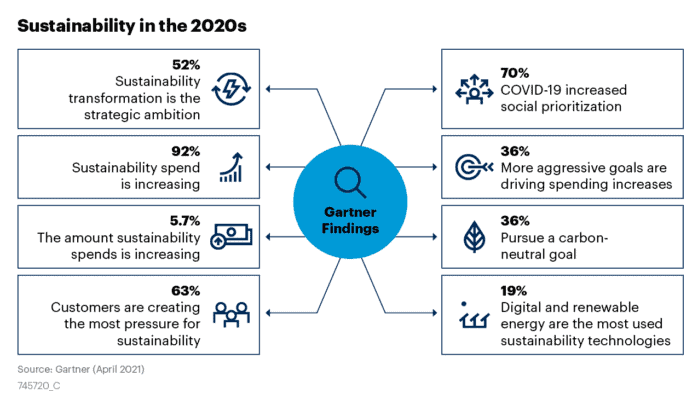

Gartner data shows that social responsibility and ESG mentions in top business priorities have almost doubled year over year (see 2021 Gartner CEO Survey: The Year of Rebuilding). ESG goals are becoming more aggressive, business investments are increasing, and consumers, employees and regulators are driving most of the change.

Against this backdrop, winning against ESG efforts will become an essential part of Financial Services leaders’ strategy, and you will be expected to play a bigger role in shaping your organization’s progress.

Source:: Gartner (April 2021)

Taking the lead on ESG strategy, though, can be a daunting task, given this is a new and evolving field without any existing playbook in place. To help you and your teams get started, we have laid down four ways for leaders to get started:

I. Begin with a “materiality” assessment to prioritize what ESG efforts to tackle.

The question we often hear from leaders is: where do we begin? There are a wide variety of issues to tackle and each stakeholder will have their own opinion of what is most important.

One powerful way that can help leaders gather different perspectives on issues that matter the most is by running a materiality assessment. Materiality is about prioritizing issues by a combination of their impact on your business and their significance to stakeholders.

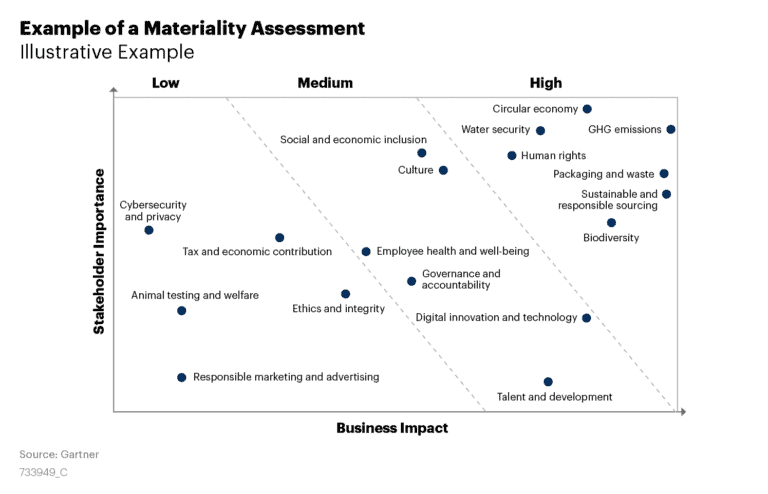

The figure below gives an example of a materiality assessment done by a firm where ESG initiatives are prioritized against two dimensions — first is the importance to stakeholders, which indicates expectations or desire for action on the part of your customers, investors, employees and the general public, and the second is the business impact that indicates the capacity of the ESG issue to slow the firm’s growth or shrink its profit margins.

Both these dimensions in the materiality assessment will allow you to filter out nonessential issues, while also helping combine issues that might require similar governance structures (for example, issues on green products and carbon emissions can be combined within a broader climate change priority for the business).

Source: Gartner

II. Don’t ignore the S (Social) and G (Governance) of ESG.

As you prioritize ESG initiatives to invest in, avoid tunnel vision by equally balancing the need for environmental, governance and social banking initiatives. Recent Gartner analysis of S&P 500 companies revealed that while 89% of firms issued an environmental impact report, fewer than 50% issued a report that addressed organizational governance.

Additionally, governance metrics accounted for only 8% of total metrics referred by firms across industries (See ESG by the Numbers: Benchmarking ESG Disclosures).

A relatively narrow focus on ESG goals carries the risk of firms falling behind, as many initial ideas and experiments may not be successful. Eventually, a narrow focus makes it harder to scale and secure returns from the limited efforts.

There is also the risk of alienating critical stakeholders who may hold higher importance on multiple priorities under the three ESG pillars. For example, while your customers may care about credit access to the underserved, your institutional investors may prioritize sustainable lending as a top priority.

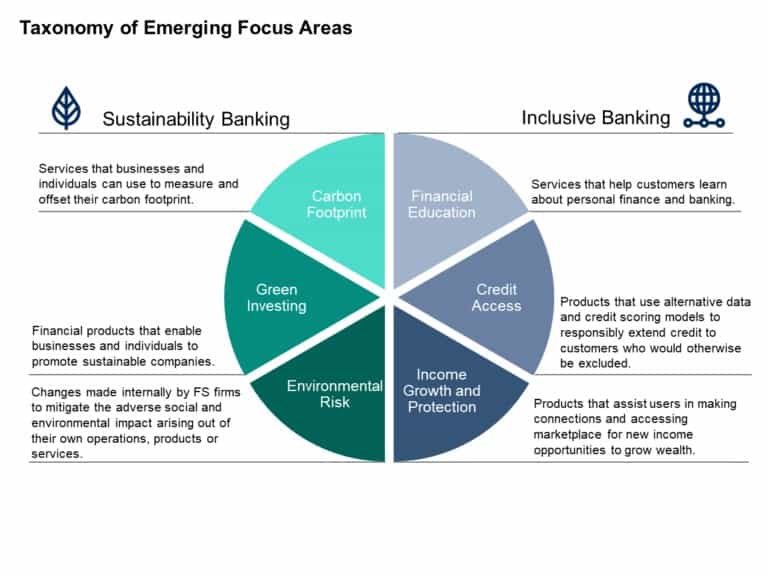

To help you think about and engage with the developments in these fields, Gartner has created a taxonomy of initiatives that cover sustainability-linked as well as inclusive-banking initiatives based on use cases emerging in the industry (see How Financial Services Leaders Are Winning on ESG Goals).

III. Build accountability and avoid the trap of ESG-washing.

Your stakeholders want to see how your organization’s ESG efforts are making a difference. But this is a new and evolving field for many, making it hard to determine which metrics to disclose and in what form.

Moreover, at the moment, there is no single standard for reporting sustainability efforts making it harder for stakeholders to compare progress made with other peer organizations.

One way forward is to use the established standards and metrics that are laid down by the Global Reporting Index (GRI) and the Sustainability Accounting Standards Board (SASB); these standards are also favoured by organizations globally.

The other is to prioritize a few most important measures and ensure there is a clear link with broader business goals. For instance, if a bank is trying to establish sustainable lending practices, illustrate how these efforts will boost business performance over time.

Building a line of sight between sustainability initiatives and business performance will help stakeholders understand the firm’s position on ESG issues and how stakeholder value will be enhanced by ESG initiatives.

Accountability tied with business results will also ensure leaders do not get caught in the ESG-washing trap where results are overinflated or misleading information about the progress is communicated to the market; bringing its own share of a reputational and legal risk.

IV. Get comfortable with results over the longer term.

Recent Gartner data shows that sustainability in its current form is only increasing revenue for 4% of executives (see Leading Sustainability Ambition, Goals and Technology in the 2020s). One reason could be that many executives are still relying on existing products and initiatives to support ESG goals, rather than creating new products. Another could be the long development and return life cycles of such initiatives.

But more importantly, leaders must also take into account that the growing interest in ESG is part of a larger trend away from the established consensus of maximizing shareholder value (MSV).

Businesses in every industry are beginning to shift towards a stakeholder or customer value model, where results are quantified beyond immediate costs and returns. Firms are beginning to be judged based on how well their actions create long-term benefits for all stakeholders, including shareholders, employees, customers and society at large.

Avoid the trap of judging the success of ESG initiatives based on old quarterly MSV thinking. Learn, improve and continue to make progress by seeking a balanced stakeholder approach to ESG and constantly iterating as you think of the longer-term ahead.

Returns on these initiatives will create a more vibrant and dynamic organization, capable of finding and creating new customer value and outperforming the competition.

By Uri Lerner and Jasleen Kaur Sindhu

This article first appeared on Gartner blog network