"With substantial amounts of the economy closed due the COVID-19 pandemic, leaders need an agile strategy that allows the supply chain organization to sense and respond to changes in the business context as they happen. Our ranking highlights companies that possess these strategies and other differentiating capabilities," said Mike Griswold, vice president analyst with the Gartner Supply Chain practice.

Notes:

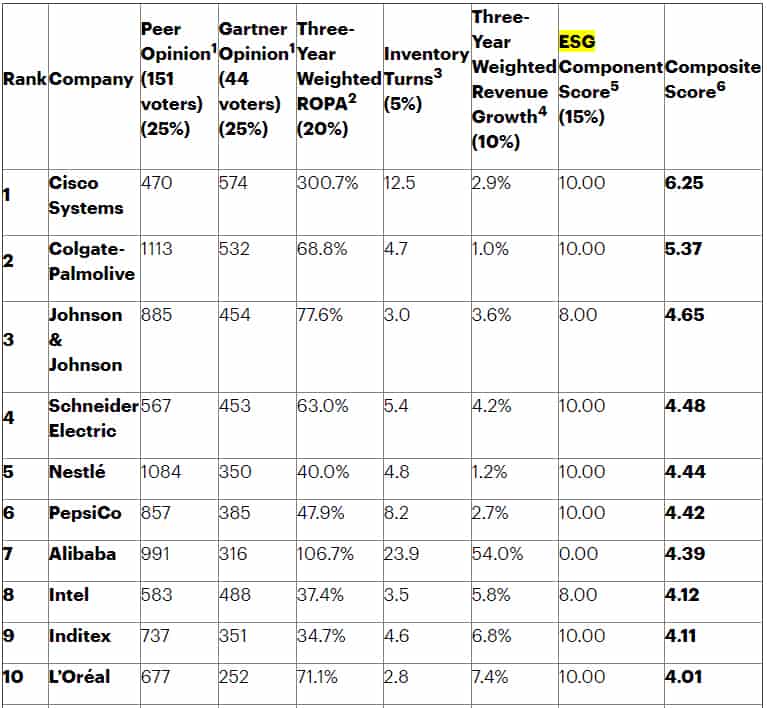

1. Gartner Opinion and Peer Opinion: Based on each panel's forced-rank ordering against the definition of "DDVN Orchestrator".

2. ROPA: ((2019 operating income) / (2019 Net property, plant equipment + year end inventory)) *50%) + ((2018 operating income) / (2018 Net property, plant equipment + year end inventory)) *30%) + ((2017 operating income) / (2017 Net property, plant equipment + year end inventory)) *20%).

3. Inventory Turns: 2019 cost of goods sold / 2019 quarterly average inventory.

4. Revenue Growth: ((change in revenue 2019-2018) *50%) + ((change in revenue 2018-2017) *30%) + ((change in revenue 2017-2016) *20%).

5. ESG Component Score: Index of third-party environmental, social and governance measures of commitment, transparency and performance.

6. Composite Score: (Peer Opinion*25%) + (Gartner Research Opinion*25%) + (ROPA*20%) + (Inventory Turns*5%) + (Revenue Growth*10%) + (ESG Component Score*15%).

2019 data used where available. Where unavailable, the latest available full-year data used. All raw data normalized to a 10-point scale prior to composite calculation. "Ranks" for tied composite scores are determined using the next decimal point comparison.

Source: Gartner (May 2020)

So how did Cisco win over two of the world’s most recognisable brands, Colgate-Palmolive and Johnson & Johnson, as a leading global supply chain?

Griswold explained that Cisco’s revenue growth, strength in environment, social and corporate governance (ESG) and recognition of leadership in community opinion polls drove the move up from the fifth position in 2019 to the top spot this year. Its environmental, social, governance (ESG) focus includes the circular economy, with the goal of having 100% of new Cisco products incorporate circular design principles by the financial year 2025.

Three key trends stand out this year for the supply chain leaders that are accelerating their capabilities, separating them further from the rest of the pack:

Purpose-driven organizations

Supply chain teams at leading companies define their work using the language of purpose. They have recognized that solving the world’s largest problems only works through partnership with others in the broader community, as well as through their own radical transparency.

“In the time of COVID-19, it has been a marvel to witness the strength and creativity of the supply chain community in keeping our society fed, supplied and healthy,” Griswold said. “For example, we’ve seen apparel companies manufacturing personal protective equipment and airlines converting dormant warehouses into food processing centres. Those shifts would normally have taken months or quarters to plan and execute. However, purpose- driven supply chain talent managed to shorten these timeframes to a couple of weeks.

Business model transformers

One of the largest external forces impacting corporate supply chains is a dynamic competitive landscape driven by a combination of expanded customer expectations, new market entrants from existing industry ecosystems, and the emergence of non-traditional competitors. Leading supply chain organizations have learned to thrive in that environment and positioned themselves as disruptors – either through reinvention of their offerings and the ability to deliver them or by acquiring start-ups that offer the expertise to compete in new and reinvented markets.

Digital orchestrators

Leading companies on the Supply Chain Top 25 are early and frequent adopters of digital technologies. More importantly, these investments enable business capabilities and outcomes that allow them to thrive in even the harshest economic conditions.

“In the current environment, the natural tendency of many companies is to pull back spending, including money tied to transformational programs. Advanced supply chains are pressing forward, and in some cases, accelerating investments in real-time visibility, planning and agile supply execution capabilities that are well-suited for supporting uncertain demand mixes and volumes,” Griswold concluded.