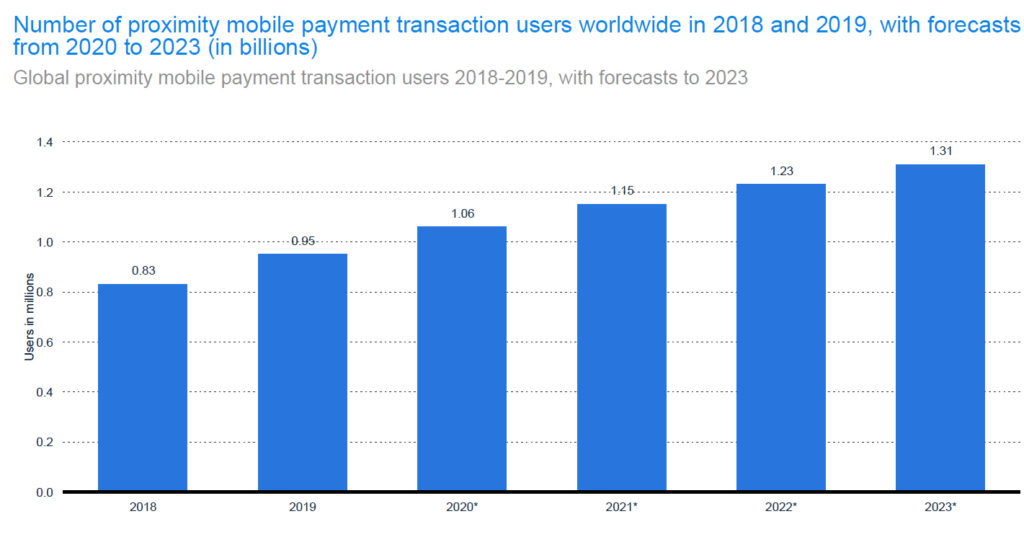

Mobile payments continue to rise even before the COVID-19 lockdown and subsequent concerns about physical money being a source of transmission. Driving this growth in mobile payments is eCommerce, mobile connectivity and the proliferation of payment options. Statista forecasts mobile payments users to reach 1.3 billion users by 2023.

A Juniper Research study forecasts that the number of users of software-based facial recognition to secure payments will exceed 1.4 billion globally by 2025, from just 671 million in 2020. This rapid growth of 120% demonstrates how widespread facial recognition has become; fuelled by its low barriers to entry, a front-facing camera and appropriate software.

The research identified the implementation of FaceID by Apple as accelerating the growth of the wider facial recognition market, despite the challenges to facial recognition during the pandemic with face mask use.

The research recommends that facial recognition vendors implement robust and rapidly evolving AI‑based verification checks to ensure the validity of user identity, or risk losing user trust in the authentication method as spoofing attempts increase.

Biometrics options

The new research, Mobile Payment Authentication: Biometrics, Regulation & Market Forecasts 2021-2025, found that fingerprint sensors will feature on 93% of biometrically equipped smartphones in 2025. This compares favourably to hardware-based facial recognition, with just 17% of biometrically equipped smartphones featuring these capabilities in 2025.

Research co-author Susan Morrow explained that: “Hardware-based facial recognition is growing, but the ability to carry out facial recognition via software is limiting its adoption rate. As the need for a secure mobile authentication environment grows, smartphone vendors will need to increasingly turn to more robust hardware-based systems to keep pace with fraudsters’ evolving tactics.”

Growing but limited in scope

The research also found that the use of voice recognition for payments is increasing, from 111 million users in 2020, to over 704 million in 2025. The report identified that, at present, voice recognition is mostly used in banking, and will struggle to grow beyond this, due to concerns around robustness.

Juniper Research recommends that vendors adopt a multi-method biometric strategy, which encompasses facial recognition, fingerprints, voice and behavioural indicators to ensure a secure payment environment.