Kantar’s Sustainability Sector Index 2022 for Asia Pacific (APAC) reveals that despite 98% of people in APAC wanting to live a sustainable life, the rising cost of living is preventing the 2 in 3 who want to do more for the planet from acting on their good intentions (67%).

The survey noted that 29% of consumers in APAC are among the most active when it comes to sustainability. Almost 8 in 10 of APAC’s “actives” – those prepared to spend more time and effort to reduce their impact on the planet – are feeling the rising cost of living on maintaining their sustainable lifestyles (77%).

Price premium on sustainable goods is not sustainable

Meanwhile, two-thirds of APAC shoppers say products that are ‘better for the environment and society’ are more expensive (66%) with just two in five of those who are ‘struggling’ with their household budgets now actively seeking brands that offer ways to offset their impact on the environment (40%) compared to the two-thirds who are financially ‘comfortable’ (65%).

Tight wallets hampering sustainability wills

“APAC’s unique make-up of diverse economies mean affordable price points are imperatives to ensure shoppers convert their intentions into action when it comes to sustainability, especially as most of us want to do good,” says Trezelene Chan, head of sustainability for Kantar in APAC.

“Brands must deliver on price to avoid sustainability being a luxury for the wealthy in our region given 7 in 10 want to buy environmentally sustainable products and services, according to our recent Global Issues Barometer.”

Trezelene Chan

“While there will always be a premium segment, brands must start mainstreaming and collaborating across the entire value chain to drive economies of scale. By offering a sustainable product with a price point that more people can afford will drive mass market adoption and help brands grow their value now and in the future,” she continued.

Unaware of sustainable alternatives

Not knowing sustainable alternatives is the second major barrier for APAC shoppers

Besides price, other barriers relate to sustainable offers such as their availability, quality, and level of information.

When making their purchasing decisions, 9 in 10 shoppers are also now ‘taking careful note of’ or ‘sometimes considering’ the causes that their chosen brands support (89%) with 7 in 10 saying that clear certification explaining the ethical benefits would influence their purchase (68%).

People are more likely to stay abreast of a company’s sustainability efforts and support or stop using brands based on their impact on the environment. But there are 6 in 10 shoppers who are finding it hard to tell which products and services are good or bad ethically or for the environment (58%).

Almost half do not know where to find sustainable or ethical products (46%) and one-third are concerned that sustainable products work less well, or they are lower quality (32%).

Greenwashing is another hurdle to overcome with 84% of sceptical consumers saying they have seen misleading information about sustainable actions taken by companies and 59% worrying brands are involved in environmental and social issues just for commercial reasons.

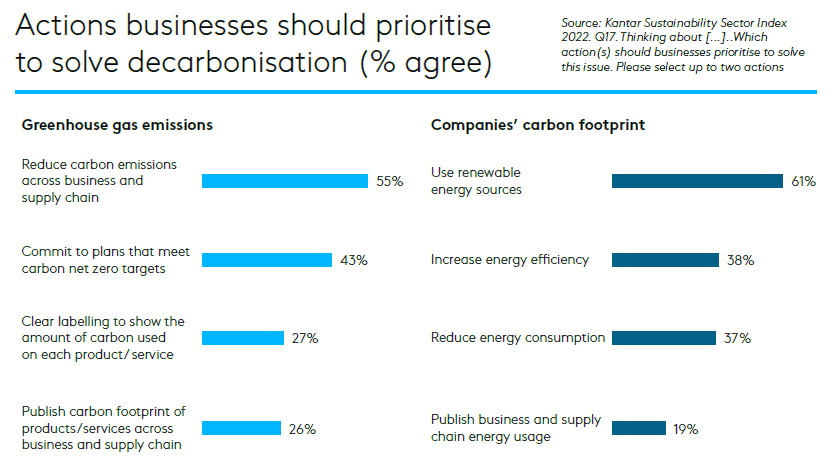

Brand owners must take leadership in decarbonisation

Over three in five people pay a lot of attention to both environmental and societal issues in the news (63%) and almost half say they are ‘usually aware’ of a company’s sustainable initiatives (46%), so it’s important for companies to address the issues that matter to consumers in APAC.

Air pollution and hazardous waste disposal are the most common issues that consumers in APAC are looking for companies in different sectors to tackle, followed by water pollution and carbon emissions leading to global warming. Consumers want companies in 22 of 38 indicated sectors to tackle overpackaging, non-recyclable packaging and landfill, overconsumption, and waste.