Expanding their strategic partnership that began in 2017, Salesforce and Google Cloud last week said they will be introducing two new data and AI innovations to enable companies to use their data and their custom AI models to better predict customers needs as well as reduce the cost, risk and complexity of synchronising data across platforms.

While 80% of business leaders say data is critical in decision-making at their organisation, 41% find their data too complex and inaccessible to be useful.

The new integrations between Salesforce and Google Cloud will help solve the problem of accessing and understanding data and allow companies to use their data to power AI insights across their business that drive better customer experiences.

“Google Cloud and Salesforce share a commitment to helping businesses accelerate their data-driven transformations. This new partnership brings together one of the world’s largest data clouds from Salesforce with analytics and AI capabilities from Google Cloud, and represents a significant leap forward in businesses’ ability to generate more value and insights from their customer data,” said Thomas Kurian, CEO, Google Cloud

The new AI and data innovations are:

- Salesforce Data Cloud + Google BigQuery: The new integration between Salesforce Data Cloud and BigQuery will enable companies to more easily create unified profiles of their customers to provide new, highly personalised experiences. Salesforce and Google Cloud will provide customers with seamless data access across platforms and across clouds, akin to having their data housed in a single location — with zero-copy or zero-ETL (Extract, Transform, Load) that can reduce the cost and complexity of moving or copying it while maintaining governance and trust. The Data Cloud and BigQuery integration will be in pilot late-2023, and generally available early 2024.

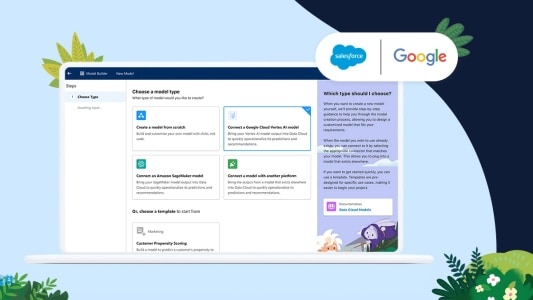

- Salesforce Data Cloud + Google Vertex AI: New integrations between Salesforce Data Cloud and Google Cloud’s Vertex AI will enable customers to bring their own models from Vertex and use them across the Salesforce Platform, addressing the specific needs of their businesses – such as predicting buying behaviour or churn likelihood – across their Salesforce Customer 360 data. Zero-copy data access for AI model training can maximise a company’s AI investment by providing immediate access to unified customer data, thereby streamlining the model development process and enhancing the accuracy and efficiency of AI predictions and insights. The Data Cloud and Google Vertex AI integration will be in pilot mid-2023, and generally available late 2023.

“AI and data are revolutionising the way businesses operate and innovate, and together Salesforce and Google are empowering organisations to unlock the full potential of their trusted data, put AI insights into action, and personalise customer experiences like never before. This partnership paves the way for unprecedented innovation and business value for our customers,” said David Schmaier, chief product officer, Salesforce.

How industries will use the new data and AI innovations

- A fashion retailer can connect CRM data, like customer purchase history and service interactions, with non-CRM data like real-time online activity or social media sentiment. They can then deploy custom AI models that predict customers’ likelihood to buy certain types of clothing based on that data, and deliver hyper-personalised recommendations to customers via the most appropriate channel, including email, a mobile app, or social media.

- A healthcare organisation can connect CRM data, like appointment history and patient feedback, with non-CRM data like patient demographics and medical history data. They can then deploy custom AI models that predict which patients are at risk of readmission, which informs personalized care plans for those high-risk patients to improve medical outcomes through proactive medical care.

- A financial institution can connect CRM data, like a customer’s transaction history, credit score, and financial goals, with non-CRM data like market analysis or economic trends. They can then deploy custom AI models that predict a customers’ spending habits, investment preferences, and financial goals to inform personalised banking services and offers.