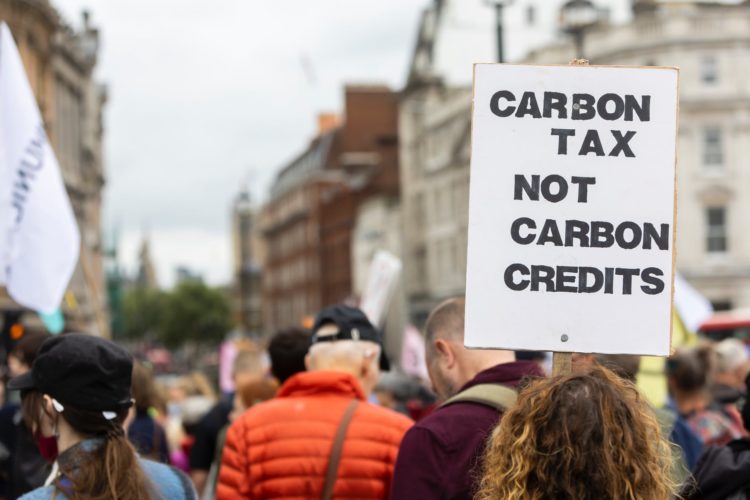

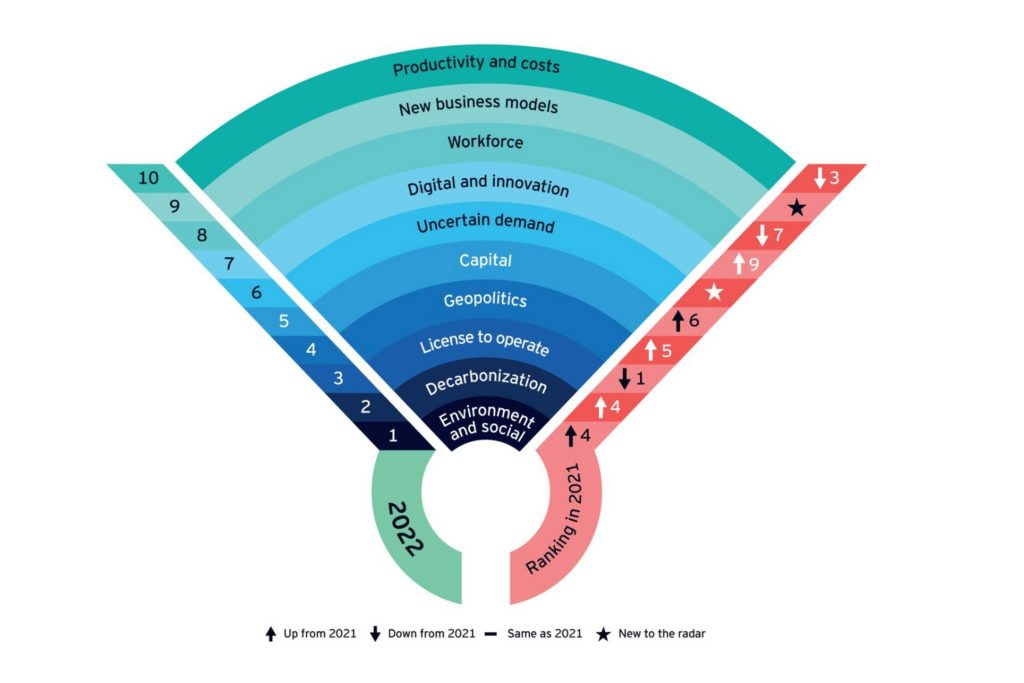

Global mining executives rank environment, social and governance (ESG), decarbonization and license to operate (LTO) as the top three risks/opportunities facing their business over the next 12 months, according to the latest EY Top 10 Business Risks and Opportunities for mining and metals in 2022.

New risks

Two new risks emerged this year: “Uncertain demand” due to energy transition and post-COVID-19 markets at number six, and at number nine, “New business models” that need to be considered to capture value amid volatility.

Despite conversations in 2021 across the industry focused on the energy transition and decarbonization, environmental and social issues emerged as the number one risk for 2022.

EY believes this reflects the industry understanding that issues will broaden as society demands continue to impact the industry.

The study reported on the push to develop and deploy new technology for a broader purpose, to further improve onsite health and safety, help miners respond to the challenge of transitioning to net zero and developing “greener” products, as well as an accelerated focus on environmental, social and governance (ESG) measures from capital markets.

The study noted that responding companies focused on operations during the COVID-19 pandemic but are planning to increase their investment in digital transformation and innovation to help them to diversify and differentiate.

EY global mining & metals Leader, Paul Mitchell, says while there were fears that the COVID-19 pandemic might slow global progress on sustainability measures, the opposite has been true.

He further opined that environment and social issues have emerged as a surprise top risk, which means miners need to think more broadly about which factors they consider; social impact, water management and biodiversity came through as strong areas of focus for 2022.

“As stakeholders continue to hold miners accountable for environmental and social practices, purpose, long-term value and sustainability are no longer add-ons to business as usual – they are themselves business as usual. In such an uncertain and shifting environment, we are likely to see greater use of data science, scenario planning and data modelling to guide more intelligent decisions and create differentiation,” Mitchell continued.

Building a positive legacy

The study also noted that the COVID-19 pandemic has focused attention on social inequalities, placing pressure on companies to go beyond their regulatory obligations and take responsibility for driving social equality in the regions in which they operate. Biodiversity has yet to receive the same attention as other ESG topics, but momentum is building. With future mines set to be carbon neutral and sustainable, most of the sector’s environmental risk and liability will lie in closed legacy assets. Progressive closure planning can assist with these challenges.

Mitchell says miners that do more to help ensure the long-term, sustainable economic and social growth of the regions in which they operate can leave a positive legacy beyond the life of the mine.

Flexible, practical decarbonization strategy

Over the past year, miners and investors have accelerated conversations and actions around decarbonization to address both the risks and opportunities it presents. Decarbonization takes second place in the ranking, up from the fourth position last year.

While the focus to date has been on abating scope 1 and 2 emissions, controlling scope 3 emissions is really where value and long-term sustainability can be created, according to the study.

According to Mitchell decarbonization is a major industry disruptor and as such needs to be treated like any other strategic risk; dealt with at a board and executive level, and managed as part of the overarching business strategy, not addressed as a separate climate strategy delegated to a discrete team.

Sharing a road map to net-zero and successes along the way will be key to gaining investor confidence and, potentially, competitive advantage, he continued.

Securing mining’s future

Despite conceding the top spot in the rankings, LTO remains an evolving and complex issue for mining and metals companies. According to EY, shareholder expectations are changing fast, impacted by numerous challenges including the mining industry’s contribution to communities, economies, protection of heritage sites and engagement with indigenous and First Nations peoples, as well as the industry’s role in prioritizing ethical supply chains, with diversity and inclusion also in the spotlight.

“Focus on long-term value will be critical if miners are to develop a sustainable license to operate strategy and reshape themselves for the future. The days of working solely to deliver quarterly results are over. The impetus instead needs to be on stakeholder value in its broadest sense; the value that they bring to customers, people and society, in addition to their own bottom line,” Mitchell concluded.