Gartner recently gathered supply chain and operations executives from seven industries for a Leaders in Action event focused on leadership through the lens of automation.

Let me start with an enormous “thank you” to Kathy Wengel, Peter Menziuso and Ryan Reinhardt from Johnson & Johnson for hosting our event at their Vision Global Headquarters in Florida. Preceding a full day of community learning sessions, we were privileged to tour a site that spans from product development to customer shipment of billions of contact lenses each year. Dr. Dirk Holbach and Sally Gilligan, CSCOs for Henkel Consumer Brands and Gap Inc., respectively, broadened the discussion with consumer product and retail member perspectives.

We always kick off these events with a frame on the central topic, so I’ll start with some Gartner viewpoints on physical automation in supply chain.

Incremental automation or a brave new robotic world?

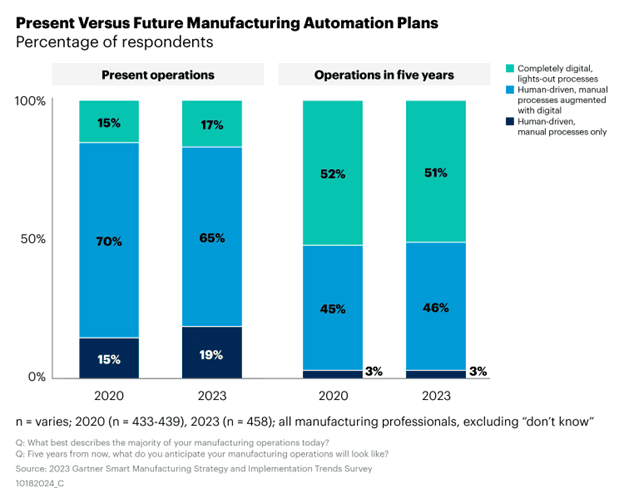

One of the perspectives I shared was from Simon Jacobson, who leads our supply chain manufacturing research. In the early 2020s, Jacobson ran two smart manufacturing strategy and implementation trends surveys. The figure below compares where the community saw itself in terms of factory automation in 2020 and 2023. Its scale ranges from fully manual, human-driven processes to completely digital, “lights-out” processes.

Anecdotally, the Gartner expert team has observed a significant wave of investment in manufacturing automation over the last several years, so it’s interesting to see data suggesting roughly the same footprint overall. Perhaps one of the pandemic’s outcomes was raising the bar for gauging automation levels. The survey’s other notable aspect is that it pulsed expected levels of manufacturing automation, five years out. When unconstrained by budgets, resources and other enablers, the community is consistently sanguine about the prospects for automation.

Reading between the lines of the time horisons, there is an opportunity to be thoughtful about where, and to what degree, automation is best applied within the four walls of a factory based on how predictable and structured its processes and data are.

I also shared a provocative 2024 Predict from VP analyst Dwight Klappich. It states that by 2028, there will be more smart robots than frontline workers in manufacturing, retail and logistics due to labor shortages. In many developed countries, the workforce is projected to grow much slower than the broader economy over the next 10 years due to demographic trends. The U.S. workforce, for instance, is expected to grow nearly five times slower than the national GDP in that timeframe.

The executives in attendance agreed with the general trend line but were less sure we’d cross over before the end of the 2020s. Across the board, people and talent management strategies generated some of the most impassioned conversations at our event.

What did we learn?

From the outset, Peter Menziuso, company group chairman of vision, Johnson & Johnson, emphasised the importance of an integrated business model and the critical role of supply chain operations to achieving business growth. Kathy Wengel, executive vice president, chief technical operations & risk officer, provided a broader perspective on how Johnson & Johnson leverages automation to stay true to its people-centric credo. She brought this to life by explaining the degrees of supply chain precision, visibility and timeliness required to deliver vein-to-vein cancer immunotherapy treatments.

Ryan Reinhardt, vice president of supply chain for vision, Johnson & Johnson, expounded on how manufacturing and distribution automation enabled the ability to handle tens of thousands of product SKUs with a balance of agility and scale. He also highlighted a proprietary model, which provides a fully integrated, holistic view across the source, plan, make, quality and deliver functions. This analytics-based platform allows their team to make informed supply chain decisions that are proactive instead of reactive.

Leaders in Action

Here are a few of the more notable takeaways from the site tour, member sessions and group discussions at this Leaders in Action event:

- During the tour of Johnson &Johnson’s Vision facility, the other company executives were impressed at the level of connection between R&D and supply chain teams. The teams are co-located at one site in Florida, and the supply chain team is highly involved in driving new product development that is timely, innovative and cost/yield effective.

- One leader shared that interpersonal dynamics are so critical to the successful implementation of digital technologies that their executive leadership team spends one day a quarter with a relationship coach to promote greater trust and cooperation. They use the framework from Patrick Lencioni’s book Five Dysfunctions of a Team to assess and resolve issues, which has a strong halo effect on overall team culture.

- Over three years, one company’s DC automation enabled increased capacity without adding space and lowered costs despite labor inflation. This company partnered with multiple startup vendors to test solutions. Selection was based on cost and performance, but also fit as a strategic partner which sometimes included creative robotics-as-a-service contract terms.

Overall, it was an inspiring two days together and we look forward to continuing these discussions with the COO/CSCO community.

Originally posted in Gartner