As technology advances at an unprecedented pace, banks find new opportunities to elevate their customer services and optimise back-office processes. Yet, amid the advantages of these technological strides, banks must also navigate the ever-evolving landscape of risks that accompany digitalisation efforts and the adoption of novel technologies.

In the first five months of this year, Hong Kong witnessed a notable decline in email phishing cases. However, it is concerning that despite this decline, there remains a glaring gap in public awareness regarding cybersecurity.

This gap was underscored when the majority of employees participating in an anti-scam drill at various companies were found to have clicked on suspicious links. These circumstances shed light on the significant cybersecurity challenges facing the banking sector within the rapidly evolving digital landscape. Financial institutions find themselves especially susceptible to cyber threats, which encompass the risk of large-scale data breaches.

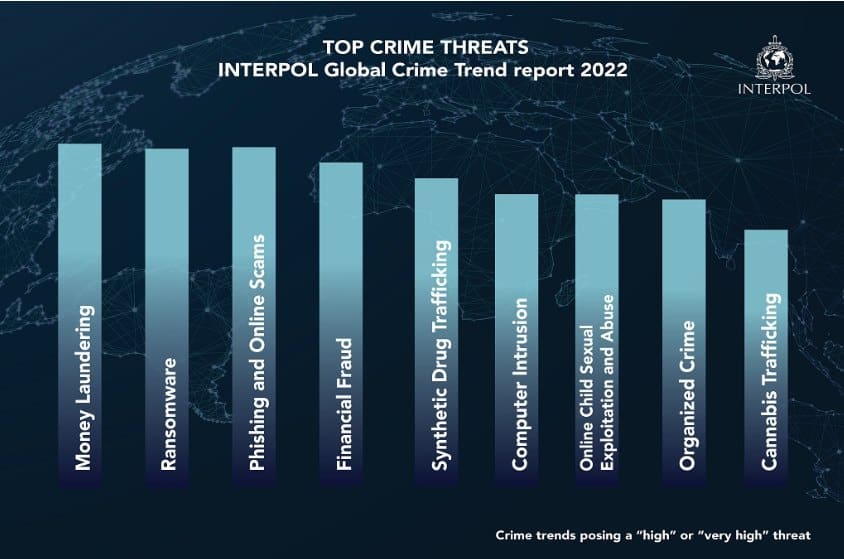

Cybercriminals have honed their focus on the financial sector, driven by motivations ranging from financial gains and the acquisition of sensitive trade secrets to the disruption of services with the intent to draw attention to social or political causes. The gravity of these financial and cybercrimes is underscored by their elevation to the status of top global policy concerns, as recently highlighted in a report by INTERPOL.

A successful breach can cause severe damage to a bank's brand, depending on the attack's severity and the specific institution involved. As digitisation becomes increasingly necessary in the banking industry, and security risks escalate, executive teams must ensure the resilience of their business operations, compliance with government and industry regulations, and the effectiveness of their cybersecurity infrastructure to safeguard against expanding attack surfaces.

Financial service providers must defend against a range of threats, including data breaches, ransomware attacks, malware, phishing, and social engineering attacks, which are growing in sophistication, frequency, and intensity.

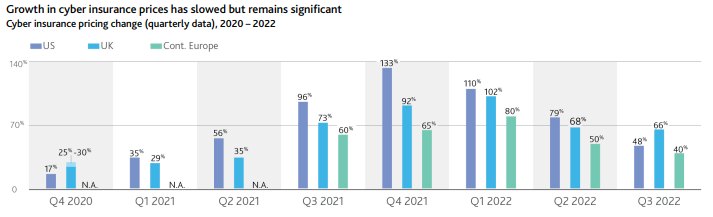

The challenges of countering these threats intensify as the attack surface widens in complexity and scope. Moody's 2023 Global Cyber Risk Outlook states that regulators and insurers are taking steps to reduce financial exposure to cyberattacks, and the demand for cyber insurance is expected to exceed supply.

Sources: Marsh, Moody's Investors Service

Cybersecurity holds a position of utmost significance in the banking sector, serving as a pivotal element for financial institutions striving to sustain their competitiveness and resilience in the ever-changing landscape of today.

To successfully fulfil this dual responsibility, banks must strike a delicate balance, continuously innovating while also ensuring the protection of the innovations driving their progress. In this framework, several critical cybersecurity priorities come to the forefront for the banking industry.

Visibility: Comprehensive network visibility emerges as a paramount concern in an era marked by the proliferation of mobile banking, seamless integration with the Internet of Things (IoT), and widespread cloud deployments. Maintaining a crystal-clear oversight of all network activities becomes indispensable to thwarting data breaches and adeptly managing the gamut of cybersecurity risks.

Automation and Operational Efficiency: The era of siloed security solutions has given way to a new paradigm that champions integrated solutions, harnessing the power of automation to minimise reliance on manual configurations and constant monitoring.

As supervisory authorities underline cyber resilience regulations, security teams find themselves at a crossroads, needing to harmonise compliance obligations with proactive defence strategies against evolving cyber threats. Here, the utilization of policy-as-code approaches can prove instrumental, effectively codifying, and automating policy checks to ensure robust compliance.

Flexibility and Scalability: Financial institutions operate within a diverse IT architecture, encompassing multi-cloud and on-premises deployments. This diversity demands not only agile security controls and policies but also scalability to accommodate growth and change.

As banks navigate the complexities of digital transformation, their security solutions, including policy-as-code practices, must be adaptable to align seamlessly with infrastructure changes and scale to meet evolving demands effectively. This combination of flexibility and scalability ensures that security measures remain robust in the face of an ever-shifting technological landscape.

Compliance Reporting: Regulatory compliance transcends the realm of a mere checkbox exercise, gaining a new dimension of significance. Central banks and supervisory authorities are increasingly emphasizing cyber resilience regulations, necessitating that security teams walk the fine line between compliance obligations and the proactive defence measures imperative to counter cyber threats effectively.

In this realm as well, policy-as-code methodologies prove instrumental, delivering the ability to codify and automate policy checks, thereby ensuring ongoing compliance in an ever-evolving landscape.

In the ever-changing digital landscape, cybersecurity is paramount for banks. Partnering with a consolidated security solution provider streamlines operations, closes gaps, enhances efficiency, and improves user experiences. This proactive approach ensures banks remain resilient and competitive in the face of evolving cyber threats, reinforcing trust and security in the digital age.