Canalys defines cloud infrastructure services as those that provide infrastructure-as-a-service and platform-as-a-service, either on dedicated hosted private infrastructure or shared public infrastructure. This excludes software-as-a-service expenditure directly but includes revenue generated from the infrastructure services being consumed to host and operate them.

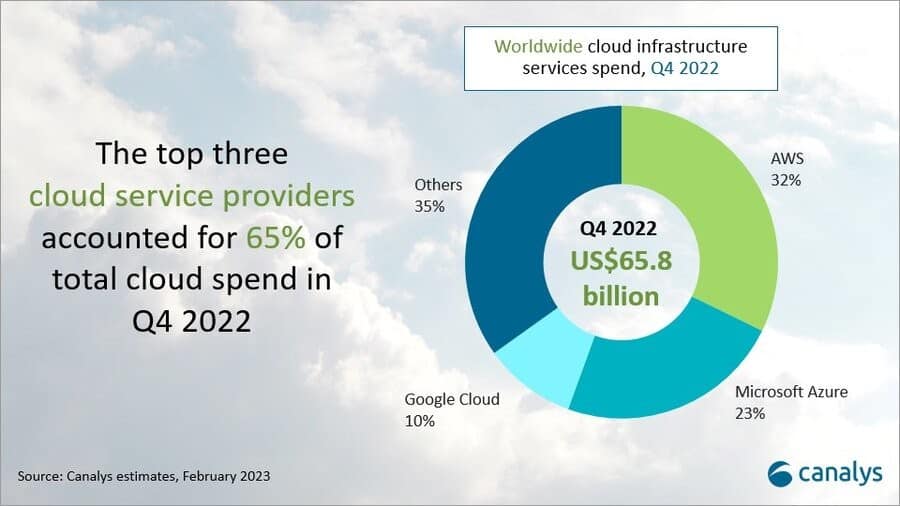

The firm estimates that worldwide cloud infrastructure services expenditure grew 23% year on year in Q4 2022 to reach US$65.8 billion, up US$12.3 billion. It also estimates that in 2022, the total cloud infrastructure services spend grew 29% to US$247.1 billion, from US$191.7 billion in 2021. It reported a quarterly growth rate slowed by 10 percentage points from Q1 2022 (34% in Q1 2022 against 23% in Q4 2022).

Factors slowing cloud spend growth

It attributes the decline to rising public cloud costs, fuelled by inflation. This is forcing enterprise customers to optimise public cloud spend after constant IT investment over the past three years in digital transformation. Macroeconomic uncertainties are contributing to a more conservative approach to IT budgets.

A growing number of customers are adjusting cloud strategies for greater efficiency and control. That includes assessing the repatriation of certain cloud workloads to private or co-location data centres to reduce costs, and driving greater adoption of hybrid and multi-cloud strategies.

While enterprise demand for cloud services persists, the growth rate for cloud infrastructure services will continue to slow for the next few quarters. Canalys expects global cloud infrastructure services spending to increase by 23% for the full year, compared with 29% in 2022.

The realities of worsening macroeconomic conditions and the looming recession prompted a slowdown in the volume and pace of migration to the cloud in Q4, especially by enterprise customers, which typically have larger workloads.

The hyperscalers were inevitably affected, with their growth falling by about 5 percentage points from the previous quarter. The top three in Q4 2022, AWS, Microsoft Azure and Google Cloud, collectively grew 26%, to account for a combined 65% share of customer spend.

“Enterprise customers are responding to higher cloud prices and higher-than-expected operating costs under the tough macroeconomic conditions,” said Canalys research analyst Yi Zhang.

“Customers that are currently on pay-per-use billing models will optimize cloud activities to reduce cloud consumption and save costs. There will also be a considerable slowdown in the take-up of cloud contracts, which will also result in a decrease in associated cloud revenue.”

Yi Zhang

According to Canalys VP Alex Smith, customers are rethinking how they use the cloud in their business operations.

“In some cases, there is a natural slowdown in computing demand as core operations see less activity. In addition, conservative budgeting among businesses will lead to less experimentation during the next 12 months.”

Alex Smith

Competitive landscape

By Canalys estimates AWS led the cloud infrastructure services market in Q4 2022, accounting for 32% of total spending. It grew 20% on an annual basis, an all-time low growth rate for AWS. The decline of enterprise customers’ spending, combined with rising server energy and operating costs, resulted in an increasingly negative impact on its profitability.

But AWS continues to actively invest in its channel ecosystems to expand its reach and acquire new customers. In terms of capital investment, it launched AWS Regions in Spain and Switzerland, as well as a second Region in India to continue growing AWS’ infrastructure footprint.

Microsoft Azure held 23% of the global cloud infrastructure services market and remained the second-largest provider after growing 31% year on year. Though seeing moderated consumption growth in Azure, its revenue is expected to be steady as its backlog commitment grew to US$189 billion in Q4 2022.

Google Cloud was the third largest cloud service provider and outpaced both AWS and Azure with the growth of 36% year on year to account for 10% of the market. Its differentiated products and focused go-to-market strategy are helping to drive customer momentum.

Google Cloud committed to deeper engagement with its channel partner community to drive growth in 2023. To improve profitability, Google Cloud announced an initiative to extend the lifecycle of its servers and networking equipment to six years to reduce depreciation costs over the next few quarters.