The Nutanix global 2022 Enterprise Cloud Index (ECI) survey and research showed that fewer financial services organisations have adopted multi-cloud than any other industry surveyed, trailing the global average by 10%.

However, adoption is expected to nearly double from 26% to 56% in the next three years, in line with the global trend of evolving to a multi-cloud IT infrastructure that spans a mix of private and public clouds.

Among financial services ECI respondents, 31% are still operating non-cloud-enabled three-tier datacentres as their only IT infrastructure. They also reported having the lowest deployment of all industries surveyed in public cloud usage, with 59% using no public cloud services compared to 47% globally, likely due to substantial existing legacy investments in applications and the highly regulated nature of the industry.

Hurdles to multi-cloud use

The complexity of managing across cloud borders remains a major challenge for financial services organisations, with 84% of respondents agreeing that success requires simpler management across multi-cloud infrastructures, and 50% citing security concerns as a challenge to the multi-cloud model.

To address top challenges related to security, interoperability, and data integration, 82% agree that a hybrid multi-cloud model, an IT operating model with multiple clouds both private and public with interoperability, is ideal.

“While the financial services industry appears to be in the early phases of deployment, the evolution to an interoperable multi-cloud IT infrastructure that spans a mix of private and public clouds is underway,” said Anand Akela, VP of product and solutions marketing at Nutanix.

He opined that with information security and operational resiliency remaining front and centre for financial services organisations, they must look to hybrid multi-cloud solutions with integrated manageability and security, and the ability to quickly move apps among cloud infrastructures cost-effectively.

Challenges ahead

Financial services survey respondents were asked about their current cloud challenges, how they’re running a business and mission-critical applications now, and where they plan to run them in the future.

Respondents were also asked about the impact of the pandemic on recent, current, and future IT infrastructure decisions and how IT strategy and priorities may change because of it.

Other findings

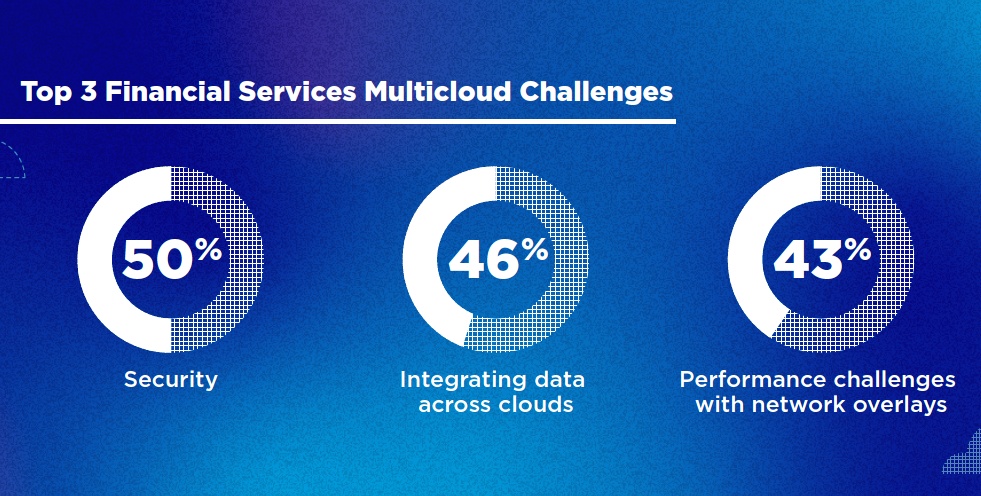

Financial services organisations face multi-cloud challenges, including security (50%), integrating data across clouds (46%), and performance challenges with network overlays (43%).

Given that nearly 78% cited the lack of some IT skills to meet current business demands, simplifying operations is likely to be a key focus in the year ahead.

However, IT leaders are realising that there is no one-size-fits-all approach to the cloud, making hybrid multi-cloud ideal according to 82% of respondents.

This model will help address some of the key challenges of multi-cloud deployments by providing a unified cloud environment in which security and data governance policies can be applied uniformly.

Up to 98% of financial services respondents (98%) have moved one or more applications to a new IT environment over the last 12 months, likely from traditional datacentres to private clouds given the industry’s relatively low multi-cloud and public cloud penetration.

With 43% citing faster app development (43%) as the reason for the move, application mobility is clearly top of mind among respondents. Security (42%) and integrating with cloud-native services (40%) were also deemed important.

With 83% agreeing that moving applications to a new environment can be time-consuming and costly, it’s expected that the adoption of containers will rise in step with multi-cloud deployments to enable apps to run and move nearly anywhere quickly and easily.

Plans for 2023 and beyond

Among financial services respondents, 86% said that containers will be important to their organisations within the next year.

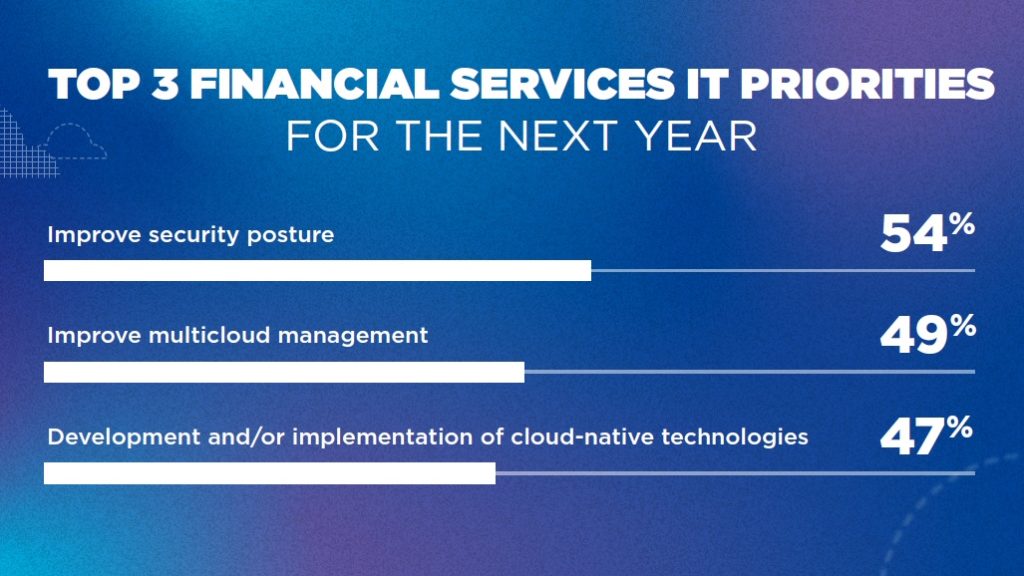

Top financial services IT priorities for the next 12 to 18 months include improving security posture (54%), improving multi-cloud management (49%), and developing and/or implementing cloud-native technologies (47%).

When asked what their organisations had done differently because of the pandemic, 70% said they had increased spending to strengthen their security posture, 64% spent more on increasing AI-based self-service automation, and 64% invested in infrastructure upgrades.