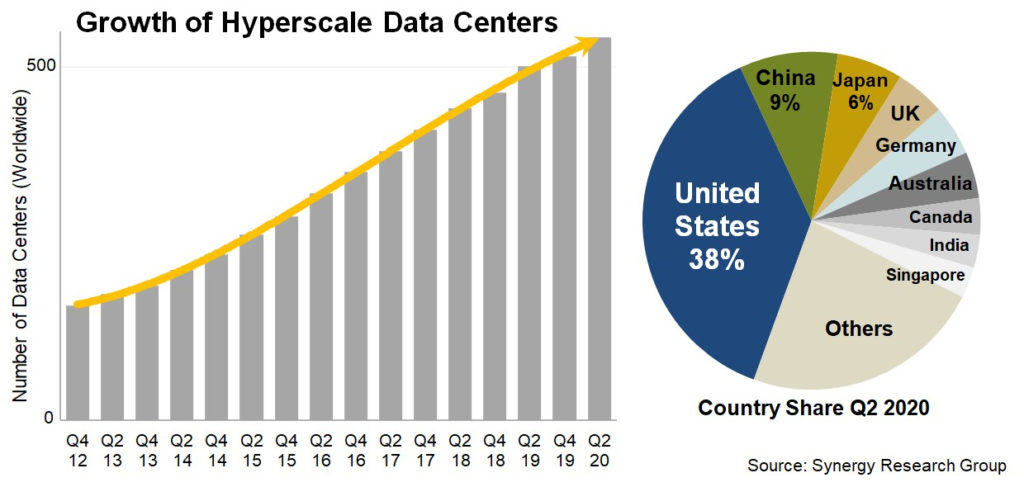

Synergy Research Group estimates that the total number of large data centres operated by hyperscale providers increased to 541 at the end of the second quarter, more than double the mid-2015 count.

The EMEA and Asia-Pacific (APAC) regions continue to have the highest growth rates, though the US still accounts for almost 40% of the major cloud and internet data centre sites. The next most popular locations are China, Japan, the UK, Germany and Australia, which collectively account for another 30% of the total.

Over the last four quarters, new data centres were opened in 15 different countries, with the US, South Korea, Switzerland, Italy, South Africa and Bahrain having the largest number of additions.

Among the hyperscale operators, Amazon and Google opened the most new data centres in the last twelve months, accounting for over half of the total, with Microsoft and Oracle being the next most active companies.

Synergy research indicates that over 70% of all hyperscale data centres are located in facilities that are leased from data centre operators or are owned by partners of the hyperscale operators.

The companies with the broadest data centre footprint are the leading cloud providers – Amazon, Microsoft, Google and IBM. Each has 60 or more data centre locations with at least three in each of the four regions – North America, APAC, EMEA and Latin America.

Oracle also has a notably broad data centre presence. The remaining firms tend to have their data centres focused primarily in either the US (Apple, Facebook, Twitter, eBay) or China (Alibaba, Baidu, Tencent).

“There were 100 new hyperscale data centres opened in the last eight quarters, with 26 of those being the first half of this year,” said John Dinsdale, a chief analyst at Synergy Research Group. “COVID-19 has caused some logistical issues but these are robust numbers, demonstrating the underlying strength of the services that are driving these investments. We have visibility of a further 176 data centres that are at various stages of planning or building, which is good news for data centre hardware vendors and wholesale data centre operators,” he concluded.

Asked whether there should be concerns about the growth given the dotcom bust history, Dinsdale note that this time around the underlying demand (and growth in demand) is real and based on business applications that have longevity.

“Cloud services are a fundamental change in the way that businesses run their IT operations, and the transition to cloud still has a long way to run,” he added.

While he conceded that the consumer side is a “little more fashion-driven” even here there is absolutely no doubt that whatever apps drive the future market, they will need ever-increasing amounts of computing facilities to support them.

“The cloud providers that are driving infrastructure growth are big, cash-rich, profitable and here to stay. This couldn’t be more different than the dotcom bubble where investor excitement was driven by ephemeral companies that had non-sensical business plans,” opined Dinsdale.