Singaporeans access 12 online accounts each week — which is the highest compared to the UK, US and Mexico — and 70% have to use their digital identity “constantly” or “often” to access online accounts.

A global study conducted by Opinium found that Singaporeans think financial services (63%) is the most important industry to use a digital identity, followed by healthcare (54%) — arguably the sectors whereby the most sensitive personal information is shared.

Overall, 84% of Singaporeans agree that they trust companies who complete identity checks to handle their personal information securely when signing up for an account. Nevertheless, 49% of Singaporeans abandon the online process when it becomes too complicated.

Global trend on digital identity

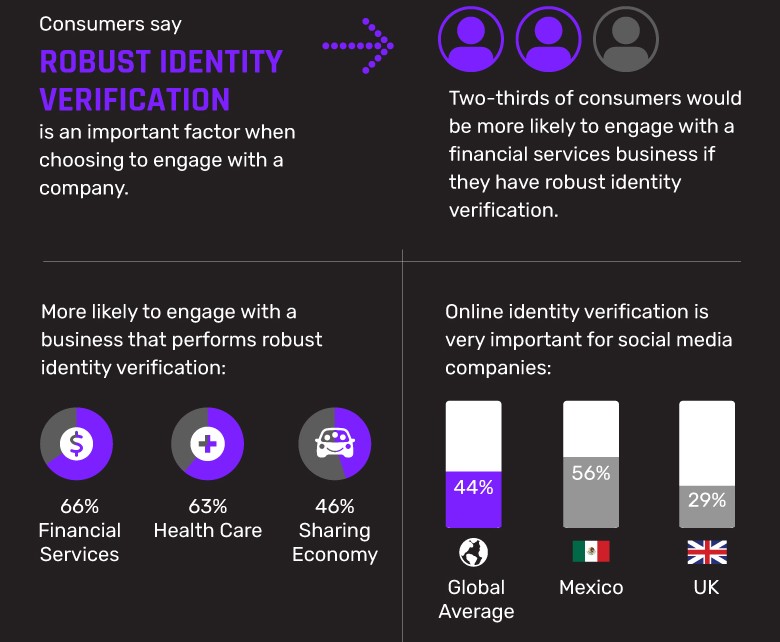

As providing a digital identity to create an online account or complete a transaction becomes more commonplace globally, consumers are now expecting this as part of their engagement with a brand, specifically in certain sectors.

Up to 68% think it’s important to use a digital identity to prove who they say they are when using a financial service online, closely followed by healthcare providers (52%) and social media sites (42%).

Where more sensitive personal data is concerned, consumers indicated robust identity verification becomes even more important.

Leaders and laggards

Despite more consumers demanding digital identity solutions for verification when engaging with companies online, they aren’t confident that all businesses are doing everything they can to protect their online accounts.

Only 34% of consumers believe that their bank has implemented more online identity verification checks since the pandemic to protect them against online fraud and identity theft. In the gaming and gambling space, 41% say they are “confident” that providers are doing what they can to accurately verify identities and prevent identity-related fraud.

Improve trust in providers and platforms

While digital identity solutions are recognized as important in preventing identity-related fraud, consumers have other concerns that these solutions could address. In healthcare, 32% of consumers are most concerned about not knowing the identity of the healthcare practitioner they are engaging with.

In the social media space, 83% of consumers think that it’s important for social media sites to verify identities so that they can hold users accountable for online hate speech/comments.

As such, the use cases and benefits of digital identity extend beyond just fraud prevention and could provide a solution to broader consumer concerns.

“As our use of online services only continues to grow, organisations are clearly implementing the robust identity verification methods required to prevent against the risks associated with virtual services,” said Philipp Pointner, Jumio’s chief of digital identity.

He added that the research reveals the demand for digital identity solutions, too – particularly in the financial services and healthcare spaces – and is clearly now a point of differentiation. Implementing these kinds of solutions should be a ‘when,’ not a ‘maybe,’ and will now ultimately determine whether a consumer chooses your business over another.