Gartner defines software maintenance as including updating software, adding new functions, fixing bugs and solving problems. Technology vendors often sell a maintenance contract with their software. This contract is usually calculated as an annual fee based on some percentage of the total software cost. It generally provides for overall support and maintenance of a software product, including applications. Support may include telephone assistance time as well.

In recent years, software maintenance contracts signed with the original OEMs are coming under greater scrutiny in part because budgets are not growing as fast as new opportunities are rising. The sources of innovation are also no longer the domain of large established players with the entry of highly targeted solutions from startups that are perceived as delivering more value-added benefits.

Yes, tailored solutions are also starting to become fashionable again. In addition, innovations around artificial intelligence, machine learning and analytics are opening new avenues for discussing just what constitutes maintenance contracts.

This is exacerbated by the COVID-19 pandemic which is forcing business leaders to scrutinise every investment avenue, including CAPEX and OPEX investments particularly those that do not directly bring in revenue.

Despite the recent growth in migration of enterprise applications to the cloud, Gartner estimates that as much as 70% of applications are still based on a traditional license and maintenance model.

FutureCIO spoke to Andrew Seow, regional GM, Southeast Asia and Greater China, Rimini Street – a third-party software maintenance company for his take on how enterprises can revisit their software maintenance strategies to better comply with current business conditions.

How are businesses responding to the pandemic, both internally and externally, as we come to the end of the year?

Andrew Seow: The COVID-19 pandemic has really shifted how businesses have been operating. Businesses have been moving online and going self-service. So, from a B2C perspective, many consumers are purchasing items online, which has stirred businesses to invest more into online IT systems.

Internally, CIOs have also shifted their mindset from being strategic and innovative to increasing efficiency and optimising employees' experience, especially to create the IT environment for employees to work from home.

Given operating constraints that organisations are in (e.g. revenues down, costs up) how should CIOs respond to calls by leadership to turn investment in technology into activities that foster productivity, innovation, and support for new products?

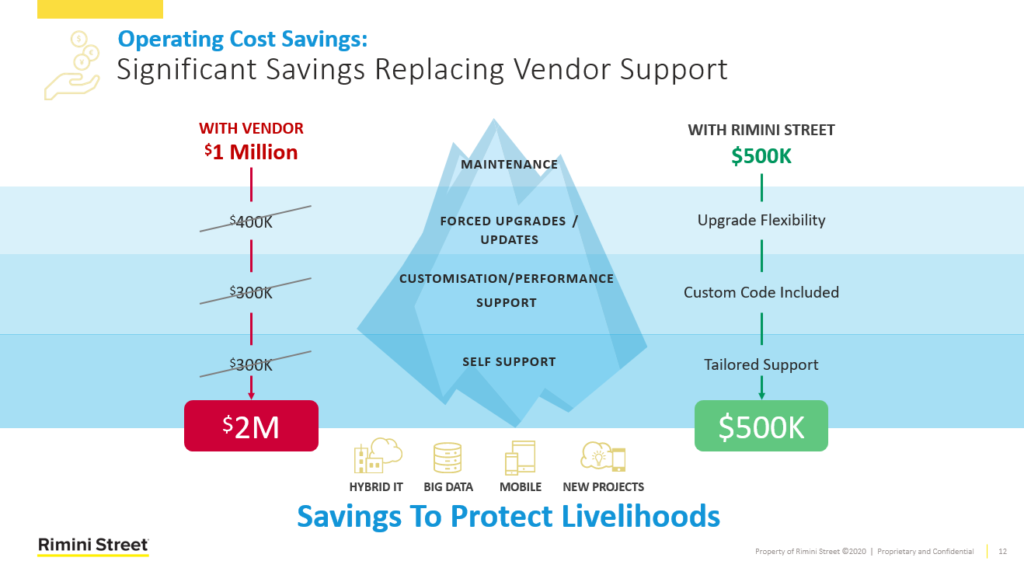

Andrew Seow: We have worked with many organisations and have seen them continuing to invest heavily in legacy ERP systems that are robust and meet the functionality requirements of the organisation. Organisations spend quite a bit on ERP maintenance, so CIOs have explored third-party providers for maintenance services outside of their principal provider.

With pressures on the one hand to drive innovation transformation technology and technology as well as evolving regulations on the other hand, is there a need for IT leaders to consider how new technologies are introduced into the organisation?

Andrew Seow: Many organisations are being led by a vendor-dictated roadmap. They make large investments into their ERP systems and are at the mercy of vendors to tell them when and how to upgrade.

Many CIOs are using the existing ERP system and innovating around the edges to derive much better value out of it.

These investments (maintenance fees) are fairly massive. Some of them (license fees) haven't even been written off the books. In the past twelve months, what sort of changes have been introduced with regards to just how organisations are able to extend the value that they have from these massive investments in enterprise applications?

Andrew Seow: Organisations invest heavily in ERP because it is the backbone of their business support, and ROI spans across 10 to 15 years. What we are seeing today is that a lot of organisations are delaying upgrades required by vendors, mainly due to the pandemic, and the need to re-channel and save costs to keep other operations alive.

A decision that stands out is whether to continue in their vendor-dictated roadmap or look for a third-party maintenance provider.

There are a lot of third-party providers out there in addition to the original OEMs. From that perspective, what should CIOs be looking at when trying to figure out which third-party maintenance solution provider they should approach going forward as their contracts for the original OEMs come near to expiring?

Andrew Seow: That is a key concern we address with customers and prospects. We encourage prospects to consider the engineering support staff and their ability to deliver service, the provider's list of customers, and the technology behind the support that could lessen the response time for tickets.

Sometimes CIOs speak to their peers to get feedback on different providers. After all this thorough evaluation, CIOs feel that third-party maintenance is a viable route to drive cost efficiencies and a better service level.

How do contracts for TPM work today? Do they give options for enterprises to decide that they only want a one-year renewal contract or do they have to stick with a five, multi-year contract?

Andrew Seow: CIOs typically see it as a journey in which their business-driven roadmap will determine the duration of the contract. Some CIOs have short roadmaps where they are decommissioning the existing ERP to move to the cloud or a newer system.

We work with many CIOs who have a longer journey, wherein they want to dictate the roadmap. Rimini Street works with customers about three to five years to ensure customers are fully enjoying the cost savings and service levels.

Can you share one or two recommendations on what CIOs might consider as part of their strategy to help drive transformation and innovation?

Andrew Seow: The first thing CIOs need to consider is what kind service that they want to provide to internal stakeholders amid an evolving digital landscape. CIOs, especially in Southeast Asia, must consider the work-from-home arrangement so that IT systems and employees are enabled to allow this capability and keep efficiency at its highest level.

Finally, CIOs must look at external opportunities in customer-facing systems to really understand how to mine customer information and provide better services to customers.