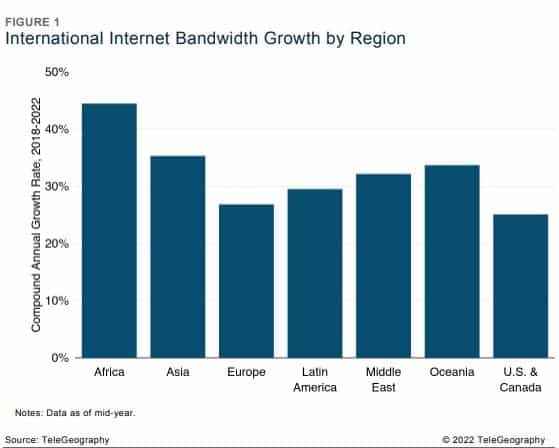

Intra-Asian internet bandwidth has steadily increased from 36% in 2012 to 60% in 2022. During the same time period, the share of bandwidth that connects Asia to the U.S. & Canada decreased from 49% to just 20%.

According to the latest Global Internet Geography research conducted by TeleGeography, international internet bandwidth growth remains strong throughout Asia, resulting in an increasingly competitive IP transit market. Between 2019 and 2022, 100 GigE IP transit port prices across Hong Kong, Singapore, and Tokyo, which play host to most of Asia’s traffic exchange and content hosting, decreased by 24% compounded annually.

In Q2 2022, weighted median 100 GigE port prices in Hong Kong and Tokyo were $0.55 and $0.58 per Mbps. And in Singapore, the 100 GigE price was just $0.45 per Mbps after dropping 27% over the past three years.

“Despite recent declines, Asia maintains a higher price compared to the U.S. and Europe. In Q2 2022, the weighted median price for a 100 GigE port in Singapore was 3.5 times that of a comparable port in London and 3.0 times that in New York. Similarly, a 100 GigE port in Hong Kong was 4.2 times that of London and 3.7 times that in New York,” said Brianna Boudreau, senior research manager, TeleGeography.

Established in 1989, TeleGeography is a telecommunications market research and consulting firm that conducts in-depth research, providing guidance to service providers, equipment makers, investors, and governments.

“Singapore, Hong Kong, and Tokyo remain competitive hubs for Asia, despite the gap compared to U.S. and Europe hubs. It’s a reminder that there’s more to becoming an internet hub than price disparity narrowing,” said Boudreau.

According to the latest research, Singapore is the biggest player out of the three established hubs, featuring over 100 Tbps of international internet bandwidth with a CAGR of 42% over the past five years, outpacing Japan, and China, including Hong Kong, in terms of absolute bandwidth and growth rates.

The research also reveals that Cloud Service Providers (CSPs) are continuing their rapid expansion in Asia, driven by the significant growth in internet and cloud service demand. There are over 70 existing cloud regions in Asia with many more in the pipeline and Asia is home to the most in-service cloud zones with a total count of over 200 zones. The United States & Canada follow suit from a distance with an estimated 120 zones.

“As the Asian market develops, content providers like Google and Meta aim to improve user experience in the region by reducing latency. To do so, they push their content across the Pacific on their private networks to host it in established Asian hubs. This places content closer to end users, hence reducing latency,” said Marvin Tan, research analyst, TeleGeography. “As a result, the demand growth to deploy high-capacity links from Asia to North America have begun to slow in comparison to demand growth from intra-Asia capacity.”