A new study from Juniper Research has found that the total BaaS (Banking-as-a-Service) platform revenue will exceed $38 billion by 2027, rising from $11 billion in 2022. The rapid growth of 240% will be driven by BaaS’ ability to deepen relationships between brands and their customers by providing a user-friendly banking and payment experience.

BaaS enables non-banking companies to offer their customers financial services without owning a banking licence or infrastructure. This allows brands to generate new revenue without using time and resources to generate new capabilities in-house.

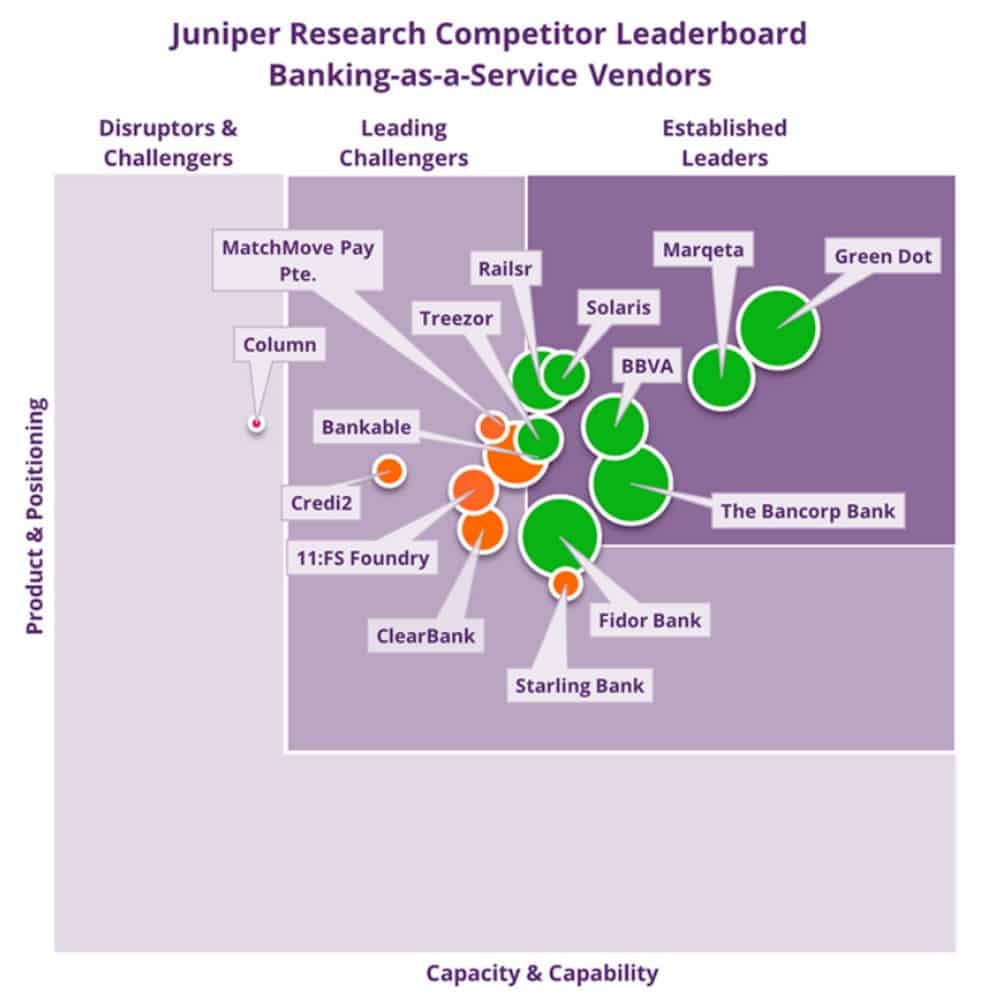

The Banking-as-a-Service: Segment Analysis, Competitor Leaderboard & Market Forecasts 2022-2027 report found that Green Dot leads the BaaS market largely due to its strong partnerships; specifically with large retailers such as Apple and Walmart. The report commended Green Dot’s array of banking and payment solutions, including card issuance, custom rewards, and payroll services.

Marqeta also ranks well due to its impressive international presence; being able to leverage a competitive position when onboarding multinational customers. Similar to Green Dot, Solaris’ success stems from its large volume of partnerships that have been achieved through its established brand, coupled with the ease of integration and technological support offered with all its services.

Research author Dominique Tetnowski explained that as digital banking is becoming increasingly advanced, pressure is on fintechs to innovate their BaaS capabilities to exceed user expectations.

“Offering a solutions portfolio in BaaS that has all the capabilities needed to offer banking services means that enterprises can focus on delivering a superior user experience, which is critical in an increasingly competitive banking environment,” she added.