Ten years ago, enterprises spent over US$80 billion per year on IT hardware and software for their own data centres, while well under US$10 billion on nascent cloud infrastructure services.

Fast forward to the present day and spending on data centre hardware and software has only grown by an average of 2% per year, while spending on cloud services has ballooned, growing by an average of 42% per year to reach US$227 billion in 2022.

As enterprises radically reshaped their IT investments and crimped spending on their own data centres, the leading cloud providers rapidly built out huge global networks of hyperscale data centres.

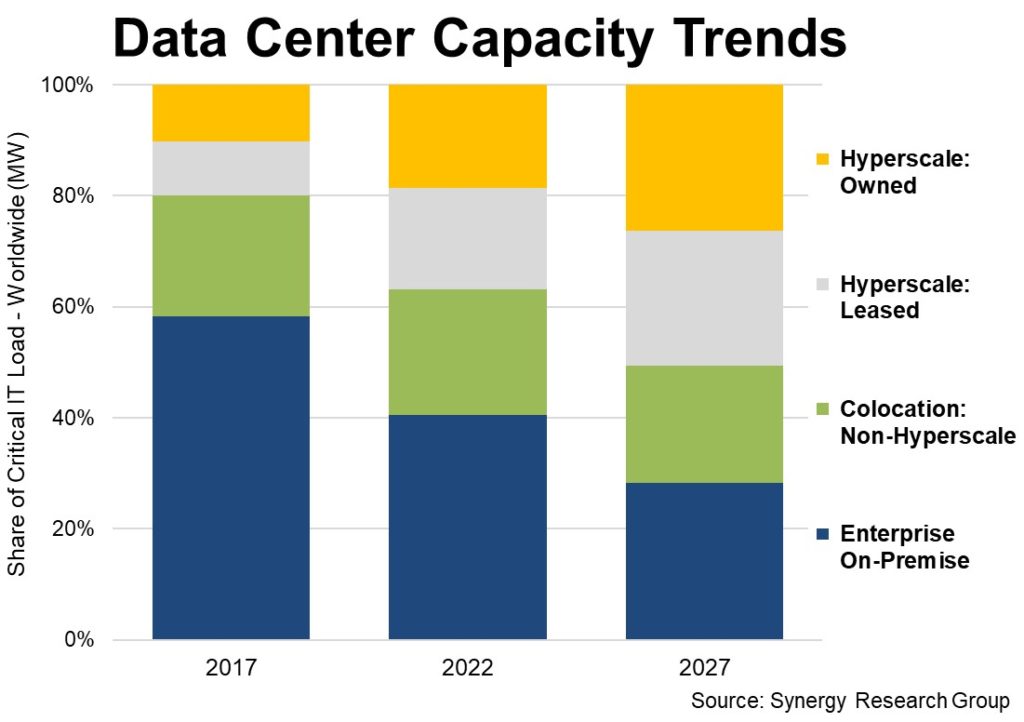

With the number of large data centres operated by hyperscale providers approaching 900, new data from Synergy Research Group (SRG) reveals that hyperscalers now account for 37% of the worldwide capacity of all data centres with about half of that capacity own-built and owned data centres, and half at leased facilities.

According to SRG, with non-hyperscale colocation capacity accounting for another 23% of capacity, that leaves on-premise data centres with just 40% of the total. This is in stark contrast to five years ago when almost 60% of data centre capacity was in on-premise facilities.

Looking ahead to five years, hyperscale operators will account for over half of all capacity, while on-premise will drop to under 30%. Meanwhile, the total capacity of all data centres will continue to rise steadily, driven primarily by hyperscale capacity almost doubling over the next five years.

While the on-premise share of the total will drop by over two percentage points per year, the actual capacity of on-premise data centres will decrease only marginally. The colocation share of total capacity will remain relatively constant.

Hyperscale operator growth continues to be fuelled by the rapid development of more consumer-oriented digital services such as social networking, e-commerce and online gaming. Furthermore, while enterprises did maintain or slowly grow spending on data centre equipment, a growing proportion of that gear has been pushed offsite into colocation facilities.

On-premise data centres will not disappear any time soon, but their scale is being increasingly dwarfed by hyperscale and colocation companies.