Following several years of turbulence, including extreme weather, the COVID-19 pandemic and disease, significant disruption is radically changing the risk landscape for consumers with more and different risks. With this reality, consumers want their insurance companies to more than just help them when there is disruption but help them reduce and prevent risk too.

Bain & Company’s new report, Customer Behaviour and Loyalty in Insurance: Global Edition 2023, revealed that consumers want more from their insurers than delivering coverage. Consumers overwhelmingly want risk prevention and mitigation services from their insurers.

Willing to pay for

In Japan, 81% of survey respondents indicated an interest in risk prevention. Globally, more than 40% of millennials are willing and interested in paying for life insurance that includes risk prevention. Changing customer behaviour also means a shift for insurance agents, who historically pushed out offerings with a pitch, and now need to pull in customers by addressing their priorities at the right moments.

Technology, including digital tools and advanced analytics, will allow insurance companies and their agents to shift away from a transactional role to broader relationship-based consumer interaction.

“The consumer demand for more risk-prevention beyond traditional insurance services has led to new services,” said Henrik Naujoks, a partner at Bain & Company. He noted that in Southeast Asia new services can lead to developing stronger relationships with consumers. He cited the example of a life insurer that launched health and parent online forums that led to 300,000 customers signing up in the first year, with one-fifth of active users having then met with their insurance broker.

Insurers will need to deliver on the promise to address elements that consumers value most, including being a purpose-driven company, as well as incorporating risk prevention and mitigation.

Recommendations for insurance companies

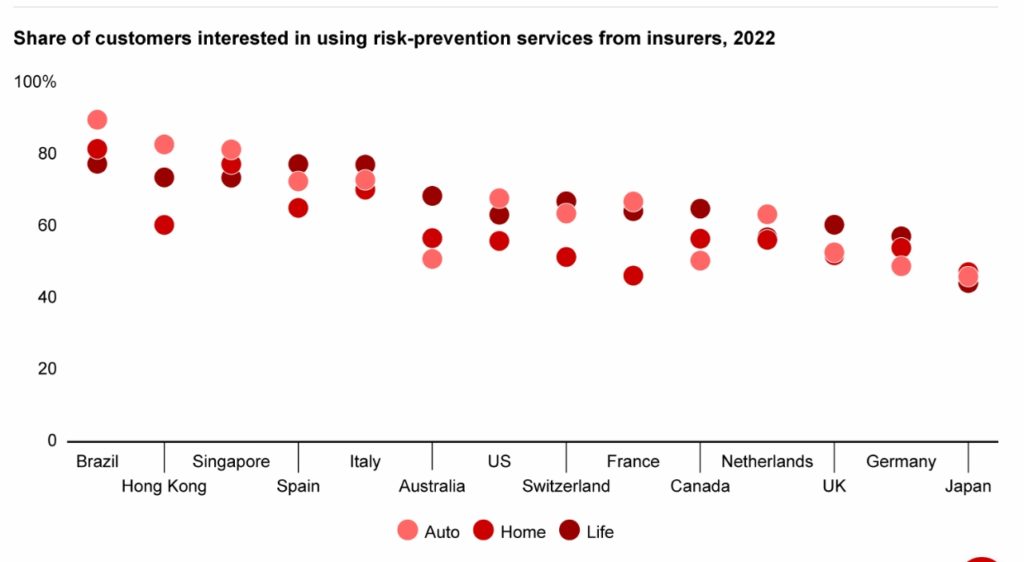

The next frontier - risk prevention: Most customers across regions are open to risk-prevention services from insurance companies. The customers also wanted to be rewarded by the insurers for their risk-prevention habits.

For example, consumers want to be rewarded for safe driving by their auto insurers. However, to date, many consumers are not currently using risk-prevention services. There is an opportunity to improve as consumers are open to sharing data with insurers and there is growing infrastructure to leverage consumer data to motivate and reward risk-prevention habits.

Insurers need to be purpose-driven: Mirroring corporate expectations across industries, insurance companies are also being expected by consumers to have a higher purpose. Eighty per cent of global consumer survey respondents want insurers to embed environmental, social, and corporate governance (ESG) initiatives into their proposition. As insurers enact a strategy focused on purpose, this will also strengthen loyalty and relationship with their customers.

Digital usage has increased, but still needs to be improved and seamlessly embedded into the omnichannel approach: While the pandemic increased the access to digital tools in the insurance industry, use still lags. Consumers often use digital tools to research and for simple episodes. However, consumers rely on a hybrid approach for more complex episodes.