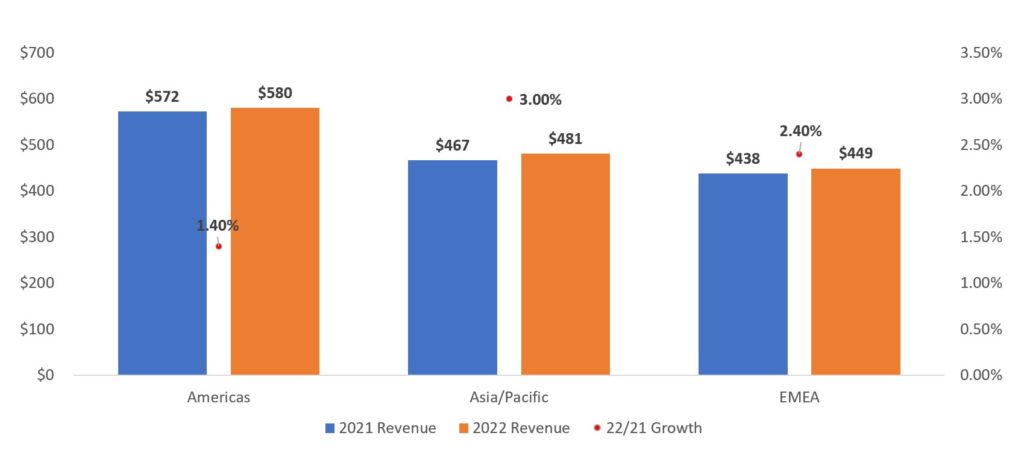

According to the IDC Worldwide Semiannual Telecom Services Tracker spending on telecom services and pay TV services reached US$1,478 billion in 2022, up 2.2% year over year.

IDC expects worldwide spending on telecom and pay TV services will increase by 2.0% in 2023 and reach a total of US$1,541 billion. The updated forecast is slightly more optimistic compared to the version published in November 2022 year as it assumes a 0.3 percentage point higher growth in 2023.

IDC believes this acceleration is a consequence of the increase in tariffs on telecommunication services fuelled by inflation. IDC says this is the second time in the last six months that it has increased its forecast for the telecom services market and positive adjustments have been made for all global regions. It confirms the thesis that inflation is equally happening in all parts of the world and that operators are all behaving in a similar way when their profitability is threatened by inflationary pressures. IDC says what is being observed now is the outcome of the initial tariff adjustments that were generally happening in mid-2022.

According to the latest IMF forecasts, inflation is here to stay for the next three years at least which means that operators will continue to increase tariffs, clients will be paying more for telco services, and the total nominal value of the market will be growing at a faster pace. This has prompted IDC to increase its forecast for 2023.

The forecast for Asia-Pacific was boosted by 0.7 percentage points, for Americas by 0.3 percentage points, and for EMEA by 0.1 percentage points. The magnitude of change in EMEA is witnessing is driven by higher-than-average inflation as the region struggles to find a replacement for cheap Russian energy, which might seem relatively low.

Asia/Pacific region is forecast to see the fastest growth fuelled by the relatively lower saturation of the markets in less-developed countries.

The influence of inflation

High inflation is not good news for any market, because the positive boost it produces is only nominal. A closer look at the forecasted growth rates reveals that they are much lower than the annual inflation rates published by monetary statisticians, which means that the market is witnessing a decline in value in real terms.

For that reason, telecom operators continue to heavily invest in advanced telco technologies. They hope that the migration to all-IP and new-generation access (NGA) broadband will help offset the fixed and mobile voice decline. They also believe that 5G will unlock new opportunities by allowing massive machine-type communications and ultra-reliable low-latency communications.

The companies are also increasing the pace of digitalization and software-isation of their business processes, creating new go-to-market strategies based on data and intelligence, and deploying innovative business models based on telco-as-a-platform and co-creation within ecosystems. They also look for additional revenue streams in the non-telco areas such as IoT, data centre, cloud, AR/VR, IT services, VoD, enterprise vertical solutions, financial solutions, cyber security, digital media, e-commerce, etc.

“Telecom operators are completely transforming - from providers of traditional commodity-style services they are becoming modern all-round full-stack technology suppliers," says Kresimir Alic, research director, Worldwide Telecom Services. "In that way, they become leaders of the digital transformation revolution and rightly hope they can acquire one of the central positions in the new digitalised world."