Gartner surveyed 166 publicly traded and privately held external audit firm clients across industries in March-April of 2021, ranging from organizations with revenue above $10 billion to those with revenue under $500 million.

Gartner says 62% of surveyed organisations expect to pay more for external audit fees. They attribute the rise to a combination of inflationary pressures, COVID-19 impacts, and acquisitions & divestitures.

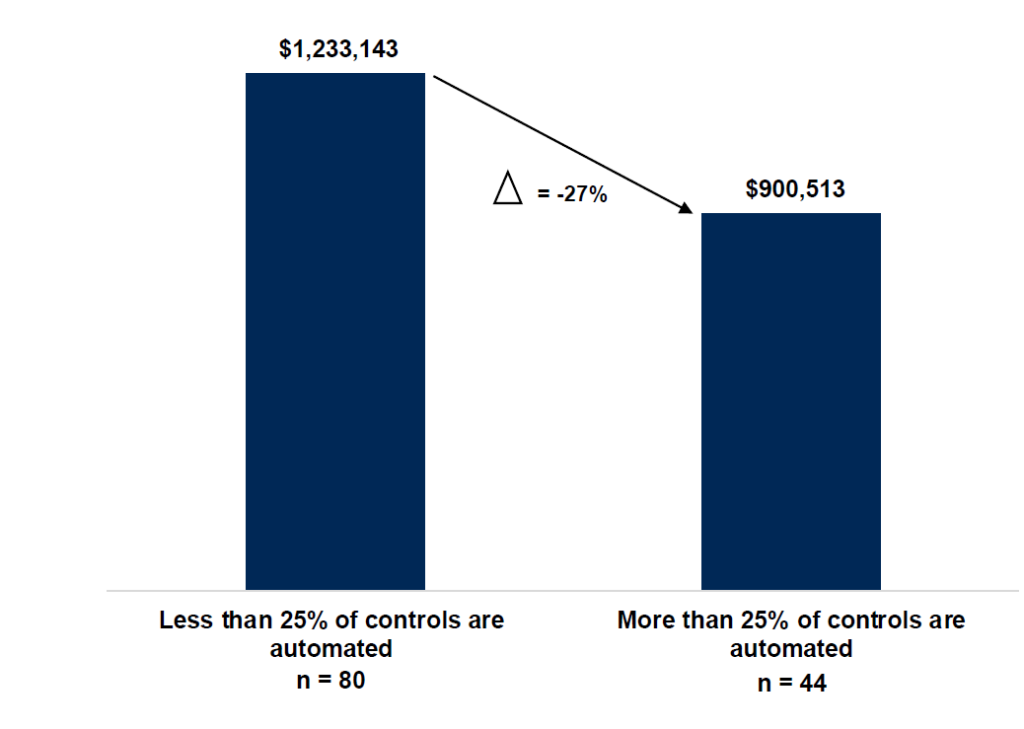

Organisations that have automated 25% of their internal controls have lowered their audit fees by an average of 27%.

“With audit fees increasing significantly, finance leaders should take note that organizations with higher levels of internal control automation saw substantially lower external audit fees on average (see Figure 1),” said Ashwani Gupta, director in the Gartner Finance practice.

He observed that the biggest decreases were seen in organizations using between 1 to 50 controls, suggesting that getting internal control automation started has potential cost benefits when it comes to audit fees.

Figure 1: Internal controls automation impact, 2020

Companies with fewer than 50 controls, and more than 25% of them automated, reported 52% lower audit fees relative to ones with less than 25% of their controls automated. Companies with 50 to 250, as well as more than 250 controls and more than 25% automated, showed 27% lower audit fees.

"Automation of internal controls can play a role in not only reducing financial reporting and audit risks but also audit costs. As organizations invest in internal controls automation it will likely become a prominent argument for audit fee reductions in the future,” said Gupta.

Negotiating for lower fees

Audit fee increases in 2020 were led by the banking and insurance sectors, with 69% of respondents in each category reporting increases.

Financial services companies have more complex accounting processes and financial reporting exposures requiring higher external auditor hours. Insurance companies also have some of the highest number of internal controls relative to companies in other industries.

The technology/telecom sector was the least impacted by rising fees, with just 41% of respondents reporting increases in 2020. The firms that did report fee increases most often indicated they were sizable, with 22% of overall respondents reporting “significant” audit fee increases of 6% or more, compared to their fees paid in 2019.

While the primary drivers of audit fee increases were macro in nature, ranging from inflation to COVID-19 related, organizations that argued a strong case with the primary auditor were able to get a flat fee or lower than expected audit fee increase. Of the respondents that attempted to negotiate their fees, 45% said their fees decreased by more than 6%, while half were able to decrease their fees by between 3-6%.