Logistics occupiers have big plans to expand their warehouse footprint in Asia-Pacific over the next three years on the back of growing optimism about the operating environment.

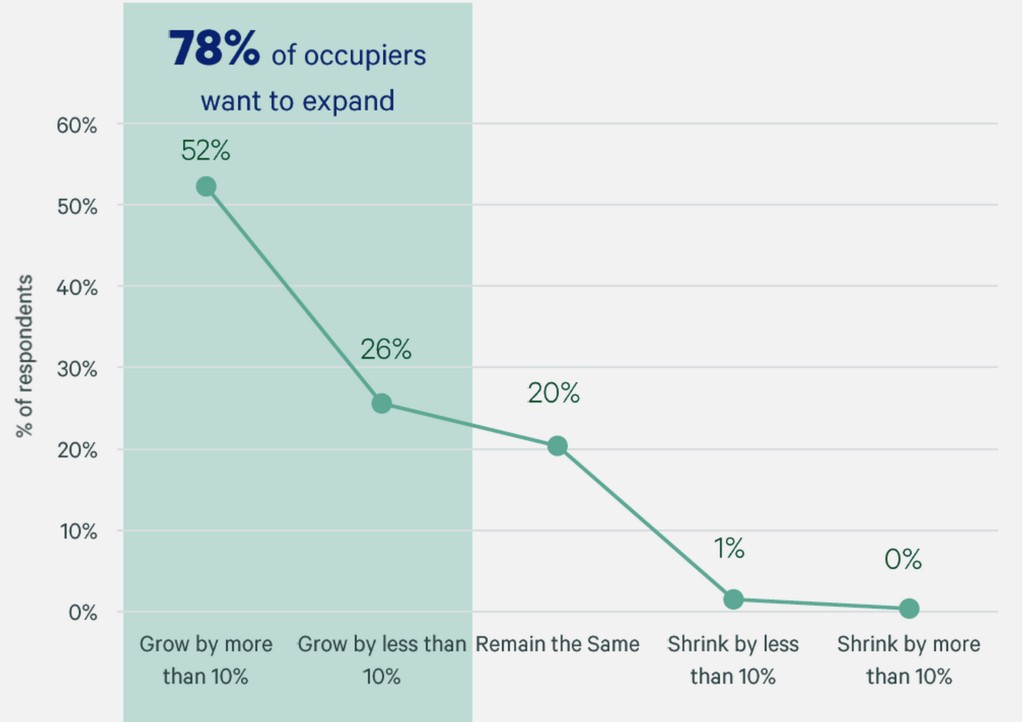

A CBRE survey found that 78% of logistics occupiers intended to expand their warehouse portfolio, with slightly more than half of the respondents eyeing significant growth. Emerging markets in Southeast Asia, such as Thailand, Vietnam, Indonesia, and the Philippines are growth targets.

Heightened demand comes amid a drop in warehouse vacancy in major Asia-Pacific markets to less than 4% in Q2 2021. Net warehouse absorption in major Asian markets also reached its highest first-half figure on record at 35.6 million sq. ft in H1 2021.

How do you expect your warehouse portfolio to change in the next three years?

Underpinning these expansion plans, occupiers are optimistic about the operating environment, with 84% expecting a significant or moderate improvement over the next three years.

Their optimism is supported by the logistics sector’s resilient performance throughout the pandemic, fuelled by accelerating e-commerce expansion, growing omnichannel retail and increased supply-chain requirements, such as maintaining additional inventory, or safety stock.

Troy Shortell, CBRE head of supply chain advisory, in Asia, said the pandemic has helped to hasten the pace of e-commerce growth and changed consumer buying behaviours, in turn shaping the logistics landscape of tomorrow.

Networks that rely on more direct and near-urban connection points are supplanting traditional multi-tier systems.

“This means that logistics property expansion in the next few years will be characterised by more demand for capacity closer to end-customers as shorter delivery times become increasingly crucial in an omnichannel era,” he added.

Optimising growth and costs

Costs have come sharply into focus for logistics occupiers in recent years as the omnichannel distribution model increases the complexity and frequency of deliveries and drives costs higher.

The survey found that increased cost for fuel, transport and labour was the biggest concern from 61% of occupiers, ahead of pandemic-related impacts (51%) and economic uncertainty (50%).

Real estate rent emerged as one of the top three factors occupiers consider when deciding where to locate facilities, alongside proximity to transportation, and proximity to markets and consumers.

The focus of logistics expansion is shifting from prime locations to satellite cities adjacent to metropolitan areas. Nearly 70% of occupiers surveyed expect to use more facilities in satellite cities, which often can be let for up to 50% less compared with prime locations.

These secondary locations also offer high-quality logistics space for expansion and consolidation. Occupiers have been quick to secure space, leading to vacancies in satellite locations such as Ken-o-do in Greater Tokyo falling from nearly 20% in 2017 to just 0.7% in Q2 2021.

Next-generation logistics facilities

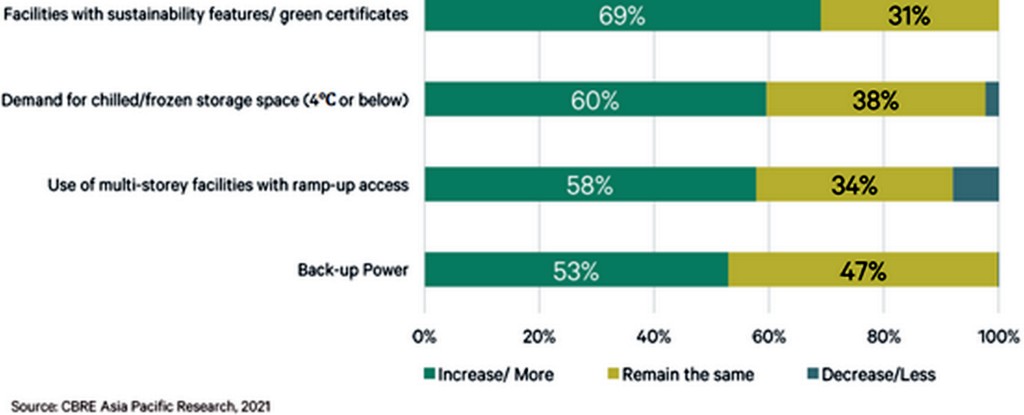

CBRE’s survey found that logistics occupiers with an eye on keeping costs low, while increasing efficiency and handling capacity, will have certain expectations for newer logistics facilities. These include requirements for facilities with green certificates or sustainability features (69%), chilled or frozen storage space (60%) because of omnichannel grocery retail demand, and multi-story facilities with ramp-up access that offer enhanced space utilisation (58%).

How do you expect your building specification requirements to change in future?

“Modern logistics operations are changing, and so the next generation facilities will need to evolve to meet new requirements. Well-designed warehouses with higher ceiling heights, wider column grids, ample dock space, and direct access are already becoming some of the most sought-after features by logistics property occupiers,” Shortell concluded.