“Successful organizations embed data and data-driven processes throughout the enterprise and use well-integrated platforms to automate the business and focus on outcome-first analytics programs.”

That was the observation from the Alteryx-commissioned Forrester report, Data and Analytics: The Key to Driving the Business During Challenging Time. The report goes on to declare that insights-driven businesses outperform competitors.

Analytic processes are embedded into business functions with the necessary investments in data, technology, and people to create a culture of data-driven decision making and automation everywhere in the firm.

Gut feel has given way to data and analytics as drivers of key business objectives. The Forrester survey noted that the top objectives of data and analytics programs are increasing efficiency, growing revenue, and improving customer experience.

A converged approach to analytics, data science, and process automation defines the ability of organizations to thrive in a strong economy and stay resilient in a rapidly changing environment. This requires automating business processes that democratize access to analytics, powering data-centric applications, and upskilling the entire workforce to create a culture of data and analytics across the organization.

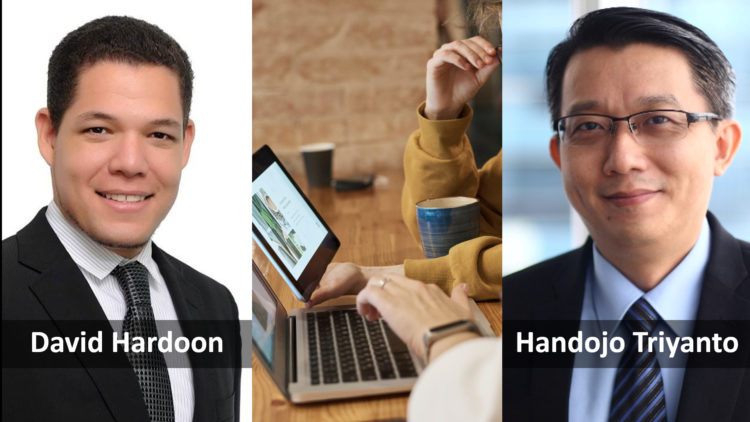

David Hardoon, a senior advisor for Data & AI at UnionBank of the Philippines, cites multiple factors driving financial institutions to become more data-driven.

“Firstly, consumers are increasingly becoming more digital savvy and are respectively expecting their various service providers to provide such services in a straight-through and digitally engaged manner. Likewise, consumers anticipate a higher level of personalisation, capturing their individual needs and wants. Furthermore, financial institutions are aspiring to be more data-driven in desire to differentiate themselves from competitors as well as unearth opportunities to drive efficiencies while enhancing revenue opportunities,” he elaborated.

For his part, Handojo Triyanto, senior research manager at IDC Financial Insights Asia/Pacific, listed competition, digitalization and artificial intelligence (AI) / machine learning (ML) technologies as key drivers:

- Competition – Data-driven financial institutions clearly have competitive advantage in productivity, reaction time, product innovation, and customer satisfaction.

- Digitalization – The massive adoption of mobile or smartphone in digital lifestyle of consumers has made data more available.

- AI/ML technology – The thriving AI/ML technology such as increased computing capability and related infrastructure in the market/industry, and more efficient algorithms for AI modelling.

Data quality – the starting gate

Any data-driven journey however cannot go ahead without data quality assurance – a consistent concern by senior executives at CXOCIETY-organised roundtables and panel discussions held through between 2019 and 2020.

Hardoon believed when it comes to data quality the onus is on everyone “who collects, interacts and uses data. While a Chief Data Officer, or Governance Committees, can take overall oversight responsibilities, it is critical that all individual in the supply chain of data appreciate their responsibility with respect to assuring quality.”

An opinion shared by Triyanto who added that “with data being used across functional units and top management levels, there needs to be a role (led by a dedicated unit i.e. Chief of Data Office) to orchestrate all data-related processes in the bank – including surveillance.”

To ensure data quality Hardoon recommends having a data governance framework/policy in place. He also suggests rolling out a data governance training plans across the organisation and having a clear use case on how the data will be used.

Triyanto suggests establishing a continuous process for the identification of data quality problem root causes including the countermeasures. Having already established a CDO role charged with orchestrating data-related aspects across the bank, he also suggests integrating data quality responsibility to each data creator’s performance review/appraisal.

Deloitte draws clear demarcation of the roles of the CDO and CIO. Whereas the former strategizes around how data is operationalised, the latter remains the technologist focused on how data moves within the IT infrastructure of the organisation.

The CIO in a data-driven bank

That is not to say that the CIO has a diminished role when it comes to data in financial institutions. Hardoon says it is important for leadership to make certain that the CIO understand their role in the bank’s data-driven transformation. The CIO must be able to respond to questions like:

- As demand on data grow, can the organisation’s IT environment readily scale rapidly?

- Do we have data science DevOps capabilities?

- How would IT support the business in uncovering new areas of businesses?

For his part, Triyanto suggests business leaders turn to the IT team to understand:

- What and how emerging technologies (e.g. AI/ML) can help the business side in basic and high-level perspective point of view

- What are the challenges and risks (critical success factors) that business should be aware to become a data-driven enterprise?

- What is the strategic framework (processes, capabilities, and outcomes) to use for 3-5 years in planning data-driven transformation?