Asia/Pacific Satellite Broadband Services Market Forecast, 2022–2026

Sooner or later, satellite connectivity will substitute terrestrial access in remote areas and other regions that are underserved by terrestrial fibre or fixed wireless access. In a rapidly evolving enterprise and consumer demands, coupled with thinning margins from traditional telco services, the communication service providers need to overcome the challenges.

Service providers must transform their strategies of engagement, revisit their business models, and overhaul their product and service offerings.

According to the Asia pacific market outlook on the satellite broadband services (excluding northeast Asia and India) for the 2022–2026 period, there are more opportunities that communications service providers can tap on. Enterprise revenue will grow faster than the number of enterprise SIOs because the data usage per services in operation (SIO) will grow.

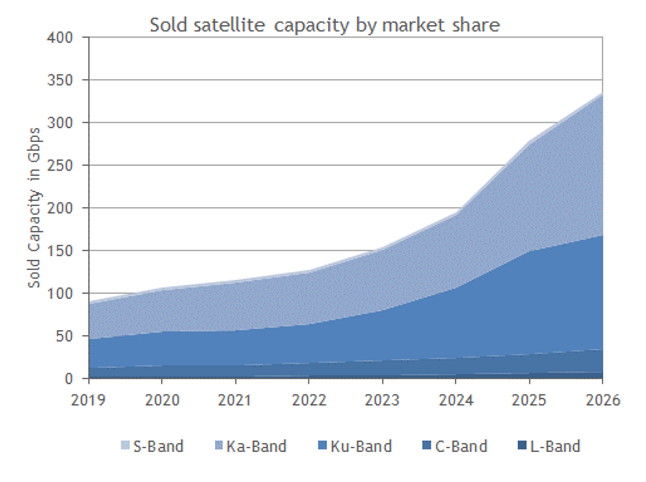

Market share split between different end-user device/terminals frequency bands, which include L-Band (1-2 GHz), S-Band (2-4 GHz), C-Band (4-8 GHz), Ku-Band (12-18 GHz), and Ka-Band (27-40 GHz). As can be seen in the figure above, sold capacity growth will be primarily in the Ku-Band (27.1%) and Ka-Band (24.1%).

Customer needs are always changing and new areas in segmented markets are still volatile. IDC's Asia/Pacific Communications Service Provider Business Transformation Strategies looks at the current telecom landscape and how communication service providers and technology vendors can leverage their core assets to transform their business and stay ahead of the competition.

Main drivers of satellite broadband demand

The main drivers for capacity are both consumer internet access and enterprise connectivity requirements. The largest consumer internet demand will come from a number of markets in the region, including the Philippines, Malaysia, and Indonesia. Satellite connectivity will be used to substitute terrestrial access in remote areas and other regions that are underserved by terrestrial fibre or fixed wireless access.

Enterprise satellite capacity demand will be driven by a number of use cases including emergency and disaster response and management, remote connectivity for townships, remote schools, private networks in mining, oil and gas, and agriculture, cellular backhaul for remote cell sites, aero-mobility for commercial airliners, merchant shipping for cargo and floating cargo platforms and private yachts.

The reason that Ku-band will grow several percentage points faster than Ka-Band is the planned supply of Ku-Band in the region, followed by the use of Ku-band for end-user terminals in some of the larger LEO constellations. Over the forecast period, IDC expects that Ka-band will dominate space-to-gateway links, and potentially by the end of the forecast period the V-Band (40-75 GHz) will also be introduced by some LEO and GEO operators.

"The emergence of large Low Earth Orbit (LEO) and mega-Medium Earth Orbit (MEO) constellations and next-generation Geosynchronous (GEO) Very High Throughput Satellites (VHTS) in Southeast Asia and Oceanic region will drive wholesale and consumer retail prices down further extending the price declines that began in 2015-2016.

The wholesale price drops will further expand the number of use cases that will become feasible to include cellular base station backhaul, IoT gateways, satellite as a second broadband line, satellite for recreational vehicles and outdoor activities, and connectivity for yachts and private aeroplanes. Moreover, satellite operators launching new satellites are expected to utilise different frequencies in their payloads to serve different needs," says Bill Rojas, research director for IDC Asia/Pacific.