IDC revised its forecast spending on blockchain to reflect downwards in overall IT spending globally and in Asia-Pacific (APAC). It predicts a more tempered growth over the 2018-2023 period with a five-year compound annual growth rate (CAGR) of 55.3% for APAC and 57.1% for Worldwide – with worldwide spend reaching $14.4 billion by 2023.

Worldwide spending on blockchain solutions is forecast to reach nearly $4.3 billion in 2020 – a tempered 57.7% growth from the $2.7 billion spent in 2019. While IDC forecasts a drop in blockchain spend in every industry in 2020 due to COVID-19, the scope of these reductions will vary across industries.

Contributing around 19.3% of the overall worldwide spend on blockchain in 2020, the APAC market is primarily driven by three use cases that are linked to the BFSI sector: Cross-Border Payments & Settlements, Trade Finance & Post Trade/Transaction Settlements, and Regulatory Compliance.

The drive across various APAC economies to improve payment methods and assist in maintaining records for regulatory compliance and checks continues to be the most dominant mindset that is expected to benefit blockchain investments in the region.

Industry outlook

Ritika Srivastava, associate market analyst at IDC Asia/Pacific said despite initial resistance, companies that adopted the technology early on have experienced significant benefits during the early months of the COVID-19 pandemic – better control of their supply chain, better traceability of goods, and the ability to maintain an auditable track record of product movement.

As a result, blockchain technology has turned out to be a saving grace for some enterprises.

“The technology has helped enterprises across many industries to overcome the challenges from managing supply chains, medical data verifications, and tracking insurance claims in the APAC region where the adoption is still in its nascent stage. Although there is reluctance to utilize the technology, many of the professional services firms and manufacturing firms will start pushing the implementation of Blockchain technology in the post COVID marketplace," added Srivastava.

Hospitality and tourism-heavy industries like transportation and personal and consumer services are expected to be the most negatively impacted markets, along with construction. Blockchain spending is expected to decline by 9.5% or more in the respective industries.

Global blockchain spending will also see moderate decline in the financial sector. While the sector will see an overall slowdown, banking, securities and investment services, and insurance industries are still expected to invest more than $1.6 billion (combined in blockchain solutions) this year.

The manufacturing and resources sector, driven by discrete and process manufacturing industries, and the distribution and services sector, led by the retail and professional services industries will also experience significant risk in 2020.

However, the manufacturing and resources sector will see the fastest growth in blockchain spending over the 2018-23 period with a five-year CAGR of 60.5%, followed closely by the distribution and services sector with a CAGR of 58.7%.

Despite moderate risk across all industries, blockchain deployments will see modest acceleration in professional services, manufacturing, healthcare, retail, and other industries that require coordination across their value chain.

Use cases

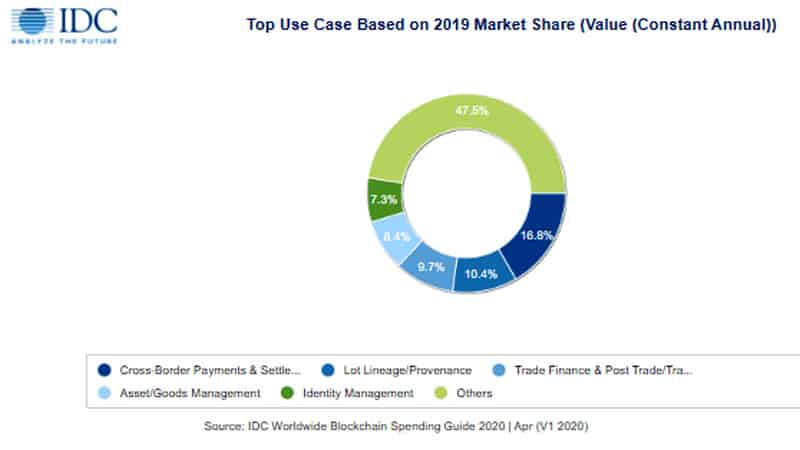

A similar picture emerges when looking at blockchain spending by use case. Loyalty Programs and Equipment and Service/Parts Management will be the most negatively impacted use cases due to the COVID-19 pandemic. Cross-Border Payments & Settlements, Others, and Lot Lineage/Provenance, on the other hand, are top blockchain use cases that will receive the most investment in 2020. Manufacturing will focus much of its blockchain investment in Lot Lineage/Provenance use cases and Asset/Good Management use cases, while Identity Management use cases will receive significant investments from the Banking, Government, and Healthcare Provider industries.

“Like all technology investment, spending on blockchain projects has been affected in the near-term by the impacts of the COVID-19 pandemic. As investment in technology recovers, however, spend on blockchain may return to normal sooner than many legacy technologies," says James Wester, research director for Worldwide Blockchain Strategies.

He attributes this to largely to the unique characteristics of blockchain technology such as decentralization, transparency, and redundancy.

“These are traits that many existing technology approaches in supply chains, healthcare, and financial services lack today – it is the lack of these features that have exposed issues in the way we currently do things such as track foods or distribute pharmaceuticals. Thus, investment in blockchain, with its ability to address these issues, will see continued interest and investment across many industries and applications,” concluded Wester.

Tech perspective

From a technology perspective, software will see the largest impact as it holds a moderate share of the blockchain opportunity – with spending expected to decline more than 7% relative to pre-COVID-19 forecasts.

IT services and business services will see a more moderate reduction in spending as companies focus on keeping their mission-critical projects going. Hardware has the lowest decrease in 2020 at 6% led by purchases of servers and IaaS.

IDC defines blockchain as a digital, distributed ledger of transactions or records. The ledger, which stores the information or data, exists across multiple participants in a peer-to-peer network. There is no single, central repository that stores the ledger.

Unlike any other research in the industry, the comprehensive spending guide was designed to help IT decision makers to clearly understand the industry-specific scope and direction of blockchain spending today and over the next five years.