Banks and lenders in Asia-Pacific (APAC) are increasingly aware of the critical need to better protect their customers from falling into financial hardship.

The credit decisioning and alternative data use conducted by Forrester Consulting study done on behalf of Experian surveyed 164 banking, fintech, and non-banking lending decision-makers managing credit risk in Australia, Indonesia and India. It found that while most are confident in their credit risk decisioning performance, the top underperforming area is the management of hardships and collections, with 54% agreeing there is room for improvement.

With consumers’ growing financial woes amidst the COVID-19 pandemic, it’s apparent that poor credit decisions are negatively impacting customers’ financial situations – more than half (54%) of APAC banks and lenders surveyed in three markets agree that putting customers in a hard situation (54%) is one of the top implications of a poor credit decision, just behind financial loss (60%).

Fortunately, the study also found 80% of organisations are focusing on developing monitoring and early-warning systems as a top risk management priority - and they have plans to continue investing in this area over the next one to three years.

This shows that organisations are actively ramping up investment in technology to predict and identify early signs of financial stress, including taking on higher-cost loans, a loss or drop in income, greater reliance on savings, and a shift in spending on high priority items.

This enables personalised management plans to be rolled out to support affected individuals through these difficult times.

Key trends

Automation is a critical priority

Source: A commissioned study conducted by Forrester Consulting on behalf of Experian, August 2021

Seventy-three per cent of businesses rank increasing automation as a high or critical priority for credit risk assessment and management in the next 12 months, with more than half (52%) saying this is to increase the speed of credit decisions and reduce manual errors in the risk decisioning and management process (50%).

However, one third face challenges in increasing the automation of credit decisioning and management, saying their current automation technologies have not matured yet, or they face challenges due to legacy technology and systems (26%).

A higher speed of credit decisioning and quicker loan approval rates could provide a vital lifeline for consumers. In fact, 75% of Australian consumers believe home loan approvals should happen within three days, while 50% expect the approval to take place within 24 hours.

Too many data sources

Source: A commissioned study conducted by Forrester Consulting on behalf of Experian, August 2021

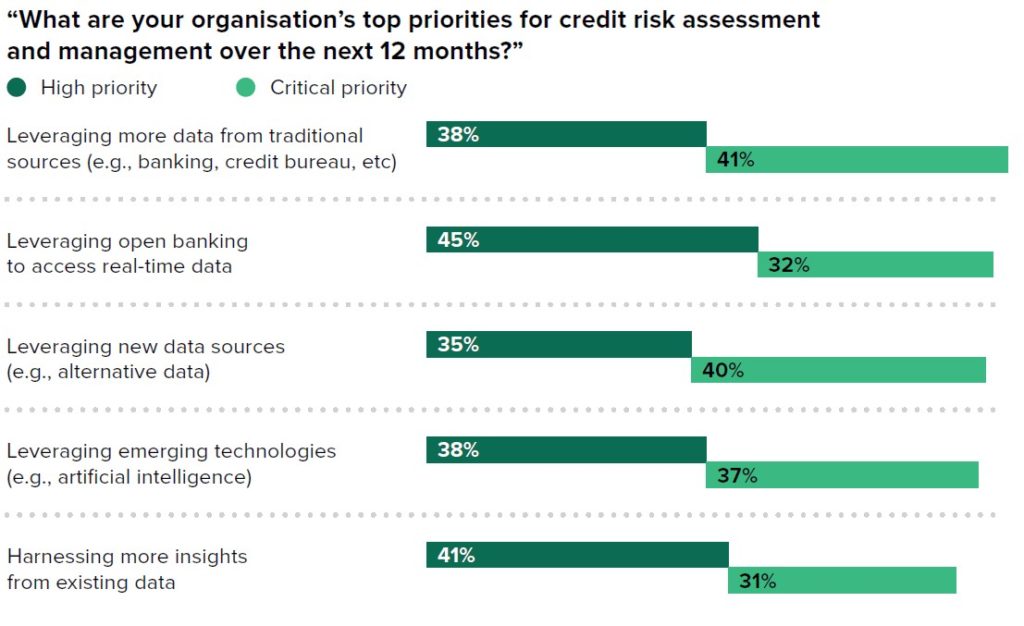

Improving the use of data and insights in business decision making has emerged as a top priority for businesses (44%) - however, organisations are not leveraging all the data sources available to them. In fact, 34% of respondents agree that their organisation has declined applications from viable customers due to insufficient credit data.

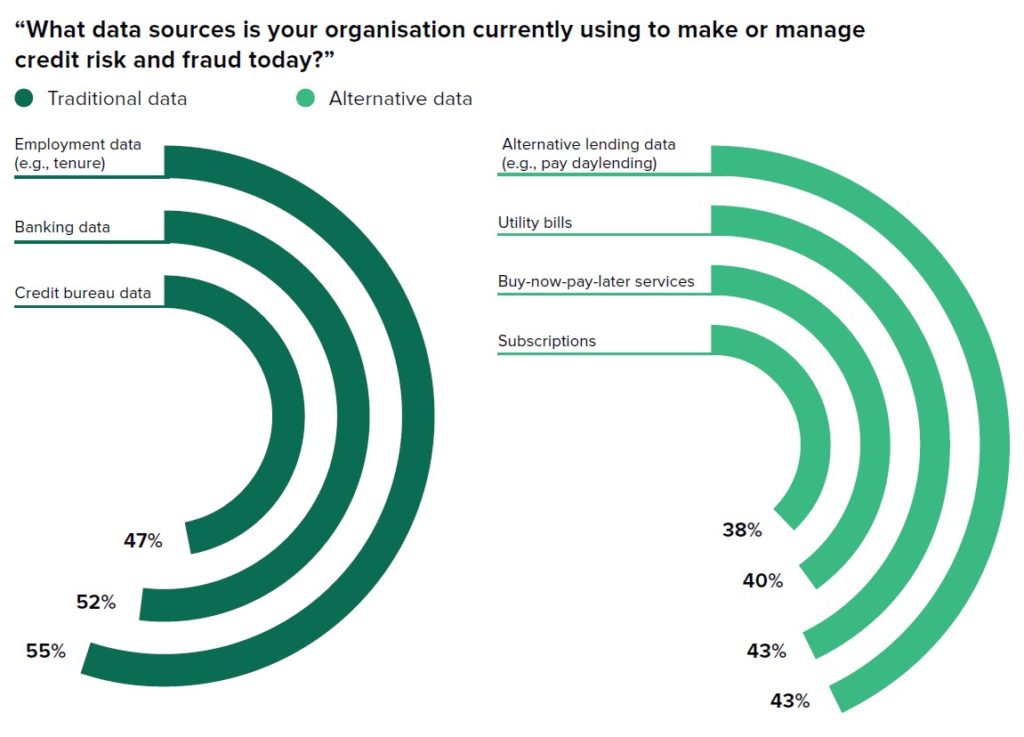

To improve risk assessment and management, lenders will continue to leverage more traditional forms of data such as banking or credit bureau data (41%) and tap on new data sources such as alternative credit data (40%) for credit risk and management over the next 12 months.

Alternative data sources include telco data, consumer data, or e-commerce data, and provide a comprehensive credit profile of a potential customer. The use of alternative data means lenders can better assess their customers’ creditworthiness, providing them with critical access to credit which could transform their lives for the better.

Today, Buy Now Pay Later platforms are gaining popularity for providing fast and easy credit to more people. While beneficial for the underbanked, if not carefully monitored, BNPL platforms could put consumers at risk of overextending themselves.

Therefore, alternative data is extremely critical in ensuring credit risk assessments are accurate in setting personalised spending limits so that customers spend sustainably and responsibly.

Priority for banks and lenders

With more customer interactions happening online, there is less of a focus on reducing cost (23%) and more investment in better engaging customers and building relationships.

The study identified improving CX as one of the most important business priorities (43%), alongside growing revenue (42%). Organisations understand that nurturing strong relationships with customers is essential to build strong brand loyalty.

According to Malin Holmberg, CEO, EMEA and Asia Pacific, Experian, at the start of the pandemic companies were forced to digitise quickly and focus on immediate concerns such as cutting costs. She added that these companies are now looking at longer-term strategies and are focused on addressing existing gaps.

“Many banks and lenders are investing in the right technology to improve the speed of their credit decisioning, and using automated decisioning, data and analytics to quickly identify customers in distress to provide a more holistic customer experience,” she concluded.