IDC states that major breakthroughs in quantum computing technology, a maturing quantum computing as a service infrastructure and platform market, and the growth of performance-intensive computing workloads suitable for quantum technology will drive most of the market growth over the next six years.

Global investment in quantum computing is growing at a healthy pace with IDC projecting the market to reach US$16.4 billion by the end of 2027. This includes investments made by public and privately funded institutions, government spending worldwide, internal allocation (R&D spend) from technology and services vendors, and external funding from venture capitalists and private equity firms.

IDC anticipates that these investments will cause current limited quantum computing capabilities to be replaced by a new generation of quantum computing solutions, leading to the development of new use cases and market segments that will accelerate the adoption of quantum computing to gain a competitive advantage. As a result, the quantum computing market will see a surge in customer spending toward the end of the forecast period.

This growth and interest are fuelled by end-user spending that is projected to US$8.6 billion by the end of 2027, from US$412 million in 2020. This represents a 6-year compound annual growth rate (CAGR) of 50.9% over the 2021-2027 forecast period. The forecast includes core quantum computing as a service as well as enabling and adjacent quantum computing as a service.

2021 was a good for year for quantum technology

IDC sees 2021 as a pivotal year in the quantum computing industry. Strategic approaches implemented to reach quantum advantage became more defined as vendors published quantum computing roadmaps emphasizing methods for improving qubit scaling and error correction, sought new funding opportunities by going public or partnering with government, educational, or private entities, or merged in anticipation of offering a more full-stack approach.

For most vendors, these approaches included the further development of the quantum ecosystem. This trend promises to continue into 2022 and beyond as quantum computing vendors progress towards quantum advantage and enterprise businesses seek a competitive advantage using current and emerging quantum technologies.

According to Norishige Morimoto, CTO and vice president, IBM Research & Development, Japan, says there are a lot of opportunities to advance quantum computing and progress work towards solutions for the greater adoption of the technology including in Asia.

"Advances in quantum computing will be a drumbeat over time with the most distant advances being most relevant to the most complex problems. Organizations should start experimenting now using quantum road maps to guide their quantum journey," added Heather West, senior research analyst, infrastructure systems, platforms and technologies group at IDC.

Morimoto revealed that IBM is working hard to drive the most sophisticated and best-performing quantum computing - pushing towards our goal of quantum advantage, the point where certain information processing tasks can be performed more efficiently or cost-effectively on a quantum computer than on a classical computer.

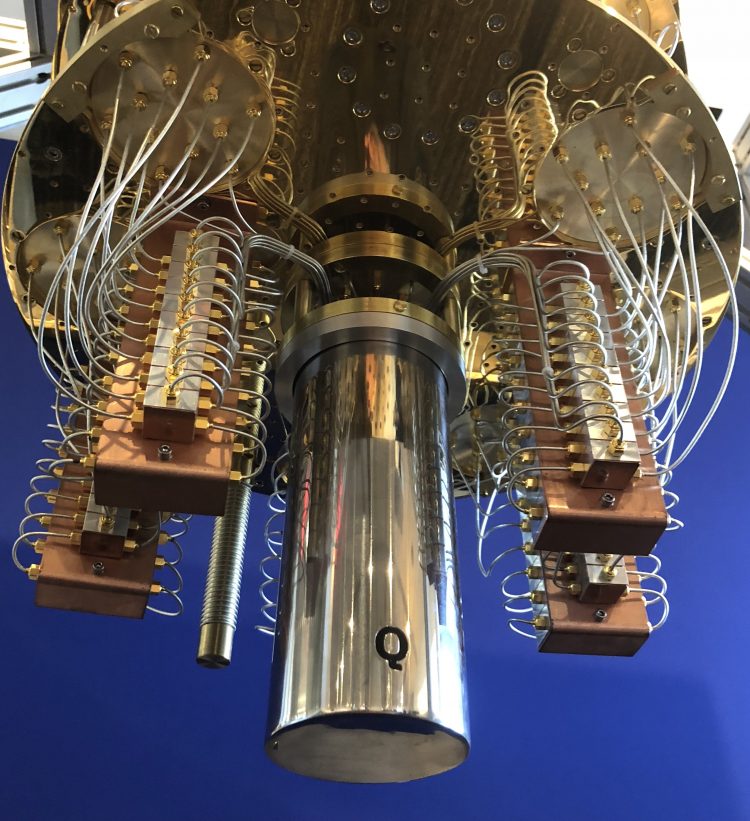

This involves driving performance improvements along 3 dimensions simultaneously: scale, quality, and speed. Recently we broke the 100-qubit barrier with the introduction of Eagle, a 127-qubit quantum processor – the first such IBM device that cannot be simulated on a classical device. This gives even more confidence to those in the industry beginning to adopt quantum and those in universities who are choosing their fields of study.

Quantum computing in Asia

In Asia, IBM continues to collaborate with educational institutions to push the boundaries of quantum computing science. This includes the IBM Quantum System One installation in Kawasaki, Japan – an ongoing collaboration between IBM and the University of Tokyo to advance Japan's exploration of quantum science, business and education.

A similar effort is underway in Korea with the Yonsei University in Seoul. “In Singapore, we were able to collaborate with the National University of Singapore to support training and promote industry-academia collaboration to develop new software in quantum computing,” said Morimoto.

Quantum computing is used in the development of lithium-sulfur batteries for electric vehicles. CERN is using quantum systems to use machine learning to look for new ways of finding patterns in LHC data. And industrial chemists at Mitsubishi Chemical and JSR Corporation, which are members of the IBM Quantum Hub at Keio University in Japan, are using quantum systems to model and analyse the deep molecular structures of potential new OLED (organic light-emitting diode) materials.

Morimoto advises enterprises in Asia to start their quantum journey is to start now. “They can develop their adoption and education strategy. They need to make their developers quantum-fluent.

“I would recommend visiting the IBM Quantum-experience online so that they can get up to speed on quantum computing in general. This includes not just programming, but also an understanding of where the science is today what the potential is and what kind of problem they want to solve,” concluded Morimoto.