A global study of 758 professionals at global financial institutions and banks noted that 94% of respondents from Hong Kong see open finance as either a ‘must have’ or ‘important’ (slightly up from 92% in 2021).

With over a third (35%) of the Hong Kong respondents identifying open finance as a ‘must have’, it suggests that the financial services sector is actively investigating products and services that would benefit from an ecosystem model.

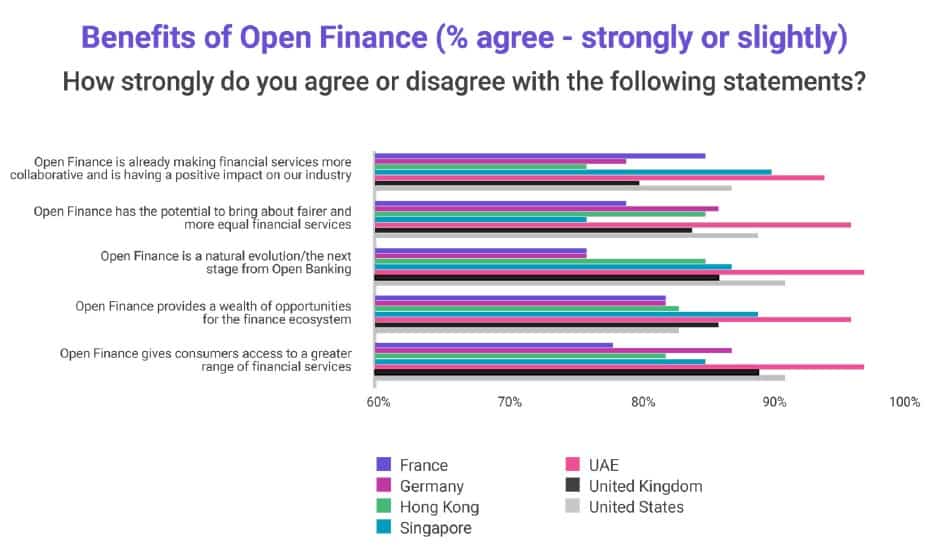

It's not hard to see why, as 82% of professionals in Hong Kong agree that open finance is giving consumers access to a greater range of financial services. Additionally, 85% agree that open finance has the potential to bring about fairer and more equal financial services, whilst three quarters (76%) agree that open finance is already having a positive impact on the industry and making the industry more collaborative.

The ‘Financial Services: State of the Nation Survey 2022’ survey also found that Hong Kong financial institutions are being cautious with their technology investments, with 87% in Hong Kong saying spending has been at least somewhat constrained by the current economic situation.

About 60% think their full investments will resume by the second half of 2023, this is below the global average of 74%. Only 6% in Hong Kong do not think their full investments will ever return, although this is higher than all other markets, where only 1-2% share this opinion.

Benefits

All territories agreed that Open Finance provides a wealth of opportunities for the finance ecosystem, with more than 8 in 10 respondents in every region agreeing on this point.

Among respondents to the study, 85% of respondents concurred that Open Finance is making financial services more collaborative and having a positive impact on the industry. Among the seven markets that participated in the study, those from Hong Kong ranked this benefit lowest (76%).

Instead, 85% of institutions in Hong Kong feel that the biggest impact is the ability to create fairer financial services. The same proportion in Hong Kong believes that Open Finance is a natural evolution of Open Banking – a benefit that was also ranked joint top by institutions in the US (91%) and UAE (97%).

Conversely, Singapore sees a large year-on-year decrease in agreement with the notion that Open Finance has the potential to bring about equity in financial services – with this having fallen from over 94% in 2021 to just 76% in 2022 (76%).

Other insights

Banking as a Service (BaaS) and embedded finance have become an industry norm, but investment has slowed in Hong Kong – More than three quarters (77%) in Hong Kong agree that BaaS and embedded finance are already expected/demanded by customers.

In 2021, Finastra’s research found that Hong Kong was leading other markets in the deployment or improvement of BaaS (42%) and embedded finance (43%), but this has slowed in 2022 with just a third (33%) saying they have improved or deployed BaaS in the past 12 months and a quarter (27%) for embedded finance.

Cloud adoption is lower in Hong Kong than other financial centres – Hong Kong appears to lag behind other markets in terms of cloud adoption, showing the lowest proportion of professionals saying they have all or most of their software stack on cloud-based solutions (41%, vs global average of 51%) and the highest percentage with all or most of their software hosted on-premises (22%, vs global average of 16%). That said, more professionals (39%) than in any other market (31% global average) said their organisation had invested in cloud adoption in the last 12 months.

Support for ESG is widespread – Almost 8 in 10 organisations (79%) agree that it’s important for the financial services and banking sector to support environmental, social and governance initiatives. Linked to this, 81% of respondents recognize that green lending presents an opportunity for growth and revenue generation.