What's the old saying? Money walks! xxxxxxxx talks!

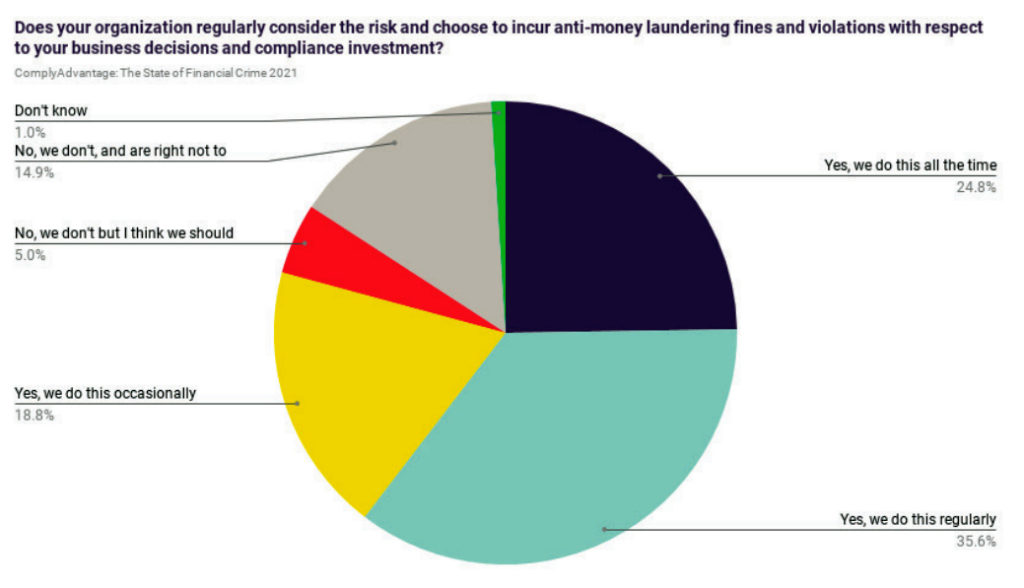

The ComplyAdvantage report The State of Financial Crime 2021 found that the Asia-Pacific (APAC) is the world’s most wayward region in reporting financial crimes, with 87% of APAC respondents admitting they consciously choose to violate laws and incur anti-money laundering (AML) fines “all the time”, “regularly” or “occasionally”.

The global average was 80%, and the figures in North America and Europe were 79% and 76%, respectively.

Among the three APAC markets surveyed, Singapore-based respondents were the most law abiding (only 72% said they will violate laws and incur fines), followed by Hong Kong (90%) and Australia (95%).

The survey respondents came from enterprise banking, investments, crypto, insurance and fintech organisations.

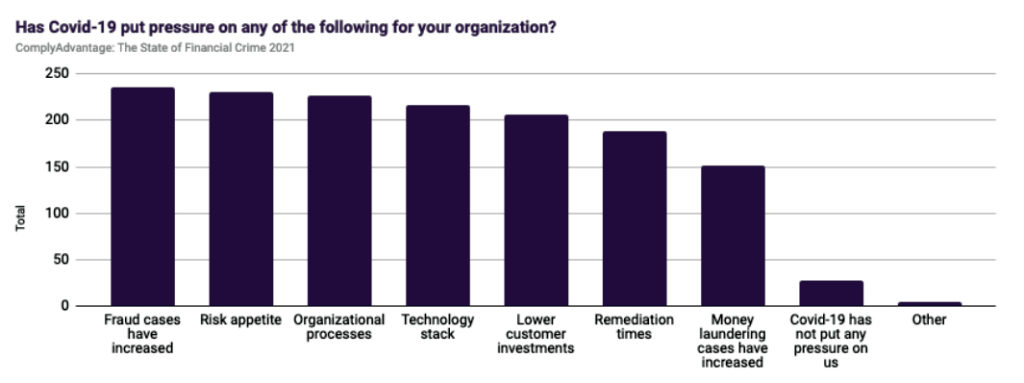

Such an attitude among banking leaders and compliance professionals undermines global and APAC governments’ efforts to fight financial crime, which has been on the upswing since the onset of Covid-19.

Crime rates have been rising due to the vast amounts of public funds flowing through the international financial system, and the heightened use of digital payments as businesses and purchases shift online.

“As a result of Covid-19, financial institutions today handle a much higher volume of digital payments, many of which need to be processed near instantly. Few of them have the processes and technologies in place to be able to carry out due diligence checks and where necessary, block the transactions, in milliseconds,” said Jaede Tan, managing director of ComplyAdvantage Asia Pacific.

Click here to listen to Tan during a PodChat on FutureCIO

“In the interest of maintaining profit, financial institutions often let unknown or even questionable transactions go through. This exposes them to punitive action from the authorities and, of course, reputational damage.”

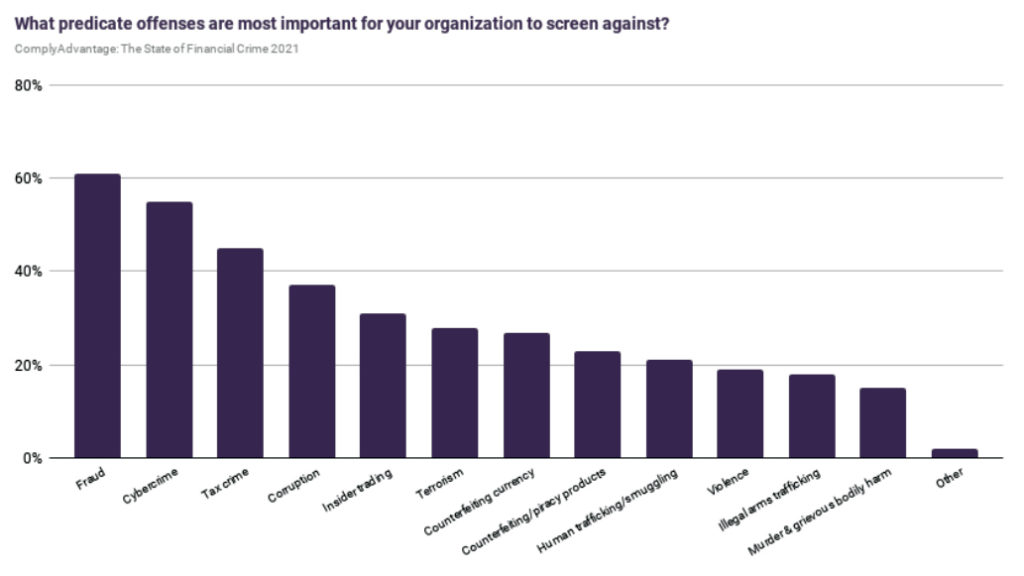

The above findings highlight the need for high-quality AML data amid higher risk appetites, and the urgency for financial institutions to be nimble and granular in their approach to combating fast-evolving financial crimes.

Considerations for beefing up compliance

- Constantly monitor global regulations to identify changes, and understand the different types of criminal activity that are prevalent in the jurisdictions in which they operate.

- Put in place processes and technologies to ensure that enterprise-wide risk assessments capture new threats and risks created by Covid-19. As new technologies are onboarded and new payment methods and channels are introduced, firms should document associated AML and counter financing of terrorism (CFT) risks; and how they are managing them to ensure that they do not expose their firms and customers to enhanced financial crime threats.

- Have robust, flexible and integrated screening and monitoring systems to navigate the complexities of the different types of financial crimes.