The Bain report, Insurance 2030: As Risks Mount, Insurers Aim to Augment Protection with Prevention, observed that risks as declining or flat-lining in mature areas, such as personal auto and mortality; expanding in new areas, such as cybercrime and digital assets; and growing more severe in others, including climate change and infectious disease.

Changes are propelling the insurance industry to take on a new role, moving from seeking reimbursements for damages to incentivizing behaviours to reduce overall risk.

While road travel is safer than ever, with death rates resulting from motor vehicle accidents in the US declining by about 70% over the past four decades, Bain & Company expects climate change will result in a roughly tenfold increase in economic losses over the next three decades.

Risk and protection are also shifting geographically toward countries with faster economic growth. Bain’s new research shows China will drive well over a quarter of global premium growth through 2030. However, few multinational insurers can participate in China’s insurance markets, due to intense competition and regulations that favour domestic firms.

“The consequences for an under-protected world with low insurance penetration may be severe, particularly in emerging markets,” said Andrew Schwedel, Leader, Macro Trends group, Bain.

He attributes this to improved technology and data, insurance companies now have the chance—and perhaps even the duty—to shift the industry’s central purpose from loss reimbursement to losing control over the next decade.

New technology can mitigate risks and lower costs

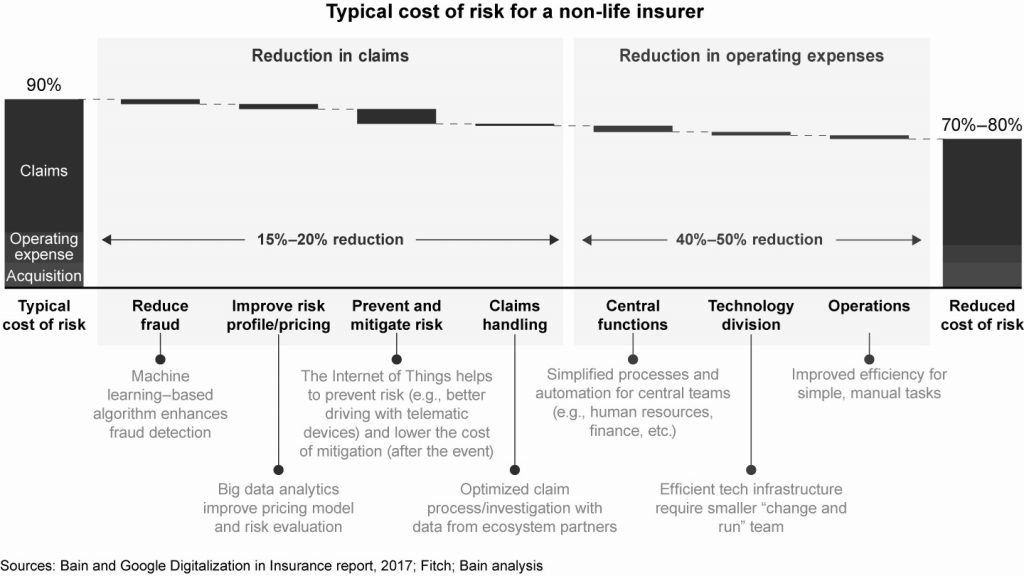

Insurers can now use technology tools, such as automation or the internet of things, to directly partner with customers to identify, prevent and mitigate each risk event. Bain says these technologies can also reduce operational costs by as much as 50% through increased efficiency and reduce claims pay-outs by up to 20% by mitigating risks.

While some of these savings may flow through to profits, competitive dynamics will likely force an overall reduction of prices for protection, leading to an increase in the penetration of insurance and faster industry growth overall.

The good and the bad diverge

Since technology and data analytics allow insurers to make unprecedented gains in understanding, preventing and mitigating risks, they are also likely to increase the pressure on bad risks, resulting in sharply higher prices, outright unavailability of coverage or increased regulation.

Insurers see three main consequences of this trend: some risks to property exposures become too expensive to cover; extreme segmentation and underwriting price discrimination weakens the subsidies at the core of risk pooling; and public pressure intensifies on out-of-favour sectors, such as carbon-intensive energy producers.

New competition for insurers

The shifts in what we need to protect, and how we protect against them, have disrupted traditional insurance value chains. As a result, insurance capabilities are unbundling, calling into question the role of the traditional, integrated insurance company.

Sensing this opportunity—and emboldened by the possibilities offered by new technologies—a variety of upstart insurtechs, big technology platforms and leaders in other industries, such as auto manufacturers, have started to target the most lucrative parts of the value chain with new business models.

The ascent of embedded insurance and capabilities as a service will reshape the industry, with estimates for gross written premiums reaching $700 billion by 2030. This impact will vary by industry, with the greatest penetration likely starting in three major sectors: auto, travel and property—where insurance can easily be embedded into the sales or booking processes.

Five questions to navigate the road ahead

To succeed in this radically different future, executive teams will benefit from conducting a holistic review of their strategy. Many of the specifics will vary across sectors and markets, but a few broad strategic questions apply to virtually all insurers.

How should we interact with customers to prevent and mitigate risks? Going beyond risk transfer to risk mitigation and prevention will be critical for insurers, customers and regulators in a riskier world.

Should we participate in embedded insurance? Certain lines, such as mobility, will inevitably include embedded insurance. Each carrier must decide whether to actively promote it, reject it or something in between.

Do we need direct customer distribution? With increased competition from insurtechs that market directly to customers, several incumbents are launching digital attacker models to increase their share of direct business, bypassing broker-led models.

Do we need to be in China? If so, how? If not, where else should we focus on growth? Winning in China has proven quite difficult for multinational carriers. Although they have gained a share in life and health lines, capturing about 8% of the market, in recent years, they have struggled in P&C, capturing just 2% of the market.

How aggressively should we explore alternative capital options? Alternative sources of capital increasingly will become available to insurers, particularly as a form of reinsurance in catastrophe bonds and other lines, and through private equity investments in life and annuities businesses.