In the first quarter of 2021 organisations woke up to the reality that the COVID-19 pandemic is not a short-term blip in the business radar. It was (is) a disruption that was fast, borderless and impervious to remedy.

Many businesses stopped operating altogether as governments raced to contain the spread by enforcing social distancing and travel bans. As the cases grew, some insurers offered to cover clients stricken by the pandemic only to eventually realise the severe financial impact to the operational profitability.

The Howden Group noted that the cost to the worldwide Property & Casualty market will reach up to US$100 billion. This will eventually be passed on to clients, which may see a rise in crime and bankruptcies which in term will put pressure on insurers’ premiums.

Deloitte’s Anuj Maniar noted that when the pandemic emerged, insurers responded by taking immediate steps to ensure business continuity, and help customers and their communities cope.

Into an uncertain future

“As they head into 2021, insurers should consider a mix of offensive and defensive actions to accelerate longer-term recovery efforts and pivot to the thrive phase when growth is reemphasized, despite challenging economic conditions,” suggested Deloitte.

Insurers have a legacy of slow adoption to innovation, particularly the smaller firms that do not have the deep financial clout enjoyed by the large global brands.

As insurance regulations adapt to respond the rise of Insurtech as a driver of innovation, business modernisation may be the way forward for everyone, particularly the smaller insurance firms.

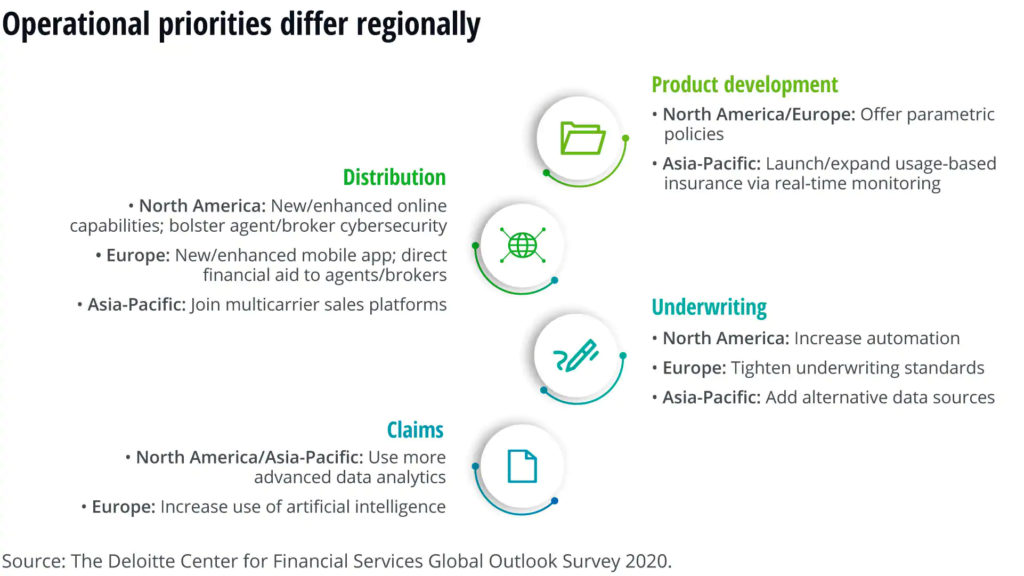

A global study by Deloitte revealed different approaches being undertaken in response to the pandemic.

FutureCIO spoke to Travis Callahan, co-founder and president at Ignatica to understand how the startup is rising up to help industry players use the opportunity to prepare for the new competitive landscape that rises in the aftermath of the COVID-19 pandemic.

We remove the cost burden of administering contract activities so FIs can focus on delivering more product innovation, unique and personalized service, and better customer acquisition. ----- Ignatica is using blockchain technology and a distributed services architecture to transform the insurance ecosystem, enabling insurers to deliver straight through, digital client experience at a fraction of their current operating costs. We remove the cost burden of administering contract activities so Insurers can focus on delivering more product innovation, unique and personalized service, and better customer acquisition.

Click on the podchat player to listen to Callahan share his views on the challenges impacting the insurance marketplace, and how players – providers and agents – are responding, including pivoting in preparation for the next black swan event:

- The Ignatica platform value proposition

- How does Ignatica modernise or transform an existing insurer’s business workflow?

- Who is the most likely candidate for modernisation?

- How does the ignatica blockchain fit in the insurance workflow?

- What does an ignatica ROI look like?

- What is the cost to modernize insurance atop the ignatica platform?

- What is your advice for established insurance players looking to potentially pick up on the insurtech to help them get ready for the next wave of opportunities and challenges?