Discussions around enterprise blockchain often lead to cryptocurrency, NFT and more recently metaverse. But what about in the real world today?

Enterprise blockchain use cases can be found in food safety, supply chain management, cross-border payments, insurance claims processing, and even telematics tracking in automotive.

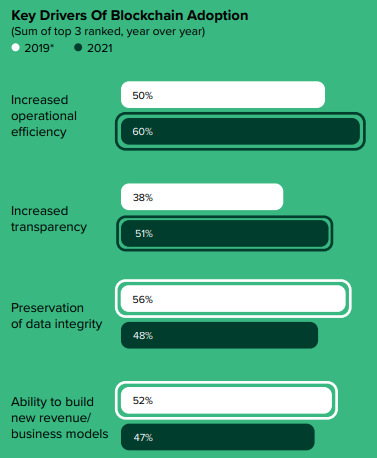

So, there is a healthy appetite for the technology as revealed in a 2021 EY and Dell Technologies commissioned Forrester Consulting study which revealed that COVID-19 saw an acceleration of projects focused on efficiencies and transparency have been accelerated.

Over 40% of respondents plan to implement digitisation and notarization of document use cases in the next 24 months.

Source: A commissioned study conducted by Forrester Consulting on behalf of EY/Dell, February 2021

*Base: 212 director+ blockchain decision-makers in the US, Germany, France, Singapore, and Hong Kong

*Souce: A commissioned study conducted by Forrester Consulting on behalf of EY, September 2019

FutureCIO spoke to two industry experts for their take on the future of enterprise blockchains and enterprise blockchain platforms.

The starting point

Forrester defines enterprise blockchain platforms (EBP) as an integrated software foundation (a software suite, a collection of public cloud services, and/or business solutions) with technology consulting and implementation services that use unaltered or optimised blockchain frameworks at its core to enable distributed collaborative processes around trusted data and is shared and distributed across organizational boundaries.

“Blockchain is catalysing a long-term shift of trust in distributed business environments worldwide,” said Charlie Dai, VP and research director at Forrester.

He noted that in the past three years, visionary enterprises and vendors began to gain business value by piloting blockchain technologies through permissioned and consortium-oriented blockchain for digital ecosystem augmentation and expansion.

Interoperability and other EBP hurdles

Despite the growing list of use cases and proof of concept initiatives, commercial models of EBP are surprisingly rarely celebrated. For Dai, part of the problem of EBP is the unfortunate association with cryptocurrencies that rely on mining on public blockchains.

He pointed out that in China, EBP doesn’t necessarily need mining-based incentives that caused huge energy consumption.

"Through strategic investment in a range of blockchain technology areas, including consensus algorithms, data privacy (e.g., zero-knowledge proof (ZKP), multi-party computation and federated learning, and security (e.g., PKI, trusted execution environment (TEE), and homomorphic encryption), vendors have already made substantial progress to address the needs of enterprises for performance, scalability, and regulatory compliance."

Charlie Dai

He conceded that the standardisation is still in the early stage worldwide. “But it is accelerating in China thanks to the open-source collaboration and government initiatives. And in the global market, NFT protocols like ERC 721/165 and 1155 can also be a good starting point for digital asset management,” he elaborated.

Aleksey Antonov, chief product officer at Unlimint, cited the shortage of strong specialists as another hurdle. “It is also hard to accurately evaluate the level of their expertise without having an expert within the company. Hence, it is often required to turn to recruitment agencies specialising in blockchain and crypto resources to hire developers from this field,” he continued.

Then there is regulation. Antonov says in most countries, there are no clear requirements regarding if and how blockchain technologies can be used for business. This especially concerns operations with personal data and financial transactions.

The scalability conundrum

A notable characteristic of the many innovations that came out of the digital era is the difficulty of scaling the business model.

According to Dai, the issue of scalability is important as business leaders normally care about outcomes, like how many transactions the system can support.

Technology leaders pose a more complex set of challenges. How many database transactions can the enterprise blockchain platform support? Will it ensure crash fault tolerance or byzantine fault tolerance? How many consensus nodes can it support? What about the support for off-chain integration? What cross-chain interoperability features does it include? And the list goes on.

Dai, however, argues that n China, companies like Ant Group, Baidu, Huawei, Hyperchain, JD, PeerSafe, and Tencent, have already achieved superior results in terms of scalability and transaction throughput. So, for him, scalability should not be a major barrier.

Antonov says the problem of blockchain scalability is associated with architecture parameters that were initially set internally and that determine the maximum network capacity.

“Limited capacity prevents the development of any services required for these parameters (for example, a payment protocol or a payment system). For instance, Ethereum has a throughput of no more than 20 transactions per second, and Visa, for reference, processes more than 20,000 transactions per second."

Aleksey Antonov

"Capacity is one of the key factors in the competition for new solutions in blockchain technology,” he continued.

Advice for those considering EBPs

Forrester’s Dai suggests thinking big and starting small.

“Learn from the pioneers. Focus on process automation and business collaboration by building distributed trust across the boundaries of systems, business units, organizations, and nations,” he opined.

For his part, Antonov suggests being very careful when choosing the technology you plan on adopting for product and service development.

“Blockchain solutions tend to gain popularity rapidly and at the same time rapidly die out. It's important to make the right decision at the early stages as migrating to another technology can potentially cost as much as building a completely new product from scratch,” he concluded.