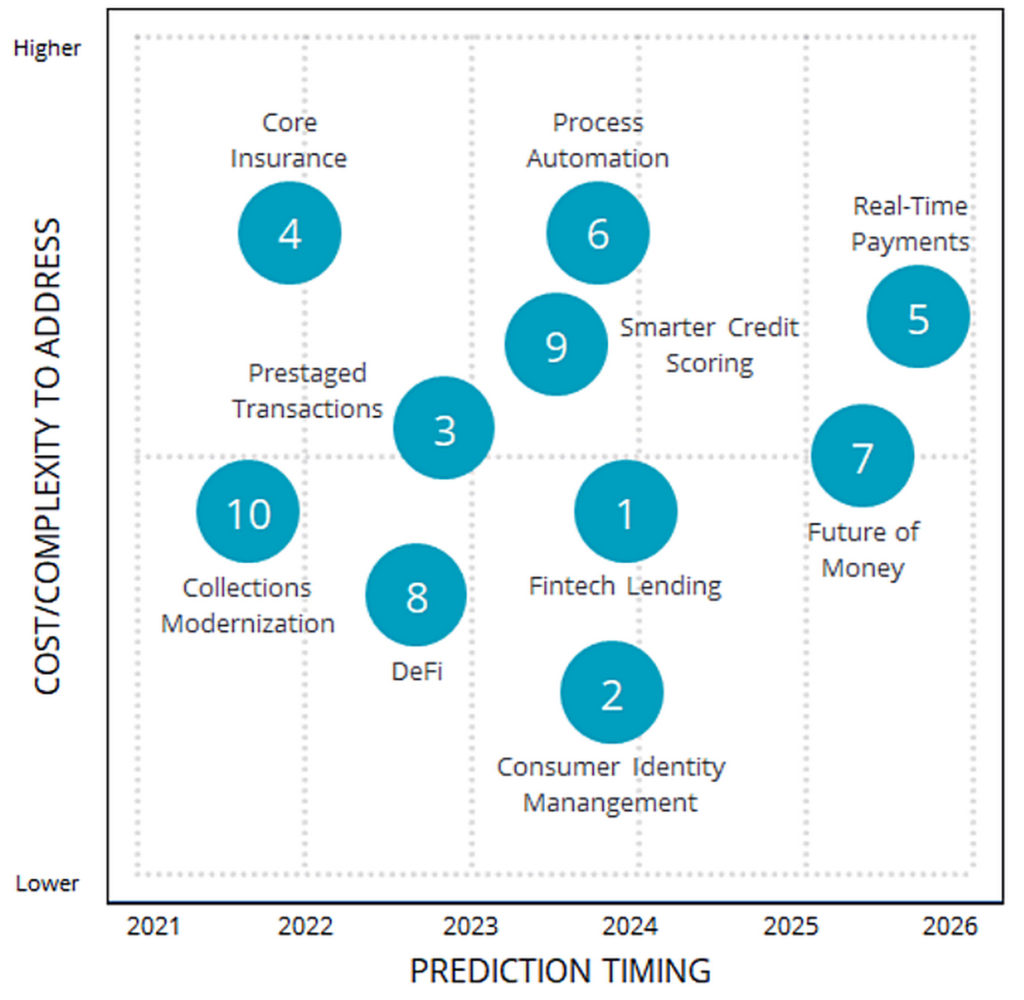

Figure 1: IDC FutureScape: Worldwide Financial Services 2021 top 10 predictions

Pre-staged interactions at bank-owned locations will expedite in-branch transactions while providing the customer with the convenience of using digital self-service tools available from online and mobile solutions.

Use cases in Asia/Pacific include preset no-card ATM transactions (already widely used in several markets), scheduling access to interact with a specialist (which fast-tracks the move of some banks to grow business from recommendations), or prescheduling specific transactions.

What needs to change at the bank for this bank branch transformation to be realized?

Ganesh Vasudevan: First and foremost, acceptance of the need to transform the branch operating model. But it is important to realise that in absence of clear understanding and agreement on the definition of branch transformation across the industry, it becomes difficult for bank executives to decide the right approach for their bank.

Hence it would be important to consider branch transformation initiatives by considering the wider socio-demographic attributes of each location.

Also, the success of branch transformation will be significantly dependent on the quality of the frontline employees, and the availability of the tools that can help them provide high-quality, consistent, and personal interactions with customers.

The conventional approach to branch channel needs to give way to a more dynamic and customised approach synchronizing the branch design and service catalogue with investment in appropriate technologies (video, bots, contactless etc) to optimize the virtual interactions.

Which technologies will facilitate this bank branch transformation?

Ganesh Vasudevan: IDC predicts that technology spending by banks in APeJ (Asia Pacific excluding Japan) to deliver omni experience engagement and enhancing customer experience will grow at the rate of CAGR 15% to over $ 3.5 Bn by 2023.

The branch channel will become the convergence point for omni experience engagement. Some of the key technology shaping the branch transformation include:

Contactless engagement – NFC, Bluetooth, facial recognition, and beacon technologies within the branch network will help coordinate the notification and authentication of customers entering the perimeter of the branch to complete their pre-staged transactions and other services.

Intelligent platforms – Increased adoption of chatbots, conversational bots and other AI tools will not only assist in streamlining, standardizing, and automating recurring processes at the digital branches but also help in delivering rich contextual insights to customers.

Video technology – Establishing a virtual personalized interaction through multiple channels like self-service kiosks, tablets, or ATMs for live chat with bank employees. This will allow the bank to empathically engage with the customer while providing the trust and credibility akin to in-person branch engagement.

Click on the podchat player and listen to Vasudevan share his views on how bank branches are transforming in response to changing customer, competition, and regulatory environments.

- In Asia, what is the most significant change to how banks engage with customers (post-COVID-10)?

- How has this change translated into (a) products sold at bank branches; and (b) channels used to market these products?

- What do you believe are the biggest challenges/hurdles for bank branches adapting to changes occurring around us (COVID + changing customer behaviour + regulation)?

- Of the many technologies affecting bank branch transformation, which do you feel will have the most impact in the short to mid-term?

- How are these changes impacting the role of the CIO?