A recent FICO survey revealed that while 73% of Singaporean banks believe AI will strengthen anti-money laundering efforts many remain unsure how to operationalise the advanced technology.

Conversely, when asked about the efficacy of much older rules-based technology, 86% of Singaporean banks say they still believe in the ability of these AML systems, despite 36% saying they experience significant struggles modifying them.

Timothy Choon, FICO’s Financial Crimes leader in Asia-Pacific (APAC) says banks in the APAC region depend on rules-based compliance systems for fighting financial crime. He added that some early adopters are starting to embrace the new world of AI and realise that the decade-old rules-based systems can’t keep up with sophisticated threats on their own.

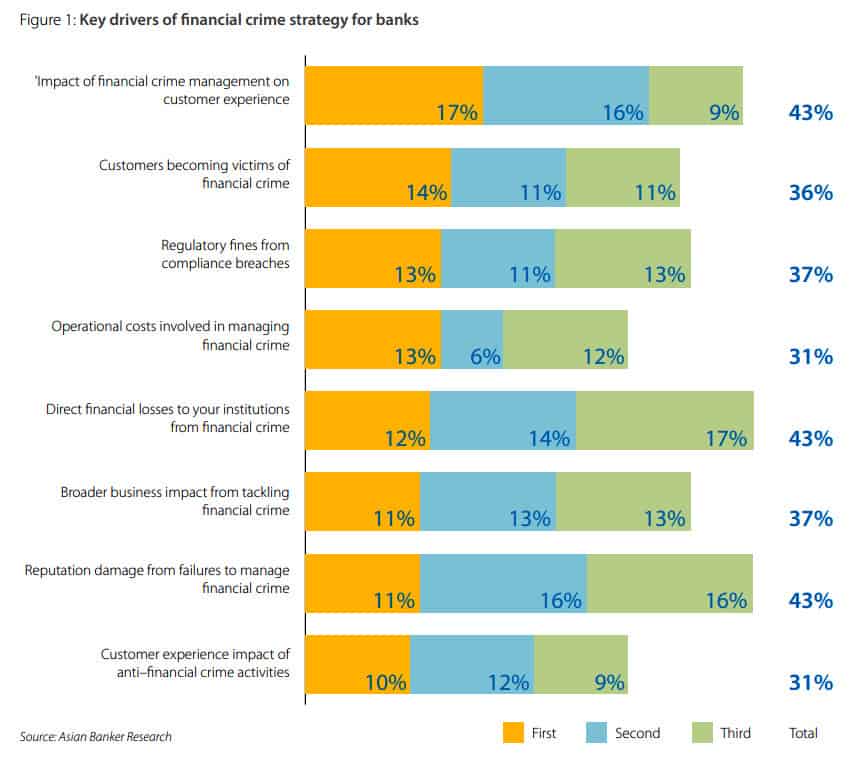

“The secret sauce is operationalising advanced AI technology and making it work side-by-side with the rules-based systems. In fact, 20% of respondents picked this as their principal obstacle in meeting financial crime risk mitigation targets,” he continued.

AI uptake landscape

Sneha Kapoor, research manager at IDC Financial Insights Asia/Pacific, commented that fraud analysis and investigation, which also includes AML transaction monitoring is the top AI use case (by spending) for the financial services industry in Asia/Pacific (excludes Japan) (Source: IDC’s Worldwide Artificial Intelligence Spending Guide, Aug (V2 2020) Release).

“With AI-powered AML transaction monitoring, AI can generate a risk score based on attributes of an entity and its behaviour. AI supports institutions by intelligently automating the process of identifying, investigating, and resolving a significant percentage of low/medium risk alerts. Only those cases that are intricate and high-risk are presented to the AML fraud and investigation teams. AI will discourage money laundering by making it more difficult,” she continued.

According to Kapoor uptake is mostly among tier-1 banks in Asia/Pacific who leverage AI to detect intricate patterns and transactions, augment risk scoring, and realize operational efficiencies. For other banks and institutions, there can be issues such as limited skilled resources and inadequate financial outlays. However, winning with AI is usually not a cakewalk.

Challenges and buying strategies

The survey showed that the key challenges for existing AML compliance solutions regionally were: the ability to meet new types of compliance risks in channels and products; the capacity to provide an end-to-end integrated compliance solution; and the facility to update quickly to changes in regulation.

Across Asia Pacific, larger multinational banks were more likely to use a vendor solution for AML, while the use of an in-house system was more common with domestic banks.

An escalating "arms race"

Dr Christopher Lee Marshall, vice president for Analytics, Big Data and AI at IDC Asia/Pacific, warned that AI will NOT Stop money laundering.

He explained that AI will make it harder and less worthwhile. However, if the rewards are sufficient criminals will use many of the same technologies including AI to second guess the banks AML defences.

“In one sense it is an arms race with the good guys using AI to augment largely statistical rules that capture the most common AML patterns, and the bad guys using AI to probe the inevitable simplifications embedded in these rules and analytics,” continued Dr Marshall.

He elaborated that in practice it goes even beyond weaknesses in an individual institution, as fraudsters target the weakest bank, which then is slowly forced by regulators and its customers to improve its defences to deal with those specific threats.

“Then of course the fraudsters improve their approaches and move on the next bank,” he cautioned.

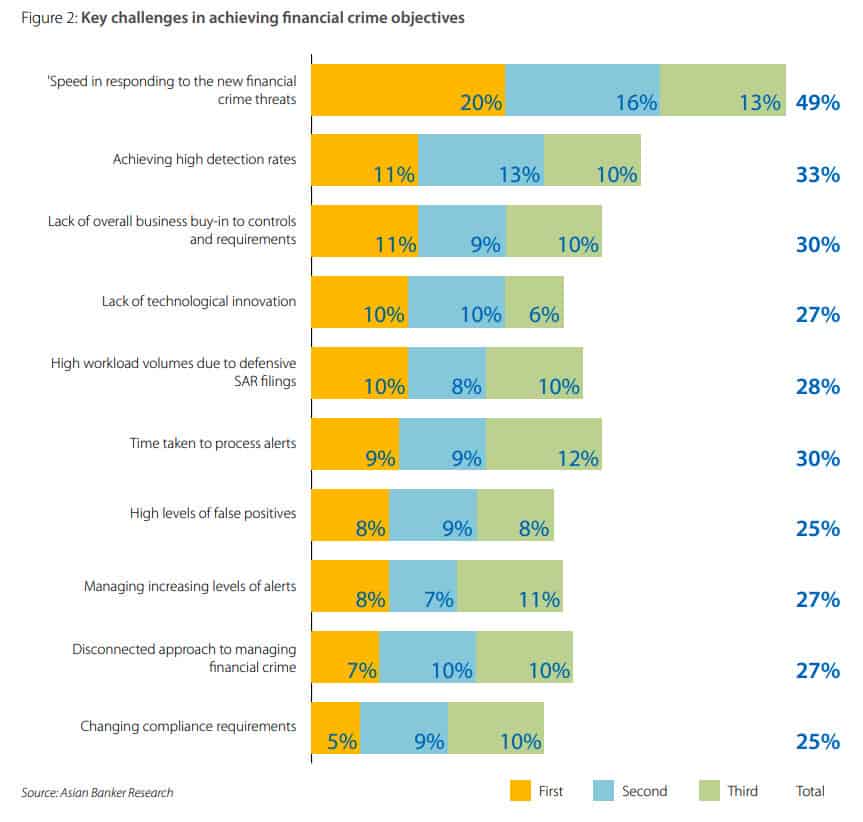

Key drivers of financial crime strategy

One of the leading indicators driving change in financial crime strategy is customer experience. Over two-in-five respondents ranked this in their top considerations with 17% of Asia Pacific banks citing it as the primary factor behind their current and future approach.

“We can see that addressing the competing needs of regulatory compliance and customer experience remains a balancing act for most institutions,” said Choon.

He added that banks are challenged by the need for more information to deal with high rates of alerts from ineffective systems, while not vexing customers with incessant due diligence questions.

Additional considerations ranked second and third by banks included reputation damage and direct financial losses. When it came to financial crime challenges almost half of the respondents cited the speed of responding to new threats, while a third believe achieving accurate detection remains a significant test.

Word of caution

AI is not infallible (i.e. unerring/unfailing/foolproof), noted Kapoor.

IDC Financial Insights has come up with the first principles for the use of AI to help institutions make right considerations when it comes to its implementations. These principles ensure that the use of AI is pragmatic, responsible, and customer-centric.

“Whilst we acknowledge that AI can create a pervasive impact; institutions need to make considerations regarding customer consent, data quality, fairness, biases, ethics, accountability, and security and governance to deliver accurate, consistent, and transformational results,” concluded Kapoor.