Almost 90% of supply chains will invest to become more resilient and more agile over the next two years1. Agility and resilience both address risk and disruption — those are not going away. Based on experience, as major disruptions fade from memory, the current focus on agility and resilience will shift back to efficiency.

How can we get the investments now that we know are needed to handle future disruptions? Based on a few hundred client discussions, executive discussions on positive resilience outcomes is the thought innovation I find most impactful.

Agility in a process provides resilience in outcomes

At a restaurant, the plan is the menu. When you order something not on the menu, you want the waiter to tell you, “Yes, we can do that and your food will be ready in less than 30 minutes” — the resilience provided by the kitchen when you alter the menu “plan.”

You would find it odd if the waiter explained that they will have to switch cooks and pop to the store for supplies — the processes in the kitchen that require agility to meet customer needs.

Your business partners and customers do not care about the agility of supply chain processes (kitchen), they care about the resilience supply chain provides to enable the outcomes they want, regardless of disruption.

Framed this way, agility enables resilience. Agility and resilience both address risk and disruption, but are concepts that are discussed with different audiences and measured different ways. Speak agility to the supply chain and resilience to the business.

Translating disruptions into resilience value

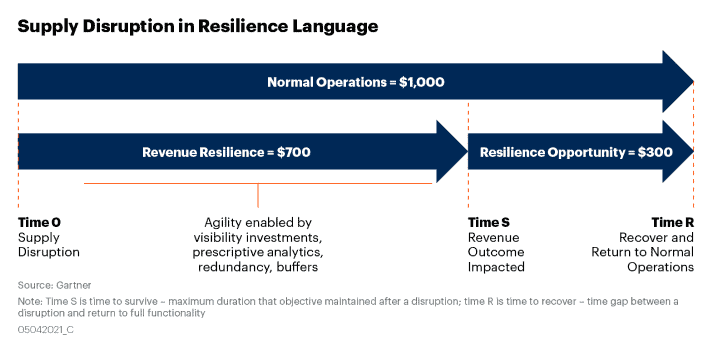

Common resilience measures include the time to survive (TTS) before a disruption impacts outcomes, time to recover (TTR) from disruption to return to normal operations and value at risk. Business resilience discussions focus on revenue, volume or margin results for particular products in particular locations. How might this work:

Supply disruption — When a massive ship blocks a major ocean transport lane or extreme weather halts production, you shift operations to other options. For example, you might shift to substitute suppliers or from ocean to air transport.

- Revenue Resilience or Agility Saved Revenue: Demand fulfilled from time of disruption to return to normal operation enabled by agility in switching between redundant options and buffers.

- Revenue Resilience Gap/Opportunity: Demand not fulfilled when TTS is less than TTR. Greater agility or more operational options and capabilities could have “saved” that revenue.

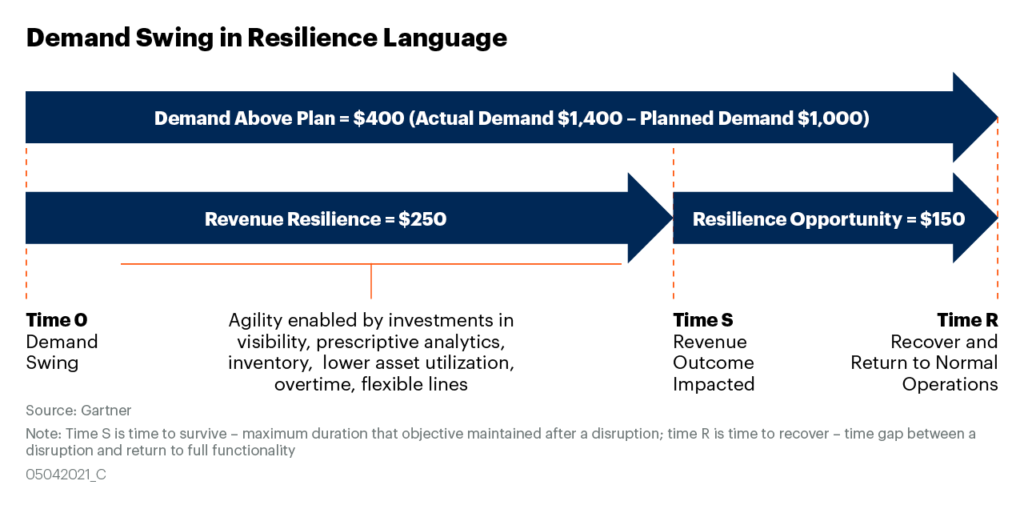

Demand swing — If demand comes in at 40% over plan for a particular location, shifting inventory, expediting shipments, adding shifts to factories or increasing production using flexible lines allows some portion of that revenue to be fulfilled.

- Revenue Resilience or Agility Saved Revenue: Demand over plan fulfilled for a period of time enabled by agility from redundancy, policies and actions.

- Revenue Resilience Gap/Opportunity: Demand not fulfilled over plan. Greater agility or more operational options and capabilities could have “saved” that revenue.

Positive framing is three times more persuasive than negative framing

How information is framed matters. Studies show that people are not entirely rational. When given two choices that represent the same facts, whether the facts are shown positively or negatively changes what people choose.

In one experiment researchers provided a positive frame (“saves 200 lives”) and a negative frame (“400 people will die”) related to the same medical treatment. With positive framing, 72% chose to do the treatment. With negative framing, 22% chose to do the treatment.2

When you want to ask for investments to increase agility, use a positive frame in a language business partners will understand — revenue resilience. Examples:

“During traditional disruptions/demand swings for product X in country Y, an investment of $1.5 million”:

“… will ensure 100% of revenue is fulfilled”

“… will allow 30% more revenue is fulfilled”

“ … would have captured $300 more revenue”

“Given historical levels of unplanned demand for product X in country Y”

“… an investment of $2 million will allow 60% or $4 million will allow 90% of unplanned demand to be supported”

Analysis and facts will determine what you propose, but how you propose it matters. The current conversation about two of the COVID-19 vaccines causing blood clots seems to be a real-time example of this decision bias.

I know I personally want a vaccine when I hear that over 1 billion vaccine doses have been administered, preventing XXX million COVID cases, even though a small number (perhaps only dozens, but no more than a few thousand) of people may have gotten blood clots after taking two variants of the vaccines.3

Bottom line: make sure you discuss investments for agility in the positive business outcomes it provides.

Contact Jennifer Loveland at Jennifer.Loveland@gartner.com

First published on Gartner Blog Network