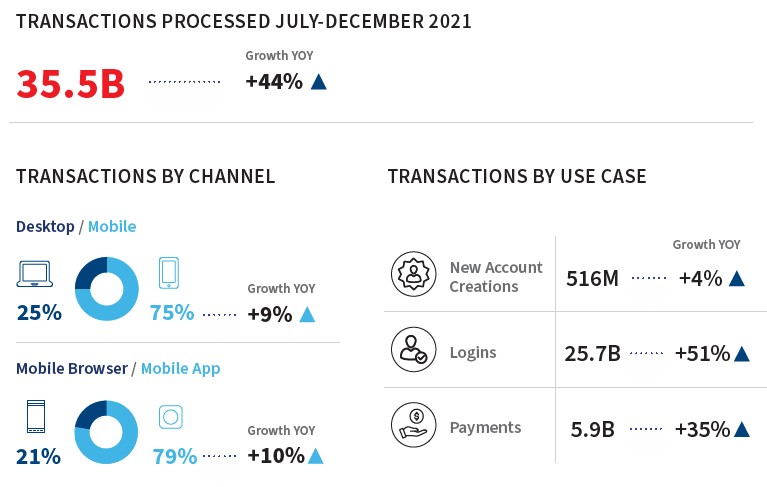

The LexisNexis Risk Solutions Cybercrime Report revealed that the second half of 2021 showed a significant shift to mobile fraud over the last four years. The report analysed 35.5 billion transactions over the six-month period, up 44% year over year. The report also found online transaction volumes continued to grow, specifically across financial services (52% YoY) and communications, mobile and media (45% YoY).

Increasing consumer confidence leads to enhanced demand for a customer-centric digital world. Companies are prioritising their digital customer experience strategies to retain and acquire new customers, which is advantageous for legitimate consumers but may lead to opportunities for fraudsters.

Rise of mobile transactions

Global accelerated digitalization and adoption of mobile applications fuelled by the pandemic continued across a multitude of different demographics and geographies.

In 2014 the percentage of mobile traffic in the Digital Identity Network was 25%. By the second half of 2021, the mobile transaction split reached 75%. This was driven by a predominance of mobile usage amongst younger generations; mobile app-only fintechs and the emerging market population moving straight to mobile and skipping desktop altogether; and the rapid decrease of service data and smart handset costs.

Rise of human-initiated attacks

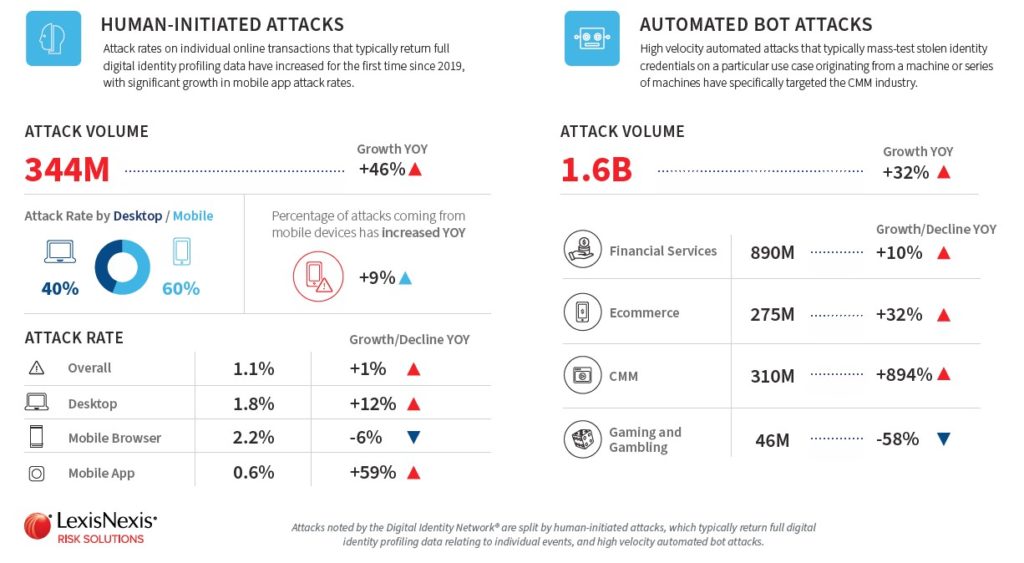

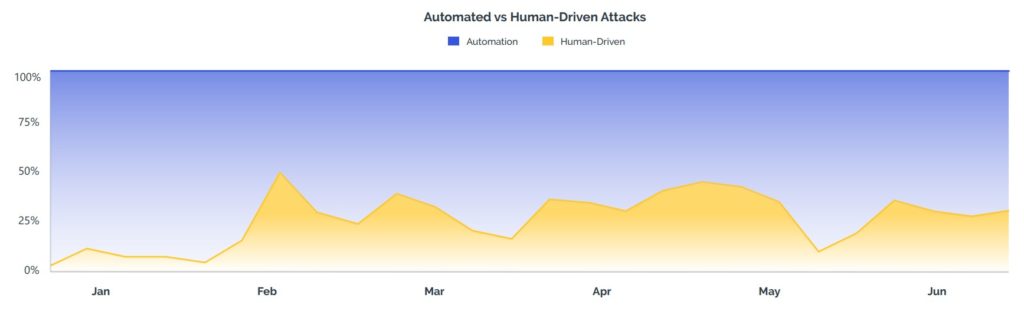

The use of automated bot attacks continues to rise (+32%). However, human-initiated attack rates rose (+46%) for the first time since 2019 with financial services being the primary target.

This phenomenon was also noted in Arkose Labs’ 2021 State of Fraud Report released in September 2021. Arkose estimated a 77% spike in human-driven attacks to supplement bot attacks. It warned of a trend towards hybrid and human-assisted attacks at scale.

“In a truly global digital economy, borders are no longer boundaries for trade or cybercriminals. It is more apparent than ever that fraud goes beyond single industries or countries,” said Stephen Topliss, vice president of fraud and identity strategy for LexisNexis Risk Solutions.

He opined that for businesses to succeed in the digital world, they need to collaborate in the fight against fraud.

“This can be achieved by utilizing the power of a global anonymized digital identity network and through the establishment of more focused digital consortiums among industry peers,” he continued.