The need for sustainable and energy-efficient cooling solutions for data centres, as well as growing environmental concerns, drive the growth of the data centre dielectric fluid market in the Asia Pacific (APAC) region (excluding China), according to a report by Research and Markets.

Non-conductive and thermally efficient, cooling systems utilise dielectric fluids to increase power use effectiveness (PUE) and save operating costs as they can manage large heat loads in contemporary data centres more efficiently than conventional air-based systems.

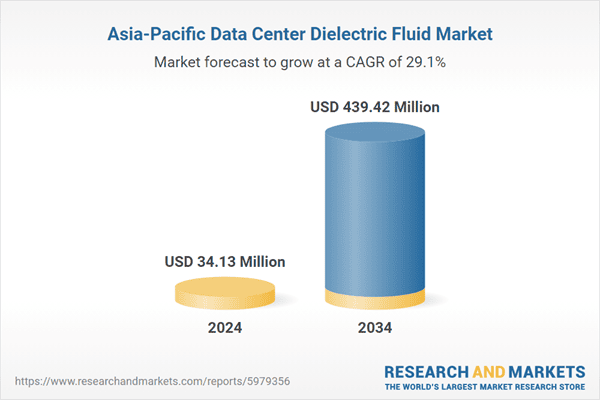

The APAC data centre dielectric fluid market, valued at $34.13 million in 2024, is projected to grow at an impressive CAGR of 29.12%. This growth trajectory suggests promising investment opportunities, with the market expected to reach $439.42 million by 2034.

Growth drivers

The growing investments in digital infrastructure across the APAC region (e.g., India, China, Singapore) and stricter energy efficiency and PUE targets imposed by governments, as well as green data centre regulations, drive market growth.

With the growing heat densities from AI, blockchain, and 5G computing workloads demanding advanced cooling, the market is expected to grow.

Moreover, sustainability initiatives are pushing data centre operators to adopt eco-friendly cooling alternatives.

One of the key factors accelerating the growth of the data centre dielectric fluid market in the APAC region is the formation of strategic partnerships. These alliances between fluid suppliers, data centre OEMs, and cloud providers are not only driving technology adoption but also increasing awareness of the total cost of ownership (TCO) benefits of fluid cooling systems over air and water cooling systems, thereby contributing significantly to market growth.

Market challenges

Several factors challenge market growth, including high upfront costs of dielectric fluids and retrofitting legacy systems, as well as limited standardisation and certification frameworks specific to dielectric fluid use in the APAC region.

Moreover, there are supply chain constraints for specialty chemicals and base fluids, as well as a lack of a skilled workforce familiar with liquid cooling system design and maintenance.

Environmental disposal and recycling complexities, particularly for synthetic and fluorinated fluids, as well as compatibility concerns with various IT and electrical hardware components, also hinder market growth.