Intentional or not, a new consumer survey by Hong Kong and Shanghai Banking Corporation (HSBC) revealed that 66% of Hong Kong residents (Hong Kongers) surveyed have made short-term investments via online channels using either a PC, laptop, smartphone or tablet, 75% have made long-term investments and 56% have done so through digital channels.

Compare these figures to Singaporeans surveyed by the bank: 39% have made short-term investments online, 33% used digital channels for long-term investments, and you’d be forgiven to think Hong Kongers are more digital friendly. But let’s not get ahead of ourselves here.

Where Singapore leads Hong Kong

When it comes to checking bank balances, 75% of Singaporeans do so from their smartphone compared to 61% of Hong Kongers. When it comes to paying bills or peer-to-peer payments, Singaporeans also lead their Hong Kong counterparts 67% versus 50% – showing opportunity for customers to further benefit from the efficiency and convenience of digital channels.

Digital uptake

The use of digital channels to invest has also increased under the social distancing restrictions because of the COVID-19 outbreak. The latest HSBC data shows that total digital retail sales in Hong Kong grew by 63% year-on-year in Q1 2020. In the first five months of the year, the Bank’s average monthly equity trading turnover via digital channels increased by over 50% year-on-year.

Noting the increased propensity to use mobile and online banking among its customers in Hong Kong, Sami Julian Abouzahr, head of Customer Wealth, Wealth and Personal Banking, Hong Kong, HSBC, added that: “COVID-19 accelerated the adoption of digital channels for wealth management, including FX, funds, equities and portfolio management – whether this be via an app or a video call with a relationship manager.”

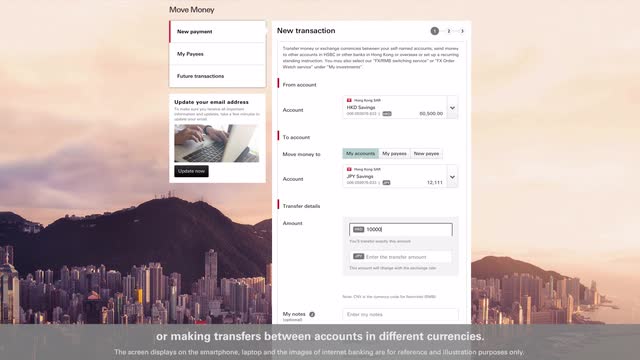

Andrew Eldon, head of Digital, Wealth and Personal Banking, further added that the COVID-19 pandemic has underscored the benefits and convenience of digital services for customers, who can now manage their personal finances through mobile channels, anytime and anywhere – an option many customers have embraced.

“Long term, we know that millennials are more likely to adopt our highly flexible mobile solutions, and so we need to accelerate our digital delivery to connect with these customers and capture this next wave of growth,” he added.

HSBC claims to have recorded a significant number of applications via the Mobile Banking app, with around 25% month-on-month growth in May 2020, with 93% of new customers are aged below 40.

Not giving up on the human touch

Despite the digital uptake, 30% of Hong Kong citizens report they apply for a credit card or overdraft in person, with 37% of long-term investors go through the traditional banking channels, either in person at branch offices or through direct interaction with experienced investment service representatives.

The demand for a blended approach was also clear during the Covid-19 outbreak where the number of HSBC frontline staff actively employing video conferencing tools with customers reached to around 11,000 in May 2020 globally.

Abouzahr added: “While we will continue to invest in digital capabilities, we understand the value that our people bring to the customer experience. We recently launched video conferencing services which has redefined the way our relationship managers engage with our customers have been well-received and is a great example of the successful integration of digital technology and human interaction. In future, we will continue to serve customers with an ever more seamless omnichannel experience.”